In the rapidly evolving world of cryptocurrency, businesses must navigate the complexities of trading platforms. The choice between centralized exchanges (CEX) and decentralized exchanges (DEX) is crucial for blockchain ventures looking to establish a robust presence in the market. This blog will explore the fundamental differences, advantages, and disadvantages of both types of exchanges, helping businesses determine which option aligns best with their goals.

Understanding Centralized Exchanges (CEX)

Centralized exchanges are platforms that facilitate the trading of cryptocurrencies through a central authority. These exchanges operate similarly to traditional financial institutions, where users deposit their funds into accounts controlled by the exchange. The platform then manages trades on behalf of its users. CEXs are often characterized by their user-friendly interfaces, which make it easy for both novice and experienced traders to navigate the platform.

One of the most significant advantages of centralized exchanges is their high liquidity. Due to a larger user base, CEXs can facilitate quicker transactions and reduce price volatility, making them appealing for traders who prioritize speed and efficiency. Additionally, centralized exchanges typically provide customer support options, allowing users to resolve issues or inquiries efficiently. This support can be invaluable for new users who may need assistance navigating the trading process.

However, centralized exchanges are not without their drawbacks. One major concern is custodial risk; users do not control their private keys but instead rely on the exchange’s security measures. This centralization can make CEXs vulnerable to hacks and fraud, as seen in several high-profile breaches in recent years. Furthermore, regulatory compliance can pose challenges for CEXs, as they must adhere to various laws and regulations that may limit user access or trading capabilities in certain jurisdictions. Lastly, the requirement for personal information during account creation can deter privacy-conscious users who value anonymity in their transactions.

Exploring Decentralized Exchanges (DEX)

Decentralized exchanges operate without a central authority, allowing users to trade directly with one another through smart contracts on a blockchain. This model emphasizes user control and privacy while eliminating the need for intermediaries. DEXs facilitate peer-to-peer trading, which enhances privacy and reduces reliance on third parties. Users maintain control over their private keys and funds, ensuring that they have full ownership of their assets.

One of the standout features of decentralized exchanges is their transparency. Transactions conducted on a DEX are recorded on the blockchain, providing an immutable record that enhances trust among users. This transparency is particularly appealing to those who prioritize security and accountability in their trading activities. Moreover, DEXs often impose lower transaction fees compared to centralized counterparts since they do not require intermediaries for trade execution.

Despite these advantages, decentralized exchanges come with their own set of challenges. The user experience can be more complex for newcomers who may not be familiar with blockchain technology or smart contracts. This complexity can deter potential users who might find centralized exchanges more accessible. Additionally, DEXs may face challenges in liquidity compared to CEXs; lower liquidity can lead to slower transaction speeds and increased slippage during trades. Finally, while DEXs reduce custodial risks associated with centralized platforms, they are not immune to vulnerabilities in smart contract code. If these contracts are not adequately audited or tested, users may be exposed to significant risks.

Comparing Centralized and Decentralized Exchanges

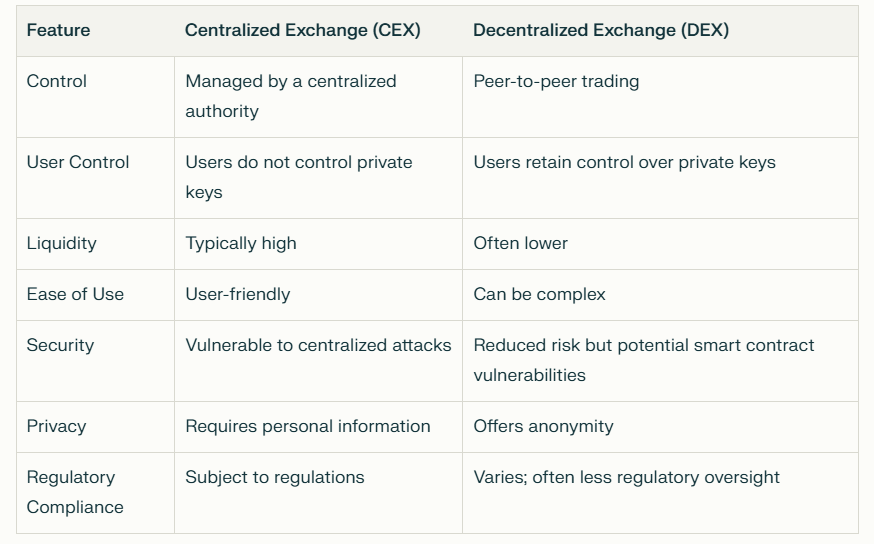

To help businesses understand the distinctions between CEXs and DEXs, here is a comparative overview that highlights key features:

This table summarizes how each type of exchange operates and the implications for users and businesses alike.

Choosing the Right Exchange for Your Business

The decision between a centralized or decentralized exchange depends on various factors unique to each business. First and foremost is understanding your target audience. If your target market includes novice traders who prioritize ease of use and customer support, a centralized exchange may be more suitable for your needs. Conversely, if your audience values privacy and autonomy in their trading activities, a decentralized platform might align better with their preferences.

Another critical consideration is your expectations regarding trading volume. Businesses anticipating high trading volumes may benefit from the liquidity offered by centralized exchanges since these platforms typically have a larger pool of users facilitating faster trades with minimal slippage. However, if your focus is on niche markets or specific cryptocurrencies that may not require high liquidity levels, developing a decentralized exchange could prove advantageous.

Regulatory considerations also play a significant role in this decision-making process. Depending on your location and target market, compliance with local regulations may be paramount. Centralized exchanges generally face stricter regulations than decentralized ones due to their custodial nature; thus, businesses must evaluate how these regulations might impact operations and user access.

Security concerns cannot be overlooked when choosing an exchange model. Evaluate your risk tolerance regarding custodial risks associated with centralized exchanges versus potential vulnerabilities in smart contracts on decentralized platforms. While DEXs offer greater control over funds by allowing users to retain ownership of their private keys, poorly designed smart contracts can introduce significant risks if exploited.

Lastly, consider your long-term vision for your business regarding user control and privacy. If decentralization aligns with your mission — such as promoting financial sovereignty or enhancing user privacy — developing a DEX could be beneficial not only for your business model but also for building trust within your community.

Conclusion

Both centralized and decentralized exchanges offer unique advantages and challenges for businesses looking to enter the cryptocurrency market. Understanding these differences is essential for making informed decisions that align with your business objectives while considering factors such as target audience, trading volume expectations, regulatory compliance, security concerns, and long-term vision.

As you navigate this complex landscape of exchange options, it’s crucial to partner with experienced professionals who understand both models’ intricacies. If you are considering developing a decentralized exchange or need guidance on navigating this complex landscape, Codezeros is here to help you every step of the way. Our expertise in DEX development ensures that you can create a platform designed to meet your specific needs while prioritizing security and user experience.

Explore how Codezeros can assist you in building your decentralized exchange platform today! Reach out for a consultation and take the first step toward realizing your blockchain vision — your journey into the world of cryptocurrency starts here!

This expanded blog provides an in-depth overview suitable for businesses exploring DEX development while maintaining clarity and accessibility for potential clients interested in understanding their options in the cryptocurrency trading space.

Cubed

Thank you for being a part of the community! Before you go:

- Be sure to clap and follow the writer ️👏️️

- Follow us: X | LinkedIn | YouTube | Discord | Newsletter | Podcast

- Create a free AI-powered blog on Differ.

- Visit our platforms: CoFeed | In Plain English | Venture | Cubed

Centralized vs Decentralized Exchange: Which Is Right for Your Blockchain Business? was originally published in Cubed on Medium, where people are continuing the conversation by highlighting and responding to this story.