Viswas Raghavan is a great hire for Citigroup Inc. but, boy, does he have his work cut out to help his new employer along its road to renewal.

Raghavan is a 20-plus-year veteran of JPMorgan Chase & Co. who held a string of senior leadership roles over the past decade, finishing up as head of global investment banking and chief executive officer for Europe, Middle East and Africa. He was well respected at JPMorgan, but its solid bench of leaders-in-waiting meant he wasn’t so hard to replace.

At Citigroup, Raghavan will run the banking division, the only business out of five that was left without a permanent head after last year’s restructuring by CEO Jane Fraser. The unit covers advisory work on deals and fundraising alongside other corporate and commercial banking, but not the separately run financial markets trading business.

Fraser’s overhaul took out a layer of executives who sat atop two mega divisions, which contained the five main business lines. The quintet now reports directly to the CEO. The bank also binned its long-held structure of separate regional leaders and management teams. Together these changes are meant to cut costs and speed up decision making as Fraser tries to lift Citigroup’s profitability and stock-price valuation out of the dumps.

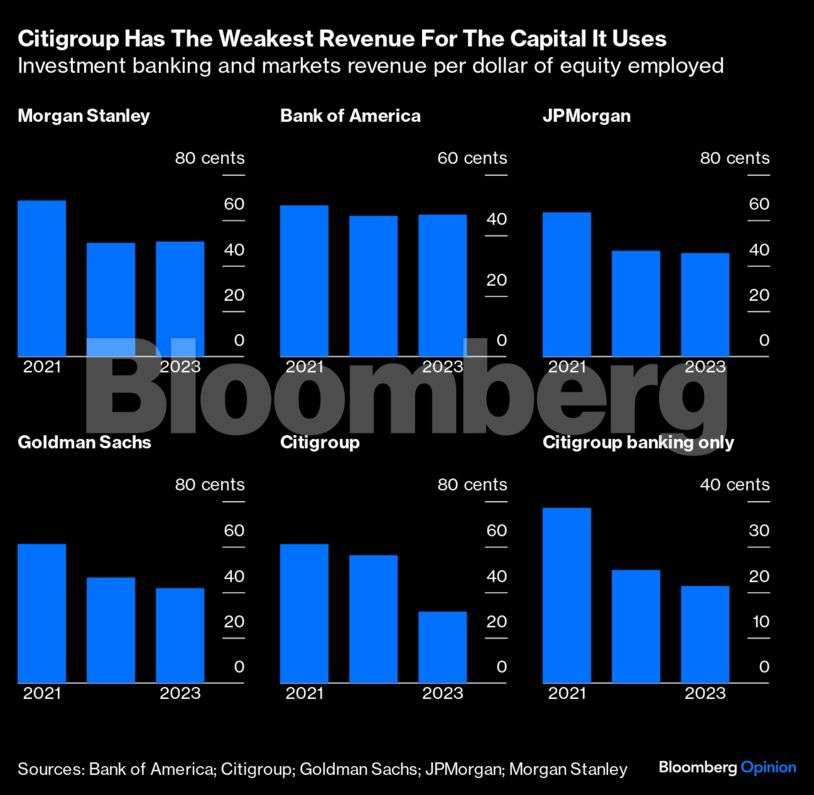

The banking division has seen revenue crumble in the past couple of years to become Citigroup’s smallest by some margin. It looks most in need of a fresh approach. Of course, all investment banks saw fees fall in this period due to the dearth of deal activity while interest rates were rising. However, Citigroup’s performed worse than its peers when you look at the revenue it earned for the amount of capital it put to work. There has been a lot of chopping and changing in Citigroup’s reporting structure and disclosure over the past few years, so it is hard to run comparisons going very far back. But in the past three years, its revenue per dollar of average assets has tumbled in the banking and markets divisions combined – the kind of structure that most US rivals have. It slipped from third-best, behind JPMorgan and Morgan Stanley in 2021, to last out of five in 2023.Similarly, its revenue per dollar of equity in these businesses dropped from fourth place, behind Goldman Sachs Group Inc., to last. But on this measure it’s much further behind its peers. It generated just 31 cents of revenue per dollar of equity in its banking and markets units last year, compared with 42 cents at Goldman, the next worst, and 51 cents at the best, Morgan Stanley.

Citigroup’s banking division on its own returned even less revenue per dollar of equity at about 21 cents. And those figures are somewhat flattered because it reports the amount of tangible equity allocated to its divisions, whereas its peers report plain equity including intangible assets like goodwill, typically a larger number. (European banks unfortunately don’t report equity allocations to their divisions in a similar way, so sensible comparisons are impossible.)

Each of the US banks significantly increased the amount of equity in these divisions between 2021 and 2022, producing a drop in the ratio of revenue earned to capital. But while the other four steadied their performance in 2023, Citigroup worsened.

At full-year results, Citigroup executives said that the restructuring and uncertainty over where its 20,000 layoffs would bite wasn’t a cause of revenue decline. However, while the job cuts are about increasing efficiency and dismantling the old regional functions, the bank has also let go of a string of senior investment bankers, research analysts, salespeople and traders.

Even with a recovery in deal activity this year, Raghavan will have to boost morale and push his new staff to extract more fees from the bank’s corporate and commercial clients. Taking market share from more settled rivals won’t be simple, especially when others, including Barclays Plc of the UK, are desperately trying to do the same in the US and elsewhere.

Citi’s banking business could do with a revamp, according to Mike Mayo, an analyst at Wells Fargo & Co. Raghavan might have been attracted in part by the weak recent performance, which makes it easier to show improvement. “Banking headwinds may turn to tailwinds, but it’s not clear when,” Mayo wrote.

A change in the market weather ought to benefit all these banks. Unless Raghavan can raise Citigroup’s efficiency in generating business from the capital it employs, it will remain a laggard. He must relish a challenge.