International derivatives marketplace CME Group Inc. (NASDAQ:CME) today reported financial results for the fourth quarter and full year of 2023.

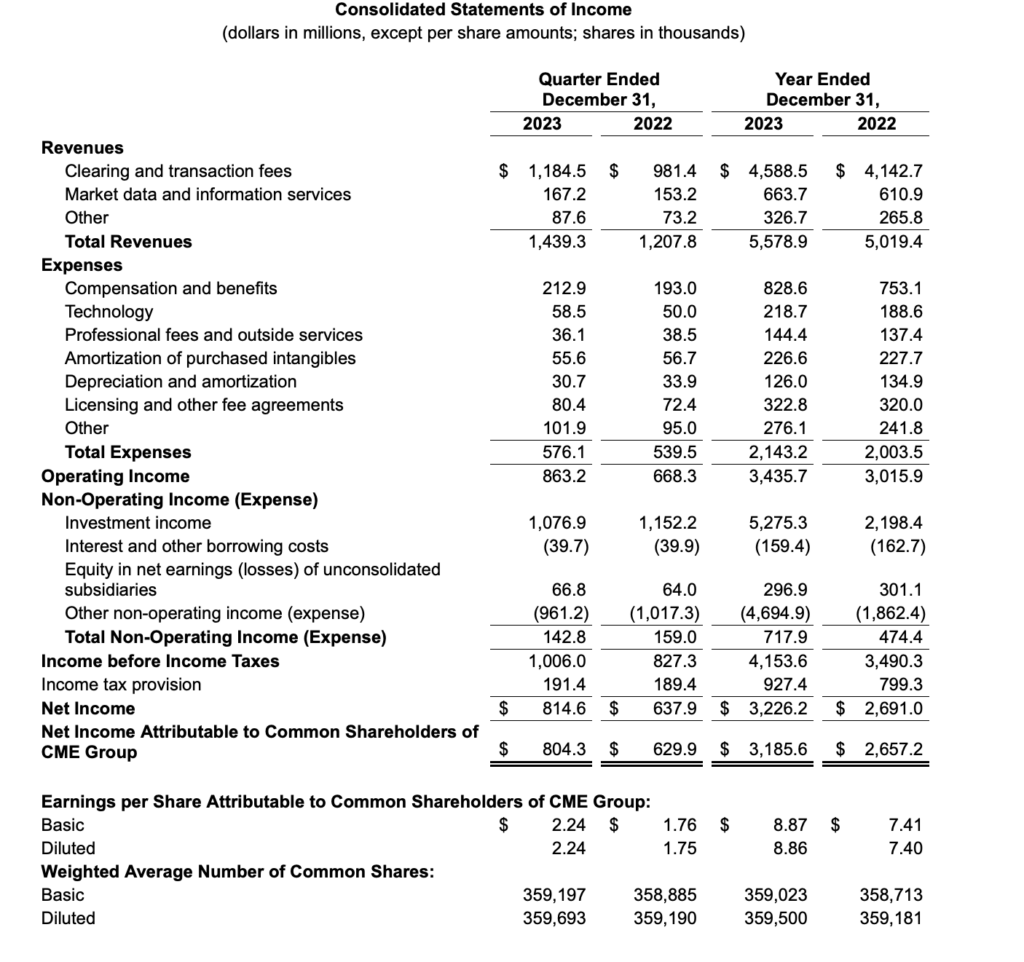

The company reported revenue of $1.4 billion, up from $1.2 billion a year earlier, and operating income of $863 million for the fourth quarter of 2023.

Net income was $815 million and diluted earnings per common share were $2.24.

On an adjusted basis, net income was $865 million and diluted earnings per common share were $2.37.

Total revenue for full-year 2023 was $5.6 billion and operating income was $3.4 billion. Net income was $3.2 billion and diluted earnings per common share were $8.86. On an adjusted basis, net income was $3.4 billion, and diluted earnings per common share were $9.34.

Terry Duffy, CME Group Chairman and Chief Executive Officer, commented:

“As global investors turned to our deep, liquid markets to manage risk across asset classes, CME Group average daily volume climbed to a record 24.4 million contracts in 2023, generating both record revenue and adjusted earnings. In Q4, we delivered our tenth consecutive quarter of double-digit adjusted earnings growth. This strong performance was driven, in large part, by a 36% increase in interest rate volumes in Q4, including a 46% rise in Treasury futures ADV. Going forward, we continue to focus on delivering new products and increased capital efficiencies, including our enhanced FICC cross-margining program that launched last month.”

Fourth-quarter 2023 average daily volume (ADV) was 25.5 million contracts, up 17% versus fourth-quarter 2022, including non-U.S. ADV of 7.2 million contracts, up 28% compared with the same period in 2022.

Clearing and transaction fees revenue for fourth-quarter 2023 totaled nearly $1.2 billion. The total average rate per contract was $0.682. Market data revenue totaled $167 million for fourth-quarter 2023.

As of December 31, 2023, the company had approximately $3.1 billion in cash (including $175 million deposited with Fixed Income Clearing Corporation (FICC) and included in other current assets) and $3.4 billion of debt. The company declared dividends during 2023 of $3.5 billion, including the annual variable dividend of $1.9 billion.

The company has returned over $24.3 billion to shareholders in the form of dividends since the implementation of the variable dividend policy in early 2012. In addition, on February 8, 2024, the company declared a first-quarter dividend of $1.15 per share, a 5% increase from the prior level of $1.10 per share.