Commodity currencies are the main movers in Asian markets today, gaining broadly, albeit against a backdrop of continued weak momentum. This situation unfolds as Chinese stocks carry forward their rebound from earlier this week, showcasing a divergence from Hong Kong’s market dynamics, where signs of profit-taking are beginning to surface. The anticipation surrounding China’s proposed CNY 2 trillion stabilization package for its stock markets has yet to materialize into actionable measures, especially notable as the Lunar New Year holiday draws near. This ongoing uncertainty casts a shadow over the recent gains in commodity currencies, suggesting a potential retraction to their earlier weekly positions unless China substantiates its supportive measures promptly.

The response to New Zealand’s employment data has been restrained. The significance of the unemployment rate returning to pre-pandemic levels cannot be understated, as it signals further loosening of the employment market. This development, coupled with the deceleration in private sector wage growth, paints a picture of an economy where labor dynamics are shifting further, albeit not at a pace that could compel RBNZ to pivot to policy loosening yet. As such, New Zealand Dollar’s trajectory is likely to be influenced by the broader market sentiment in the short term, until more definitive cues from RBNZ’s meeting at the month’s end.

On a global scale, Dollar is currently the softer one, digesting its near term gains in consolidation. More Fed officials would offer their views on the economy and monetary policies today. However, the muted market response to Fed communications overnight suggests that up coming speeches may not significantly sway market dynamics. Meanwhile, European currencies are facing some downward pressures, and Japanese Yen shows mixed performance.

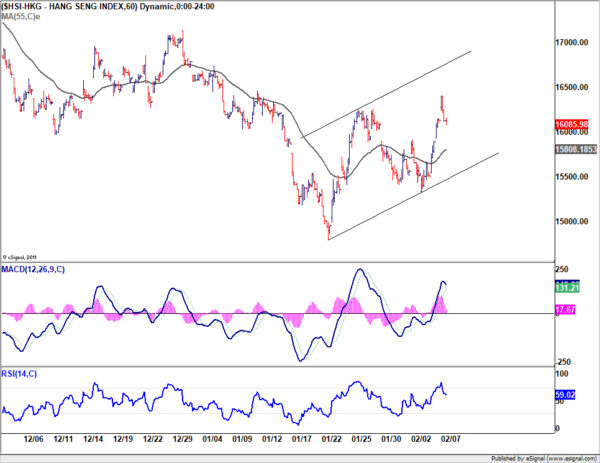

Technically, Hong Kong HSI faced strong rejection by 55 D EMA today after initial attempt to resume its near term rebound from 14794.16. Break of 55 H EMA (now at around 15808) in the next few days will argue that this near term has already completed, and the medium term down trend is ready to resume.

In Asia, at the time of writing, Nikkei is down -0.18%. Hong Kong HSI is down -0.48%. China Shanghai SSE is up 0.64%. Singapore Strait Times is up 0.95%. Japan 10-year JGB yield is down -0.0117 at 0.711. Overnight, DOW rose 0.37%. S&P 500 rose 0.23%. NASDAQ rose 0.07%. 10-year yield fell -0.074 to 4.090.

Fed’s Mester warns against premature and rapid interest rate cuts

Cleveland Fed President Loretta Mester underscored the importance of a cautious approach towards adjusting interest rates during an event overnight. Highlighting the necessity of “risk management,” Mester articulated concerns over reducing rates “too soon or too quickly,” emphasizing the need for concrete evidence that inflation is on a definitive downturn towards Fed’s 2% target.

Mester’s remarks signal a careful balancing act for the Federal Reserve, which is contemplating when to initiate an easing cycle. “It would be a mistake to move rates down too soon or too quickly without sufficient evidence that inflation was on a sustainable and timely path back to 2%,” she stated.

Looking ahead, Mester expressed optimism that the Fed could start to consider easing “later this year,” provided that the economy continues to align with current expectations. This shift in policy, however, would likely occur at a gradual pace to ensure the Fed’s dual mandate goals of price stability and maximum employment are met without inadvertently reigniting inflationary pressures or unsettling inflation expectations.

“The FOMC’s job now is to ensure that the economy reaches an even better place by calibrating monetary policy to achieve our dual mandate goals,” Mester emphasized, “Risk management will take center stage.”

Fed’s Kashkari: Inflation progress made, yet target not fully achieved

Minneapolis Fed President Neel Kashkari acknowledged the strides made towards controlling inflation, yet emphasizing the journey towards 2% inflation target is ongoing.

During an event, Kashkari highlighted, “We’re not all the way there yet, but we’ve made a lot of progress on inflation.”

Kashkari pointed to recent inflation data as a sign of encouraging trends, noting that both three- and six-month inflation measures are aligning closely with Fed’s target. “The six-month data is basically there and the three-month data is basically there,” he observed, indicating that if current patterns persist, Fed is on a track to achieving its inflation objective.

However, Kashkari remains cautiously optimistic, refraining from declaring an outright victory over inflation. “I don’t want to say we’re necessarily going to just glide past all the way to 2% but fingers crossed, the data is looking positive.”

Fed’s Harker signals confidence in economic soft landing

Philadelphia Fed President Patrick Harker’s speech overnight delivered a dose of cautious optimism regarding US economy’s trajectory, suggesting that a “soft landing” could be within reach.

Harker highlighted key indicators supporting his positive outlook: a trend towards disinflation, a labor market moving towards equilibrium, and sustained consumer spending.

These factors, according to Harker, are crucial for achieving the much-discussed soft landing, a scenario where inflation is controlled without causing a recession.

Emphasizing the progress made thus far, Harker also cautioned that the journey is not yet complete, likening the current economic phase to an airplane’s final approach but not yet landing.

“Now certainly we haven’t touched down, and we’re going to have to keep our seatbelts on, but with inflation continuing to fall back to our 2% target, with employment remaining strong, and with consumer sentiment looking up, the runway at our destination is in sight,” he elaborated.

BoC’s Macklem: Path to 2% inflation slow and risks remain

In a speech, BoC Governor Tiff Macklem underscored the importance of allowing “more time” for monetary policy to take full effect in mitigating inflationary pressures within the Canadian economy. The path to 2% target is “likely to be slow” and “risks remain.

Macklem acknowledged the successes of recent rate hikes in aligning supply with demand, pointing to a discernible decrease in inflation across both goods and services. Shelter inflation, however, continues to pose a significant challenge. He attributed this trend not only to monetary tightening but also to deeper issues in the “structural shortage of housing” that monetary policy alone cannot resolve.

Further complicating the inflation landscape are the volatile oil and transportation costs linked to international conflicts and disruptions. While these factors are beyond the control of BoC, Macklem emphasized the central bank’s focus on mitigating any broader inflationary impacts these cost increases might “feed through” to inflation in other goods and services.

Macklem’s outlook projects a gradual return to the 2% inflation target, with expectations set for inflation to remain near 3% in the first half of the year, decreasing to about 2.5% by the end of the year, and finally achieving 2% target in 2025.

“Putting this all together, the resulting push and pull on inflation means the path back to 2% inflation is likely to be slow and risks remain,” he noted.

NZ employment grows 0.4% in Q4, unemployment rate ticks up to 4%

New Zealand’s employment grew 0.4% qoq in Q4, slightly above expectation of 0.3% qoq. Unemployment rate ticked up from 3.9% to 4.0%, below expectation of 4.3%. Labor force participation rate fell from 72.0% to 71.9%.

Labor cost index for salary and wage rates, inclusive of overtime, recorded a 4.3% yoy increase, maintaining the same annual growth rate observed in the preceding three quarters of the year.

The Quarterly Employment Survey revealed a notable 6.9% yoy increase in average ordinary time hourly earnings, with public sector wages leading the charge.

Public sector hourly earnings surged by 7.4% yoy, marking the largest annual increase since March 2006 quarter, up from previous quarter’s 5.4%. In contrast, private sector had a slight deceleration to 6.6% yoy, down from 7.1% yoy in previous quarter.

Looking ahead

Germany industrial production, France trade balance; Swiss unemployment rate and foreign currency reserves will be released in European session. Later in the day, US and Canada will release trade balance. BoC will also plublish summary of deliberations of the latest monetary policy meeting.

AUD/USD Daily Report

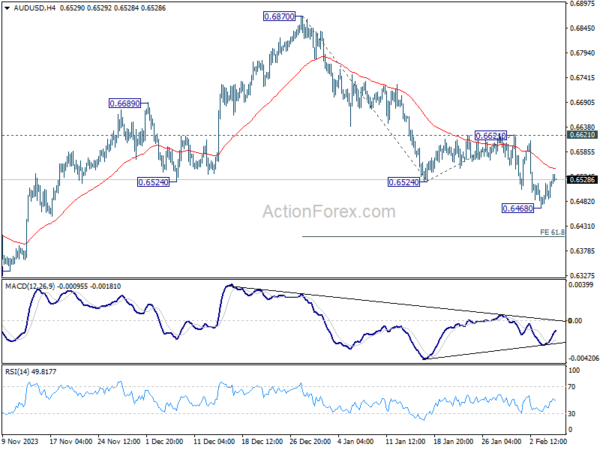

Daily Pivots: (S1) 0.6492; (P) 0.6509; (R1) 0.6539; More…

AUD/USD is extending consolidations from 0.6468 and intraday bias remains neutral. Stronger recovery cannot be ruled out, but outlook will stay bearish as long as 0.6621 resistance holds. On the downside, break of 0.6468 will resume the fall from 0.6870, as part of the down trend from 0.7156, to 61.8% projection of 0.6870 to 0.6524 from 0.6621 at 0.6407 next.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Employment Change Q4 | 0.40% | 0.30% | -0.20% | -0.10% |

| 21:45 | NZD | Unemployment Rate Q4 | 4.00% | 4.30% | 3.90% | |

| 21:45 | NZD | Labour Cost Index Q/Q Q4 | 1.00% | 0.80% | 0.80% | |

| 05:00 | JPY | Leading Economic Index Dec P | 110 | 109.5 | 107.6 | |

| 06:45 | CHF | Unemployment Rate M/M Jan | 2.20% | 2.20% | ||

| 07:00 | EUR | Germany Industrial Production M/M Dec | -0.20% | -0.70% | ||

| 07:45 | EUR | France Trade Balance (EUR) Dec | -6.0B | -5.9B | ||

| 08:00 | CHF | Foreign Currency Reserves (CHF) Jan | 654B | |||

| 09:00 | EUR | Italy Retail Sales M/M Dec | 0.20% | 0.40% | ||

| 13:30 | USD | Trade Balance (USD) Dec | -62.3B | -63.2B | ||

| 13:30 | CAD | Trade Balance (CAD) Dec | 1.1B | 1.6B | ||

| 15:30 | USD | Crude Oil Inventories | 1.7M | 1.2M | ||

| 18:30 | CAD | BoC Summary of Deliberations |