Commodity currencies rises broadly in Asian session today, buoyed by slight improvement in risk sentiment after a relatively quiet weekend in the Middle East. This contrasted with the performance of typically safe-haven assets such as Swiss Franc, Japanese Yen, and Dollar, all of which traded mildly lower. Gold also dips away from 2400 mark, while WTI crude oil lingered around 82. Overall, the picture suggests relative calm in the markets for now.

China’s central bank kept benchmark lending rates unchanged today, with one-year loan prime rate holding steady at 3.45% and five-year rate at 3.95%. On the geopolitical front, US Congress moved forward with legislation targeting TikTok, mandating the divestiture of its Chinese ownership within a year. Concurrently, a move mirrored the tensions as Apple dropped WhatsApp and Threads from its app store, in compliance with Chinese regulator’s request. These developments have minimal immediate impact on market so far.

Looking ahead, the trading day is expected to be subdued with few economic data due. However, the markets are poised for a volatile period this week in anticipation of a slew of important data releases, including US GDP and PCE inflation. These figures, alongside global PMIs and Australian CPI, could significantly influence market movements. Additionally, central bank activities, particularly BoC’s summary of deliberations and BoC policy decision and economic projections, are highly anticipated too.

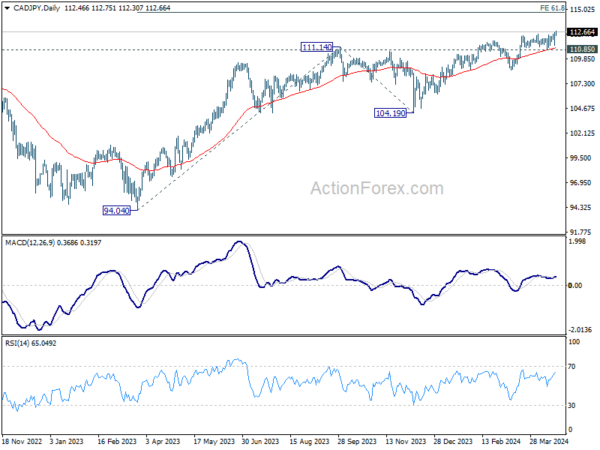

Technically, CAD/JPY is extending its long term up trend today. Outlook will stay bullish as long as 110.85 support holds. Next target is 61.8% projection of 94.04 to 111.14 from 104.19 at 114.75. The momentum of the move would depend on how markets interprets BoC minutes and BoJ forecasts.

In Asia, at the time of writing, Nikkei is up 0.46%. Hong Kong HSI is up 1.97%. China Shanghai SSE is down -0.51%. Singapore Strait Times is up 1.30%. Japan 10-year JGB yield is up 0.0432 at 0.880.

In Asia, at the time of writing, Nikkei is up 0.46%. Hong Kong HSI is up 1.97%. China Shanghai SSE is down -0.51%. Singapore Strait Times is up 1.30%. Japan 10-year JGB yield is up 0.0432 at 0.880.

Copper’s momentum intensifies with trade sanctions with 4.7 level as pivotal marker

Copper’s up trend resumed last week and accelerated significantly higher. The move was primarily driven by imposition of new trade sanctions by the UK and US, targeting Russian exports of key metals including aluminium, copper, and nickel to major commodity exchanges like LME and CME. This policy move, aimed at penalizing Russia for its actions in Ukraine, has effectively curtailed supplies of these metals, exerting upward pressure on prices.

The underlying fundamentals of Copper have also been robust, shaped by a combination of supply-side challenges and a upturn in the global economy. Notably, rebound in China’s industrial activity has played a crucial role in bolstering market momentum. Additionally, disruptions at significant mining operations have tightened the supply further, adding to Copper’s momentum.

From a speculative standpoint, the enthusiasm in the copper market is also palpable. According to recent LME data, hedge funds have increased their net long positions in Copper to the highest levels since February 2021. This influx of financial investments into copper futures suggests that prices may now be exceeding the actual market fundamentals, indicating a speculative bubble in formation.

Technically, the strong break of 4.3556 resistance confirmed resumption of whole rise from 3.1314 (2022 low). Near term outlook will stay bullish as long as 4.2645 support holds. Next target is 261.8% projection of 3.5021 to 3.9346 from 3.6324 at 4.7647.

This level is close to 100% projection of 3.1314 to 4.3556 from 3.5021 at 4.7263, as well as long term channel resistance. The cluster resistance zone at around 4.7 would be crucial to decide whether Copper is already in a secular bull markets that’s ready to power through 5.000 psychological level.

SNB’s Jordan cautions against using monetary policy to finance debt

In an interview with SRF, SNB Chairman Thomas Jordan stressed the critical issues of sluggish growth and the need for structural reforms. He underscored the importance of enhancing productivity to bolster economic growth across nations. Additionally, e highlighted the troubling high levels of debt and substantial deficits many countries are grappling with, which he deemed unsustainable in the long run.

Jordan emphasized that correcting these fiscal imbalances is imperative for future economic stability. He warned against the misuse of monetary policy as a tool for financing state debts, asserting that such practices could lead to dire consequences.

“It is very important that at the same time monetary policy remains geared towards price stability, rather than monetary policy being needed to finance debt, otherwise it will not end well,” Jordan cautioned.

ECB’s Villeroy: We must not wait too much on interest rate cut

ECB Governing Council member Francois Villeroy de Galhau, in a discussion with Les Echos, stressed that increase in oil prices due to conflicts in the Middle East would not trigger a “mechanical” policy shift. Instead, the bank would carefully assess whether these increases significantly fuel core inflation and inflation expectations before deciding on any action.

Villeroy made it clear that ECB is prepared to act without undue delay in lowering interest rates. “No — unless there is a surprise, we must not wait too much,” he said.

“From the point we have sufficient confidence in the fact that we will meet the 2% inflation objective by next year, our duty is to minimize the cost in terms of activity and employment,” Villeroy said. “That is the sense of a first cut in June.”

Will US GDP and PCE inflation shift Fed cut expectations further?

A series of economic events are in focuses this week, including central bank activities in Japan and Canada, as well as high profile economic data globally.

Significant attention is on US Q1 GDP advance and March PCE inflation data, which would heavily influence Fed policy easing expectations, including timing for the first reduction and the number of cuts this year. Presently, Fed funds futures suggest about 65% likelihood of the first rate cut occurring in September. Meanwhile, the probability of a total of two rate cuts within the year stands at around 50% only. Stronger-than-expected economic growth paired with slowdown or even stalling in disinflation, could push the first cut further out, and even diminish the probability of multiple rate cuts.

BoJ meeting is also highlight anticipated due to the release of new economic projections. The central bank is expected to forecast inflation to stay at around 2% target well into early 2027. But some economist because this inflation outlook is insufficient to spur BoJ fort another rate hike this year. The central question is whether the recent wage hikes will effectively boost consumption enough to sustain inflation and support there economy, thereby justifying further tightening of monetary policy. A recent Bloomberg survey indicates that only about 40% of economists are pointing to October as a potential window for the next rate increase.

The markets are also monitoring BoC summary of deliberations too. Although BoC’s latest statement has not explicitly indicated an imminent rate cut, Governor Tiff Macklem clearly indicated later that a June reduction is possible. The markets will scrutinize the summary document to understand the balance of factors BoC considers critical for the decision.

Spotlight is also on Australia’s quarterly CPI data. According to ASX’s RBA Rate Tracker, the first rate cut is not fully priced in until March next year, with no second cut anticipated yet. But these expectations could shift depending on the CPI data and its implications for ongoing disinflation.

Furthermore, the week is packed with other crucial data releases including US durable goods orders, Japan’s Tokyo CPI, Germany’s Ifo business climate, and Canada’s retail sales, along with PMI figures from most major economies.

Here are some highlights for the week:

- Monday: Eurozone consumer confidence; Canada IPPI and RMPI, new housing price index.

- Tuesday: Australia PMIs; Japan PMIs; Eurozone PMIs; UK PMIs; US PMIs, new home sales.

- Wednesday: New Zealand trade balance; Australia CPI; Swiss Credit Suisse economic expectations; Germany Ifo business climate; Canada retail sales, BoC summary of deliberations; US durable goods orders.

- Thursday: Germany Gfk consumer climate; ECB monthly bulletin; US GDP, goods trade balance, pending home sales.

- Friday: Japan Tokyo CPI, BoJ rate decision; Australia PPI, import prices; US personal income and spending, PCE inflation

AUD/USD Daily Report

Daily Pivots: (S1) 0.6376; (P) 0.6404; (R1) 0.6447; More…

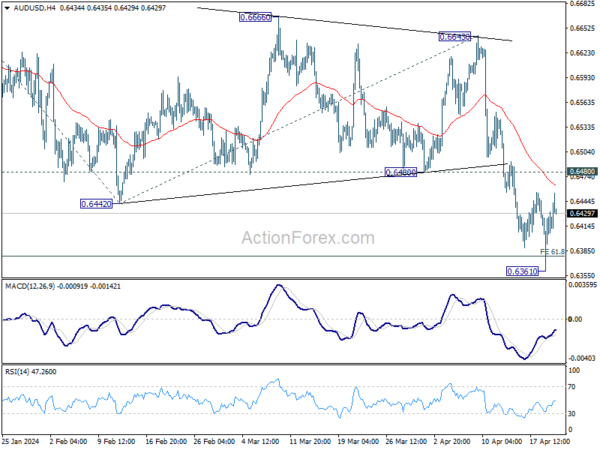

Intraday bias in AUD/USD remains neutral as consolidation from 0.6361 is extending. Upside of recovery should be limited by 0.6480 support turned resistance to bring another decline. On the downside, break of 0.6361 will resume the fall from 0.6870 to 100% projection of 0.6870 to 0.6442 from 0.6643 at 0.6215.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which is still in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Apr | 1.10% | 1.50% | ||

| 01:15 | CNY | PBoC 1-y Loan Prime Rate | 3.45% | 3.45% | 3.45% | |

| 01:15 | CNY | PBoC 4-y Loan Prime Rate | 3.95% | 3.95% | 3.95% | |

| 12:30 | CAD | Industrial Product Price M/M Mar | 0.80% | 0.70% | ||

| 12:30 | CAD | Raw Material Price Index Mar | 2.90% | 2.10% | ||

| 12:30 | CAD | New Housing Price Index M/M Mar | 0.10% | 0.10% | ||

| 14:00 | EUR | Eurozone Consumer Confidence Apr P | -14 | -15 |