The majority of home loans are linked to the EBLR, which stands for External Benchmark Lending Rate. The interest rates on all floating rate home loans will be linked to an external benchmark. For example, starting on October 1, 2019, SBI started using the repo rate as the external benchmark to link its floating rate home loans.

Beside the interest rate set by the bank according to the RBI guidelines, final interest rate depends on various factors.

Also read: This strategy will save Rs 16 lakh on Rs 40-lakh home loan, finish it 6 years early

Here are the top five banks and their home loan interest rates. Make sure to check your eligibility before applying.

SBI home loan interest rates

SBI offers home loan interest rates between 8.60% to 9.45% for individual borrowers. These are the campaign rates that are valid up to December 31, 2023. (Current EBR: 9.15%)

Also read: Home loan borrowers may have to wait longer for EMIs to drop as RBI holds repo rate

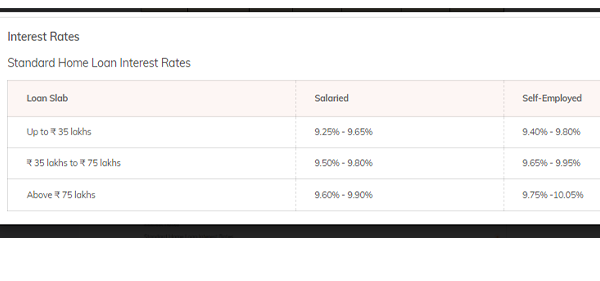

ICICI Bank home loan rates

ICICI Bank offers special home loans at the rate of 9.00% interest rate for CIBIL score between 750 – 800 for salaried individuals. The special home loan rates are valid up to September 30, 2023. The repo rate stands at 6.50%.

Standard home loan interest rates

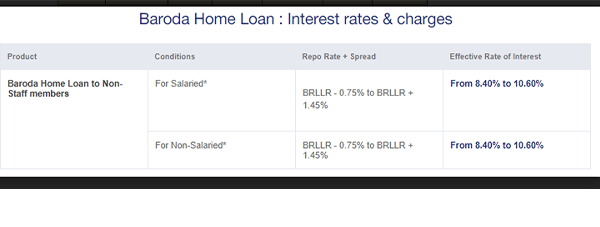

Bank of Baroda

Bank of Baroda offers home loans with interest rates ranging from 8.40% to 10.60% to both salaried and non-salaried people. The loan limit and the applicant’s CIBIL score both affect the interest rate. Customers who choose not to purchase credit insurance will be charged a risk premium of 0.05%.

According to the Bank of Baroda website, “For Retail Loans applicable BRLLR is 9.15% w.e.f. 14.02.2023 (Current RBI Repo Rate: 6.50% + MarkUp/Base Spread 2.65%).”

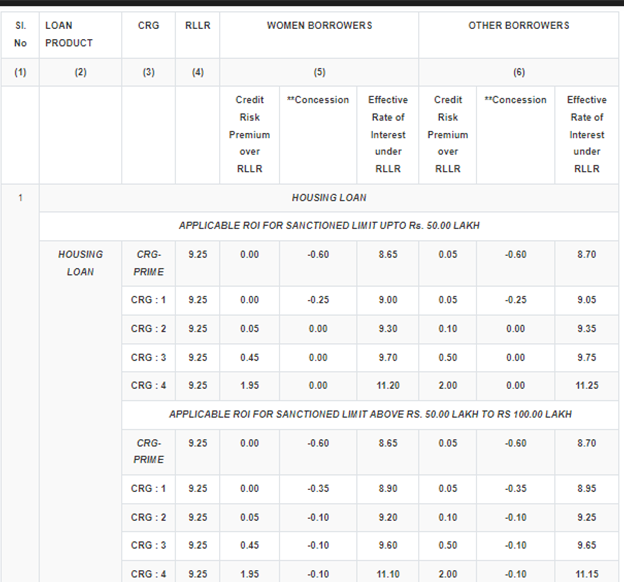

Canara Bank home loan interest rates

According to the Canara Bank website, “*The reviewed rate will be applicable only to new accounts opened on or after September 9, 2023 & accounts completing 3 years under RLLR regime on or after 12.09.2023. The accounts having not completed 3 years under RLLR regime will continue to be at earlier RLLR i.e. 9.40%.”

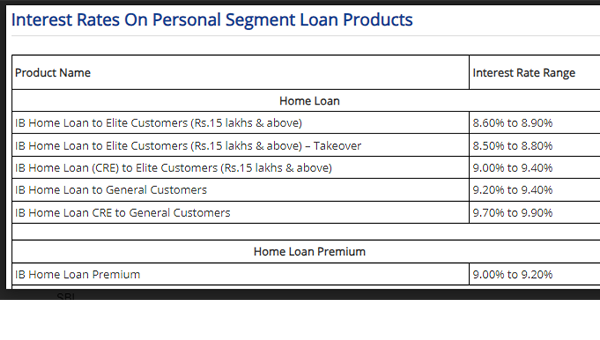

Indian Bank home loan

Indian Bank offers interest rate between 8.60% to 9.90% on home loans. Interest rate differs depending on the type of customers.

Importance of CIBIL score

The CIBIL score is crucial because it enables banks to limit loan and credit card offers to those with a strong credit history. Giving credit to someone with a strong credit score enables them to be sure that the loan is going to a responsible borrower. A CIBIL score of 700+ is considered the good CIBIL score for home loans.

CIBIL scores often vary from 300 to 900. However, the majority of lenders want a credit score of 650 or above in order to approve a home loan. Anything below 550 is seen as having a terrible CIBIL score, with an optimal CIBIL score for a home loan being 800. You can improve your credit score if it is between 550 and 700 so that it meets the requirements of your lenders.