Dollar rises significantly in early US session supported by the latest consumer inflation data, which also triggers a marked in DOW futures, dropping by over -300 points. Concurrently, 10-year Treasury yield is soaring near 4.3% mark. Most critically, the inflation data revealed that core CPI remained unchanged at 3.9% in January. This stagnation in core CPI—previously at 4% just three months ago and 4.3% six months back—sparked debates on whether disinflationary trends are stalling. This development would likely delaying any immediate Fed rate cut. Now, the May timeline for initiating rate reductions appears increasingly doubtful.

Meanwhile, Sterling, currently as a distant second best performer after Dollar, was supported by robust UK employment data. Although the data revealed gradual easing of wage pressures, they are not decelerating as quickly as BoE had hoped. Additionally, the decline in the unemployment rate underscores a persistently tight labor market, likely to sustain wage inflation. Attention is now keenly directed towards wage settlements expected by April, with some financial analysts adjusting their forecasts for BoE’s initial rate cut from May to later in the summer. However, Pound’s robustness will still be tested by the forthcoming UK CPI tomorrow and Thursday’s GDP data.

Conversely, Swiss Franc found itself at the bottom of today’s currency performance, affected by Switzerland’s lower-than-expected January CPI data and a significant slowdown in core CPI. These developments have fueled speculation among investors that SNB might advance its timeline for the initial rate cut, moving from September to a possible June action. The next set of CPI data due in early March could critically influence the SNB’s decision-making process in its March 21 meeting. A further surprise on the downside could prompt SNB to take preemptive action in March, potentially marking it as the first G10 central bank to commence easing in the current economic cycle.

Elsewhere, New Zealand Dollar and Australian Dollar trailed behind, with the former particularly impacted by RBNZ’s survey indicating a further easing of inflation expectations. Canadian Dollar, however, secured its position as the third strongest performer of the day, while Euro is mixed.

In Europe, at the time of writing, FTSE is down -0.41%. DAX is down -0.92%. CAC is down -0.79%. UK 10-year yield is up 0.076 at 4.134. Germany 10-year yield is up 0.040 at 2.406. Earlier in Asia, Nikkei rose sharply by 2.89% to new 34-year high. Japan 10-year JGB yield rose 0.0052 to 0.730. Singapore Strait Times rose 0.11%.

US CPI slows to 3.1% yoy in Jan, but core CPI unchanged at 3.9% yoy

US CPI rises 0.3% mom in January, above expectation of 0.2% mom. CPI core (all items less food and energy) rise 0.4% mom, above expectation of 0.3% mom. Index for shelter rose 0.6% mom, contributing over two thirds of the monthly all item increase. Food index rose 0.4% mom while energy index fell -0.9% mom.

For the 12-month period, CPI slowed from 3.4% yoy to 3.1% yoy, above expectation of 2.9% yoy. CPI core was unchanged at 3.9% yoy, above expectation of 3.8% yoy. Energy index fell -4.6% yoy while food index rose 2.6% yoy.

German ZEW sentiment rises to 19.9, anticipating rate cuts

German ZEW Economic Sentiment rose from 15.2 to 19.9 in February, above expectation of 17.5. Current Situation Index, however, fell from -77.3 to -79.0, below expectation of -81.7.

Eurozone ZEW Economic Sentiment rose from 22.7 to 25.0, above expectation of 20.1. Current Situation Index increased 5.9 to -53.4.

ZEW President Achim Wambach said: “The German economy is in a bad place. The assessment of the current economic situation by the respondents has deteriorated to the lowest level since June 2020. In contrast, economic expectations for Germany have improved again.”

“Accordingly, more than two-thirds of the respondents expect the ECB to make interest rate cuts over the next six months in light of falling inflation rates. Almost three-quarters of respondents expect imminent interest rate cuts by the American central bank.”

UK unemployment rate falls to 3.8%, wages growth slows but beat expectations

UK payrolled employment rose 48k or 0.2% mom in January. Over the 12-month period, payrolled employment grew 413k or 1.4% yoy. Median month pay rose 6.4% yoy, ticked up from December’s 6.3% yoy. Claimant count rose 14.1k, below expectation of 15.2k.

In the three months to December, employment rate rose 0.2% (quarterly change) to 75.0%. Unemployment rate fell -0.2% to 3.8%. Inactivity rate was unchanged at 21.9%. Average earnings including bonus rose 5.8% yoy, down from prior month’s 6.7% yoy, but above expectation of 5.7% yoy. Average earnings excluding bonus rose 6.2% yoy, down from prior 6.7% yoy, above expectation of 6.0% yoy.

Swiss CPI down to 1.3% yoy in Jan, below expectation 1.6% yoy

Swiss CPI rose 0.2% mom in January, well below expectation of 0.6% mom. Core CPI (excluding fresh and seasonal products, energy and fuel), fell -0.3% mom. Domestic products prices rose 0.6% mom. Imported products prices fell -1.3% mom.

Annually, CPI slowed sharply from 1.7% yoy to 1.3% yoy, below expectation of 1.6% yoy. Core CPI slowed from 1.5% yoy to 1.2% yoy. Domestic products prices growth slowed from 2.3% yoy to 2.0% yoy. Imported products prices fell deeper, down from -0.2% yoy to -0.9% yoy.

RBA’s Kohler points to slightly faster than expected inflation decline

Marion Kohler, RBA’s Head of Economic Analysis, noted in a speech that inflation is “still high” but acknowledged a welcome trend: it’s decreasing “at a slightly faster rate” than what RBA had forecasted three months prior.

Looking ahead, RBA’s expectation is for inflation to settle back into its 2-3% target range by 2025 and reach the midpoint by the following year. However, Kohler underscored the “substantial uncertainty” surrounding these long-term predictions.

A notable aspect of Australia’s inflation dynamics, as Kohler pointed out, is the “divergence in the path of core goods and services price inflation.”

The primary driver behind the recent dip in inflation rates is the decrease in goods price inflation, whereas services price inflation remains “high and broadly based.” This sector’s inflation is predicted to “only gradually” diminish as a more equitable demand-supply relationship is established and domestic cost pressures begin to ease.

Kohler also touched on labor costs, particularly significant in the labor-intensive services sector, as a crucial factor influencing the pricing strategies of businesses. RBA believes wage growth is “around its peak” and anticipates a gradual reduction in line with improvements in the labor market. Signs of “easing wage pressures” are already evident in specific industries, notably within business services.

Australia NAB business conditions down to 6, price pressures easing

Australia NAB Business Confidence improved slightly form 0 to 1 in January. Despite this marginal improvement, Business Conditions dropped from 8 to 6, with notable decreases in trading conditions from 11 to 8, profitability conditions from 7 to 5, and employment conditions also falling from 7 to 5.

In terms of cost pressures, labour cost growth remained steady at 2.0% in quarterly equivalent terms, while purchase cost growth saw a slight increase to 1.8% from 1.7%. Product price growth experienced a pickup, moving to 1.2% in quarterly terms from 0.9%, reflecting a broader trend of easing price pressures. Specifically, retail price growth rose to 0.9% from 0.5%, and the growth rate for recreation & personal services prices increased to 1.2% from 0.9%.

NAB Chief Economist Alan Oster commented on the findings, stating, ” Capacity utilisation remains high, despite the slowing in growth over the second half of 2023, and price pressures are easing, with hopes they settle well below where they are now.”

Australian Westpac consumer sentiment hits 20-Month high, but still pessimistic

Australia Westpac Consumer Sentiment Index surged by 6.2% mom to 86 in February, marking the highest level since June 2022. This increase also represents the largest monthly gain since April of the previous year, which conincided with a period when RBA temporarily halted its tightening cycle.

According to Westpac, the surge in consumer sentiment was notably propelled by improved sentiment towards major purchases, which climbed 11.3% to 86.8, and more optimistic outlook for the economy over the next year, rising 8.8% to 88.9—the highest since May 2022. Additionally, five-year economic outlook rose 4.4% to 93.

The cooling inflation and more favorable perspective on interest rates are believed to be the primary factors behind this uplift. However, despite the recent gains, consumer mood remains in the pessimistic territory.

A notable “sharp turnaround” in sentiment was observed following RBA’s decision in February to maintain the cash rate steady, with sentiment dropping from 94.1 to just 80 post-meeting. While the decision to keep rates unchanged aligned with general expectations, the decline in sentiment suggests consumers were anticipating a “clearer indication” that interest rates might begin to decrease.

Looking forward, Westpac anticipates the RBA will maintain the current interest rate in March, contingent on inflation continuing to align with expectations.

RBNZ survey reveals easing inflation expectationss

According to RBNZ’s latest Survey of Expectations, one-year inflation expectation fell by 38 basis points from 3.60% to 3.22%, marking its lowest point since September 2021. The survey also indicates a growing consensus, with more than half of respondents expecting that CPI inflation will fall back to RBNZ’s target range of 1-3% by the end of 2024

Furthermore, the survey pointed to a decrease in inflation expectations over the longer term, with two-year-ahead predictions dropping from 2.76% to 2.50%, and expectations for five and ten years ahead also seeing decline to 2.25% (from 2.43%) and 2.16% (from 2.28%), respectively.

In terms of interest rates, survey participants anticipate OCR to average at 5.46% by the end of March, with projected decrease to 4.74% by the end of the year. The OCR currently stands at 5.50%.

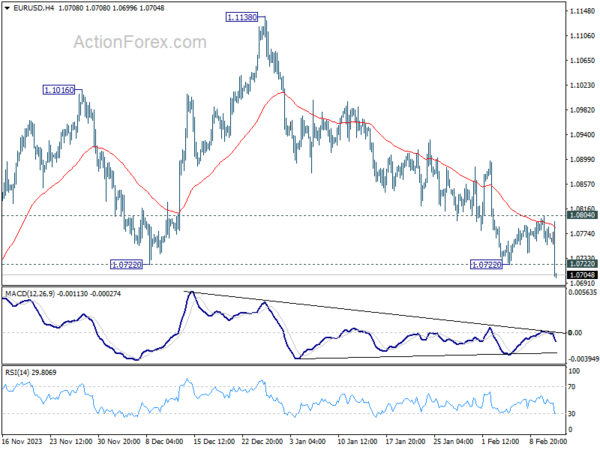

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0750; (P) 1.0778; (R1) 1.0800; More…

EUR/USD’s fall from 1.1138 resumed by breaking 1.0722 support today. More importantly, current development argues that whole rise from 1.0477 has already finished. Intraday bias is back on the downside for 1.0447. On the upside, break of 1.0804 resistance is needed to signal short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

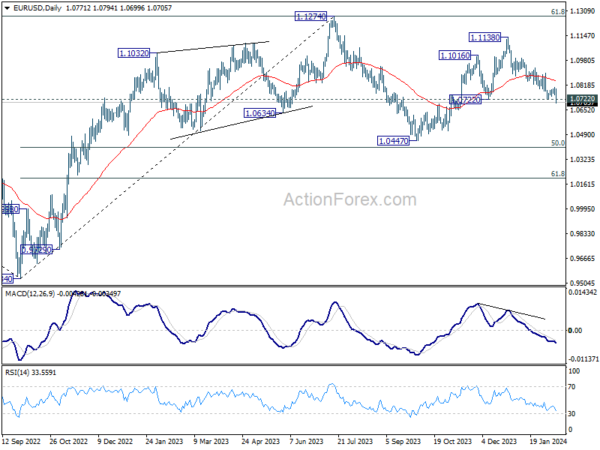

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Feb | 6.20% | -1.30% | ||

| 23:50 | JPY | PPI Y/Y Jan | 0.20% | 0.10% | 0.00% | 0.20% |

| 00:30 | AUD | NAB Business Confidence Jan | 1 | -1 | ||

| 00:30 | AUD | NAB Business Conditions Jan | 6 | 7 | ||

| 02:00 | NZD | RBNZ Inflation Expectations Q1 | 2.50% | 2.76% | ||

| 06:00 | JPY | Machine Tool Orders Y/Y Jan | -9.90% | |||

| 07:00 | GBP | Claimant Count Change Jan | 14.1K | 15.2K | 11.7K | 5.5K |

| 07:00 | GBP | Unemployment rate Dec | 3.80% | 4.00% | 4.20% | |

| 07:00 | GBP | Average Earnings Including Bonus 3M/Y Dec | 5.80% | 5.70% | 6.50% | 6.70% |

| 07:00 | GBP | Average Earnings Excluding Bonus 3M/Y Dec | 6.20% | 6.00% | 6.60% | 6.70% |

| 07:30 | CHF | CPI M/M Jan | 0.20% | 0.60% | 0.00% | |

| 07:30 | CHF | CPI Y/Y Jan | 1.30% | 1.60% | 1.70% | |

| 10:00 | EUR | Germany ZEW Economic Sentiment Feb | 19.9 | 17.5 | 15.2 | |

| 10:00 | EUR | Germany ZEW Current Situation Feb | -81.7 | -79 | -77.3 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Feb | 25 | 20.1 | 22.7 | |

| 11:00 | USD | NFIB Business Optimism Index Jan | 89.9 | 91.1 | 91.9 | |

| 13:30 | USD | CPI M/M Jan | 0.30% | 0.20% | 0.30% | |

| 13:30 | USD | CPI Y/Y Jan | 3.10% | 2.90% | 3.40% | |

| 13:30 | USD | CPI Core M/M Jan | 0.40% | 0.30% | 0.30% | |

| 13:30 | USD | CPI Core Y/Y Jan | 3.90% | 3.80% | 3.90% |