- Data have to turn quickly negative for the March gathering to become live

- Market assigns only 30% chance for a March move; April rate cut is a done deal

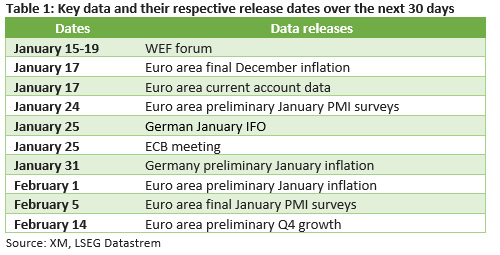

- January concludes with preliminary PMIs and the January 25 ECB meeting

Despite the upside surprise at the December inflation report, the market remains convinced that the ECB will probably be the first one to announce a rate cut in 2024. The market is currently pricing in a 30% probability of a March 7 rate move. With President Lagarde remaining adamant that the ECB is not yet in an easing mood, what needs to happen for the ECB to cut rates in March?

1. Inflation falling aggressively

Contrary to the Fed’s dual mandate, the ECB’s only target remains price stability i.e. 2% inflation over the medium term. Hence, an unexpected drop in inflation, particularly in the core indicator, would clearly open the door to a more dovish stance. The next CPI release for the month of January comes on January 31 and February 1 for Germany and the euro area respectively.

Energy prices played a massive role in pushing inflation to double digits. As our colleague Marios Hadjikyriacos wrote in a recent special report, downside risks for oil prices are mounting with a price war possibly around the corner. Such an outcome would mean much lower oil prices going forward with inflation dropping aggressively due to the negative base effects. Of course, lower oil prices would potentially fuel growth and consumer spending but that would be a problem for another day.

2. Growth tanking

Last year was a difficult one in terms of growth. The Euro area on the whole managed to grow but Germany has probably contracted. The IMF, the OECD and the European Commission agree that 2024 will be a stronger year with Germany returning to positive growth territory. However, these forecasts were made before the German debt shenanigans with the resulting fiscal tightening further complicating the outlook. The ECB’s own projection for euro area growth is a mere 0.8%. The next German IFO survey will be published on January 25 with the preliminary PMI surveys for January scheduled for a February 5 release.

3. Fiscal tightness = no more energy support programmes

Following four years of fiscal relaxation, the euro area countries agreed to reactivate the Stability and Growth Pact. In layman terms, euro area countries must have a credible plan of cutting their debt and should aim mostly for balanced budgets. In case of another strong oil rally, the euro area governments would be unable to offer financial support to consumers, with the crashing consumer spending appetite causing an acute economic slowdown.

4. External events

An escalation in Ukraine and/or the Middle East, or even a flare-up in one of the world’s troubled areas would impact world trade routes and investment appetite, thus resulting in a significant drop in growth. As mentioned earlier, Europe is already barely growing. Should such an event occur, the ECB will be forced to cut interest rates in order to stop the economy from falling off in a recession.

Euro to suffer from an early rate cut?

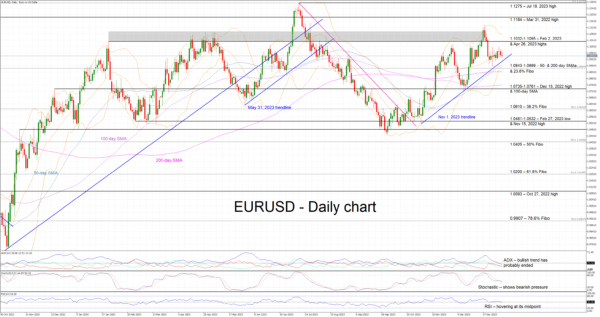

Despite the evident divergence between the decent growth seen in the US and the continued economic weakness recorded in the Euro area, euro-dollar has been enjoying an upleg from the October lows. The contradictory rhetoric at the December central banks meetings supported this rally but data releases will probably determine the short-term outlook.

A gradual build-up of market expectations for a March ECB rate cut could open the door for correction towards the 1.0735 area. On the flip side, with the market continuing to inflate the expected rate cuts by the Fed, euro bulls could feel more confident in targeting another rally towards the recent peak of 1.1139.