- BoJ meeting minutes summary keep the door open to a July rate hike

- Key data due this week, especially Friday’s Tokyo CPI

- Retail sales data to show consumer appetite

- Yen remains under pressure as officials avoid verbal intervention

The BoJ is still willing to hike rates

On June 14, the Bank of Japan kept its interest rate unchanged and failed to surprise the market. Despite reaching an agreement to reduce the current bond buying programme, BoJ members opted to announce the reduced amount at the July meeting, disappointing the growing expectations for another hawkish move by the BoJ.

It looks like the Nikkei article highlighting that the BoJ is indeed considering scaling back the purchases, published before the meeting, caught Governor Ueda et al off guard. One would have expected better preparation from the BoJ, but at least they now appear to be heading in the right direction as BoJ officials are scheduled to hold meetings with main Japanese bond market players on July 9-10, ahead of the July 31 gathering.

The July meeting could be a massive one

Interestingly, the Summary of Opinions from the last BoJ meeting was released earlier this week and it was a touch more hawkish than anticipated. There seems to be good support for further action on the rates front and for significantly curtailing the bond buying programme. But, at the end of the day, economic data releases during July should dictate the new size of the bond programme and the realistic possibility of another rate hike. The market is currently pricing in 19bps of rate hikes until year-end, while it is currently looking for 48bps of rate cuts by the Fed by end-2024.

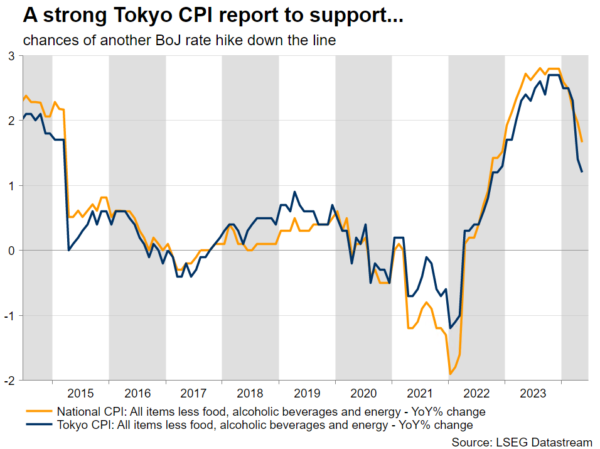

Tokyo CPI released on Friday

On Friday, the Tokyo CPI for the month of June will be published. There will be another release of this inflation report on July 30, a day before the actual BoJ meeting, but Friday’s print is important for sentiment. The market is looking for a small uptick across the board, albeit nothing worthwhile to affect the chances for a rate hike in July. The BoJ hawks would probably appreciate an upside surprise on Friday following the recent relatively weaker prints seen in the national inflation rates.

Retail sales key for the BoJ outlook

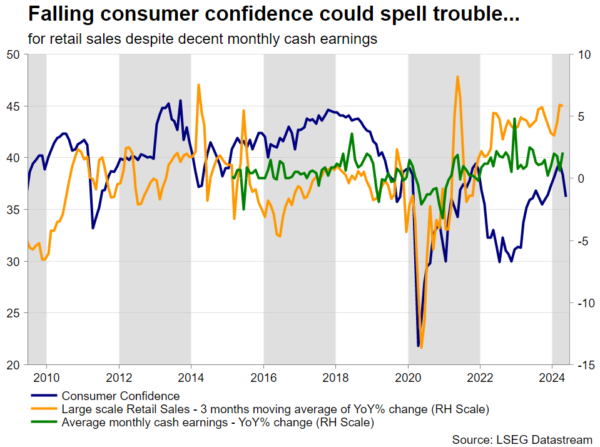

What is more crucial for the BoJ though is the demand side of the economy. Governor Ueda has repeatedly talked about the need for demand-led inflation and thus raising the importance of the annual wage negotiations. However, despite the positive developments recorded on this front earlier in 2024, these strong pay increases have yet to translate into higher consumer spending.

More specifically, consumer confidence is getting weaker, and the annual pace of retail sales has eased considerably since the latter part of 2023. Part of the reasons for this situation is the public’s frame of mind after almost 30 years of deflation and the aggressive depreciation of the yen.

The BoJ might not be overly negative about the ongoing yen weakness as it is probably boosting exports and should, down the line, benefit the domestic industrial sector. The preliminary industrial production data for May will be published on Friday, ahead of next week’s key quarterly Tankan survey, and it would be interesting to see any impact from April’s yen move.

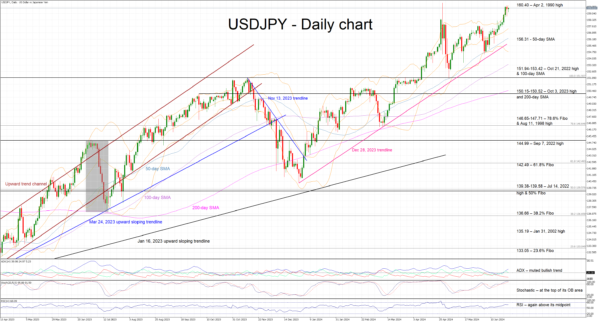

Dollar/yen close to intervention levels

In the meantime, dollar/yen is trading a tad below 160-yen level and sounding an alarm at the trading floors of the big investment houses. The last time this pair traded at similar levels was in late April when the BoJ intervened twice and pushed it lower. That correction proved short-lived though as the chances of a Fed rate cut ahead of the November US presidential election remain low.