Dollar is showing signs of revival in early session, in the wake of the release of CPI data, which indicated a marginally stronger headline inflation than anticipated. This uptick is further supplemented by a parallel recovery in treasury yields, lending some support to the greenback. However, any substantial upside for Dollar remains in check, as stock futures are holding steady, underscoring a lack of significant market jitters in response to the inflation data. Overall, while the momentum of Dollar’s pull back this week has clearly receded, it remains to be seen if it is reversing.

For the day, Canadian Dollar and Swiss Franc are vying for top spots, closely trailing the greenback. Meanwhile, Australian and New Zealand Dollars are lagging, registering as the day’s underperformers. British Pound is also on the weaker side, even though monthly GDP data showcased a return to growth. Euro presents a mixed picture, following the revelation from ECB meeting accounts about the narrowly-decided stance of most policymakers on the September rate hike. Yen, in a similar vein, is somewhat directionless, though there’s apparent interest in pushing it closer to 150 mark against Dollar.

On the technical front, key levels across several currency pairs are in focus, including 1.0518 support in EUR/USD, 1.2110 support in GBP/USD, 0.9081 resistance in USD/CHF, and 1.3674 resistance in USD/CAD. A simultaneous break of these level is needed to offer a more unequivocal affirmation of Dollar’s underlying bullish momentum, thus confirming the end of its near term correction.

In Europe, at the time of writing, FTSE is up 0.63%. DAX is up 0.24%. CAC is up 0.18%. Germany 10-year yield is up 0.023 at 2.749. Earlier in Asia, Nikkei rose 1.75%. Hong Kong HSI rose 1.93%. China Shanghai SSE rose 0.94%. Singapore Strait Times rose 0.81%. Japan 10-year JGB yield fell -0.0236 to 0.755.

US CPI rose 0.4% mom in Sep, core CPI up 0.3% mom

In September, US CPI rose 0.4% mom above expectation of 0.3% mom. CPI core (ex-food and energy) rose 0.3% mom, matched expectations. Energy index rose 1.5% mom. Food index rose 0.2% mom.

Over the last 12 months. CPI was unchanged at 3.7% yoy, above expectation of 3.6% yoy. CPI core slowed from 4.3% yoy to 4.1% yoy , matched expectations. Energy index was down -0.5% yoy while food index was up 3.7% yoy.

US initial jobless claims unchanged at 209k

US initial jobless claims was unchanged at 209k in the week ending October 7, below expectation of 215k. Four-week moving average of initial claims fell -3k to 206k. Continuing claims rose 30k to 1702k in the week ending September 30. Four-week moving average of continuing claims rose 5k to 1674k.

BoE’s Pill: The question of sufficient policy action more finely balanced

BoE Chief Economist Huw Pill noted today that the pressing question of whether tightening has been adequate to curb high inflation is becoming “more finely balanced”.

Over the past two years, the BoE has executed 14 consecutive interest rate hikes, a strategy that is still in the process of fully impacting the economy. “We have done a lot over the last two years. A lot of that policy is still to come through,” Pill told a panel discussion at IMF meetings in Morocco.

But, “Whether we’ve done enough – or whether we have more to do – I think is becoming a more finely balanced issue,” he added. Despite this, Pill assured that the bank remains committed to ensuring inflation returns to the 2% target on a lasting basis.

On the topic of potentially reducing rates, Pill deemed such conversations premature. He reaffirmed the bank’s position that high borrowing costs are likely to be maintained for a duration.

UK GDP shows modest 0.2% mom growth in Aug, services the sole contributor

UK’s GDP data for August reveals a mixed bag of results, characterized by modest growth and a sector-specific performance variance. The economy grew by 0.2% mom, aligning with market expectations

Dissecting the numbers, the services sector emerges as the sole contributor to GDP growth, registering a 0.4% mom increase. Contrastingly, the production output faced a downturn, shrinking by -0.7% mom , while the construction sector similarly contracted by -0.5% mom .

In a more expansive view, the 0.3% rise in GDP over the three months leading to August paints a picture of gradual, albeit inconsistent, economic expansion.

In this three months period, production led the charge with a 1.2% increase, highlighting a resilient manufacturing and industrial segment that counters the monthly dip in August. Construction also showed promise with a 0.9% rise, indicating a level of sustained activity in infrastructure development over the quarter. Services, though only increasing by a marginal 0.1%, maintained its positive contribution.

ECB Minutes: Despite being close call, solid majority back rate hike in Sep

Minutes from ECB’s meeting held on 13-14 September 2023 revealed that “a solid majority of members” supported for the 25bps rate hike, event though the decision was described as a “close call”.

These members were particularly concerned about the persistently high levels of inflation. They stressed the importance of the rate increase as it would “signal a strong determination” to bring inflation back to the target in a timely manner.” The emphasis was on ensuring that the duration to realign inflation to the 2% target “should not extend beyond 2025.”

A significant concern raised was the potential misinterpretation of ECB’s commitment if there was a decision to pause. The minutes noted that “erring on the side of pausing the first time the decision was a close call could risk being interpreted as a weakening of the ECB’s determination,” especially given the backdrop of both headline and core inflation rates were above 5%.

Furthermore, it was highlighted that any such pause in the rate-setting process might be misconstrued, fueling market speculations that “the tightening cycle was over.” Such speculation, the members argued, “increased the risk of a rebound in inflation.”

ECB’s Stournaras cautions against hasty monetary tightening amid rising geopolitical risks

ECB Governing Council member Yannis Stournaras emphasized caution against tightening monetary policy further today. He noted borrowing costs had already risen since the ECB’s last policy meeting as a result of higher bond yields. Furthermore, given that minimum reserves are not subject to remuneration, the total interest dispensed by the 20 Eurozone central banks to their respective commercial banks would see a decline.

He noted borrowing costs had already risen since the ECB’s last policy meeting as a result of higher bond yields. Furthermore, given that minimum reserves are not subject to remuneration, the total interest dispensed by the 20 Eurozone central banks to their respective commercial banks would see a decline.

Stournaras expressed skepticism regarding any immediate shift towards a tighter monetary stance. He articulated, “For the moment I see no reason why we should tighten monetary policy now because increasing the minimum requirements will imply monetary policy tightening.”

He also responded to suggestions from some counterparts on an early end to the ECB’s PEPP bond-buying initiative. Stournaras emphasized the importance of maintaining this tool, especially in the current context marked by significant geopolitical uncertainties.

He stated, “I see no value in bringing it (the end) forward especially now under the new uncertainty we have because of the events in Israel and Palestine.” Reiterating ECB’s need to retain its adaptability, he concluded, “So we need to keep our flexibility and act if necessary.”

Japan’s PPI slows to 2% yoy in Sep, trailing CPI core for the first time since 2021

Japan PPI slowed from 3.3% yoy to 2.0% yoy in September, below expectations of 2.3%. That’s the lowest level since March 2021. Also, PPI is now below CPI core (at 3.1% yoy) for the first time since early 2021.

Import price index was unchanged at -15.6% yoy, the sixth month of decline. Export price index rose for the first time in seven months, up 0.2% yoy, comparing to prior month’s -0.7% yoy.

For the month, PPI fell -0.3% mom. Import price index rose 0.6% mom. Export price index rose 0.5% mom.

EUR/USD Mid-Day Outlook

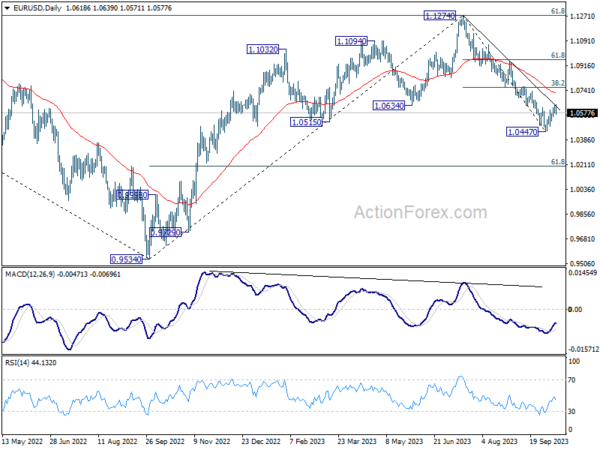

Daily Pivots: (S1) 1.0588; (P) 1.0611; (R1) 1.0643; More…

Intraday bias in EUR/USD is turned neutral first with current retreat. On the upside, break of 1.0639 will resume the rebound from 1.0447 to 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763). On the downside, though, break of 1.0518 will indicate rejection by near term trend line resistance. Intraday bias will be back on the downside for resuming the fall from 1.1274 through 1.0447.

In the bigger picture, fall from 1.1274 medium term top could still be a correction to rise from 0.9534 (2022 low). But chance of a complete trend reversal is rising. In either case, current fall should target 61.8% retracement of 0.9534 to 1.1274 at 1.0199 next. For now, risk will stay on the downside as long as 55 D EMA (now at 1.0719) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Sep | -69% | -68% | ||

| 23:50 | JPY | Bank Lending Y/Y Sep | 2.90% | 3.10% | 3.10% | |

| 23:50 | JPY | PPI Y/Y Sep | 2.00% | 2.30% | 3.20% | 3.30% |

| 23:50 | JPY | Machinery Orders M/M Aug | -0.50% | 0.70% | -1.10% | |

| 00:00 | AUD | Consumer Inflation Expectations Oct | 4.80% | 4.60% | ||

| 06:00 | GBP | GDP M/M Aug | 0.20% | 0.20% | -0.50% | -0.60% |

| 06:00 | GBP | Industrial Production M/M Aug | -0.70% | -0.20% | -0.70% | -1.10% |

| 06:00 | GBP | Industrial Production Y/Y Aug | 1.30% | 1.70% | 0.40% | 1.00% |

| 06:00 | GBP | Manufacturing Production M/M Aug | -0.80% | -0.40% | -0.80% | -1.20% |

| 06:00 | GBP | Manufacturing Production Y/Y Aug | 2.80% | 3.40% | 3.00% | 3.10% |

| 06:00 | GBP | Goods Trade Balance Aug | -16.0B | -15.2B | -14.1B | -13.9B |

| 11:30 | EUR | ECB Meeting Accounts | ||||

| 12:00 | GBP | NIESR GDP Estimate (3M) Sep | -0.10% | 0.20% | 0.30% | |

| 12:30 | USD | Initial Jobless Claims (Oct 6) | 209K | 215K | 207K | |

| 12:30 | USD | CPI M/M Sep | 0.40% | 0.30% | 0.60% | |

| 12:30 | USD | CPI Y/Y Sep | 3.70% | 3.60% | 3.70% | |

| 12:30 | USD | CPI Core M/M Sep | 0.30% | 0.30% | 0.30% | |

| 12:30 | USD | CPI Core Y/Y Sep | 4.10% | 4.10% | 4.30% | |

| 14:30 | USD | Natural Gas Storage | 85B | 86B | ||

| 15:00 | USD | Crude Oil Inventories | -0.4M | -2.2M |