Market Picture

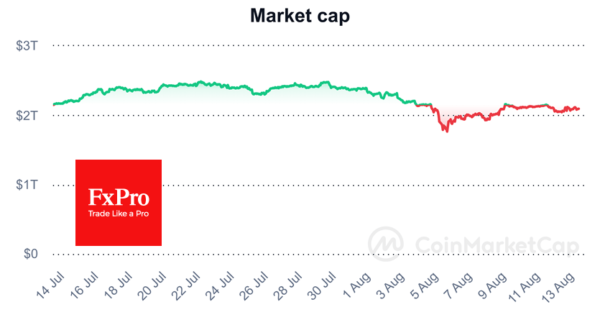

Over the past 24 hours, the cryptocurrency market has rallied 1.6% to $2.08 trillion, but in the past few hours, there has been a sell-off from a high of $2.15 – roughly the midpoint of the past 30 days’ range. Although cryptocurrency prices are higher on average than the previous day, there is a noticeable selling trend on the upside. The sentiment index stands at 31 (fear), up from 25 the previous day.

Bitcoin does not break above $60K and faces selling after it tried to break above the 50—and 200-day MAs late last week, showing seller dominance. Although sentiment has moved out of extreme fear territory, the RSI index on the daily timeframe has moved out of oversold territory, losing momentum for further strength. In this environment, Bitcoin is likely to fall by $5K rather than rise by the same amount.

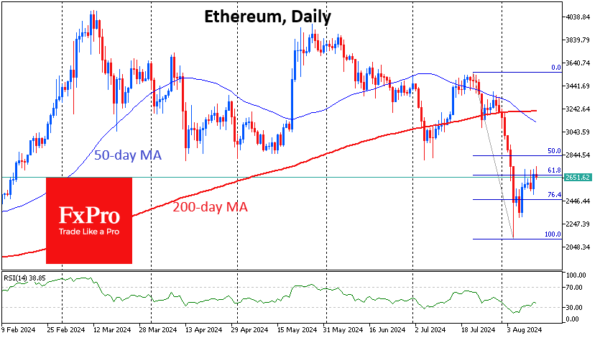

Ethereum is up 4.5% in 24 hours, but on the daily chart, the 61.8% Fibonacci level from the 22nd of July high to the 5th of August low acts as the upper boundary of the technical correction.

A sharp move lower in cryptocurrencies could be a harbinger of renewed momentum pressure on equities, which are still recovering from the 5 August lows.

News Background

According to CoinShares, investments in crypto funds rose by $176 million last week after a notable weekly outflow of $528 million. Bitcoin investments were up just $13 million, Ethereum investments were up $155 million, and Solana investments were up $5 million.

Inflows are recovering from the market correction as investors saw the recent pullback as a buying opportunity. Ethereum benefited the most from the correction, bringing year-to-date inflows to $862 million, the highest since 2021. Outflows from ‘short bitcoin’ ETFs were the largest since May 2023, showing a significant investor exit, CoinShares noted.

The US SEC said it needed more time to study the rationale and legal implications of simultaneously launching a universal ETF focused on Bitcoin and Ethereum.

MARA (formerly Marathon Digital) will raise $250 million through convertible notes to buy Bitcoin and for general corporate purposes. In July, MARA increased its holdings of the first cryptocurrency by 2,282 BTC to 20,818 BTC ($1.14 billion). MARA CEO Fred Thiel said the company is committed to a “full steam ahead” strategy.

According to Blockchain.com, bitcoin miners’ revenues have slumped to a one-year low. Bitcoin mining has been pushed to the brink of profitability by marketers without access to cheap electricity, according to BlocksBridge Consulting.

Keith, who has owned 1 million Ethereum since the ICO, transferred 5,000 coins ($13.2 million) to OKX. Over the month, he sent 48,500 ETH ($154 million) to the exchange at an average price of $3176,” Lookonchain noted.