De Beers on Wednesday said it expects to sell two-thirds fewer diamonds in the final sales cycles of 2023 than in the same period last year, as company CEO Al Cook said the gemstone seller’s push to limit supply is now showing signs it’s working to reduce the market glut.

The company, which was founded by British mining magnate Cecil Rhodes in 1888, has intentionally restricted sales of rough diamonds to its wholesale customers, called Sightholders, in its bid to combat oversupply caused by a market slump.

In the final five-week sales cycle of 2023, this strategy is set to see De Beers sell just $130 million worth of rough diamonds to its Sightholders, sums equivalent to less than a third the $417 million it reaped selling gemstones in the same period in 2022.

Shares in Anglo American

AAL,

which took control of De Beers in 2011, fell 1% on Tuesday having lost 40% of their value over the previous 12 months.

De Beers CEO Cook, who joined the diamond seller in February from Norway’s state-owned oil company Equinor, has said the company’s push to rebalance the market now seems to be working.

“As the end-of-year holiday season progresses, we are seeing signs that the diamond industry is regaining its balance between wholesale supply and demand. Polished diamond prices look to have stabilised as inventory levels have decreased, though we expect improvements in rough diamond trading conditions to be gradual,” Cook said.

The London headquartered company, which is owned by FTSE 100 listed mining giant Anglo American, had previously started limiting its sales in the eighth sales cycle of 2023, in response to falling demand throughout 2023.

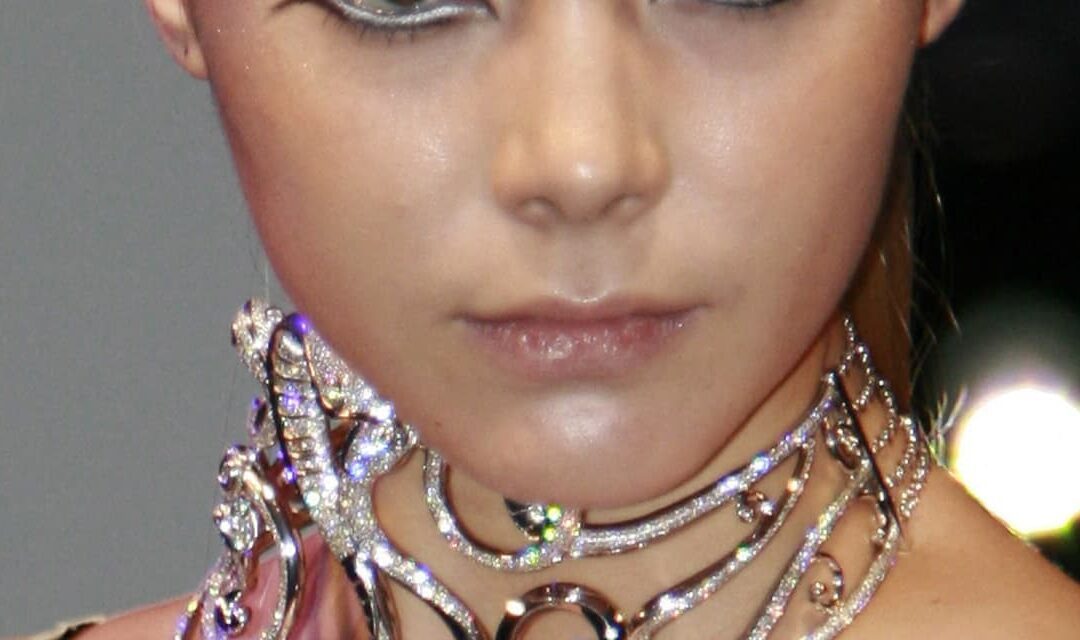

The diamond seller’s push comes amid a slump in demand for gemstones caused by the downturn in the global economy, the rise of lab-grown diamonds, and a drop off in engagements and marriages in the wake of COVID-19.

For reference, the world’s top gemstone sellers divide the year into a series of five-week sales cycles that correspond to amounts of time it takes for manufacturers to cut and polish the rough diamonds they purchase.

During those roughly-five week periods, the vast majority of rough diamonds made available on markets are sold to a select group of licensed wholesalers, while a smaller portion are sold to a wider group of accredited buyers via online auctions.

De Beers this year also launched a revamped version of its classic “A Diamond is Forever” advertising campaign, in the U.S. and China, in its bid to boost demand for natural diamonds.