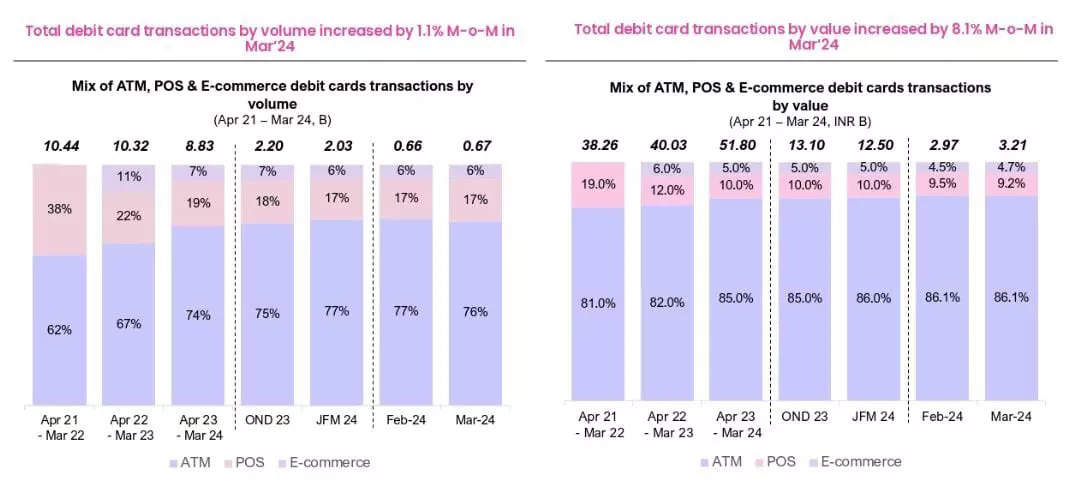

According to latest data by 1Lattice, on a year on year basis, debit cards transaction volume has decreased by a massive 14 per cent while the value of transactions increased by approximately 29 per cent in March 2024. However, on a month-on-month basis, the total debit cards transaction volume witnessed a slight increase by 1.1 per cent in March 2024, while the value increased by 8.1 per cent during the same month.

About 0.67 billion debit card transactions were carried out in March 2024, with 76 per cent of it constituting ATM transactions, 17 per cent in PoS and 6 per cent in E-commerce. The numbers had a marginal difference compared to February 2024, with approximately 0.66 billion debit card transactions in February 2024, 77.1 per cent of it being ATM transactions, 16.7 per cent in PoS and 6.2 per cent in E-commerce.

ALSO READ: HDFC and SBI dominate credit and debit cards market, BoB records highest growth in Mar’24

In comparison to the volume of transactions, the month of February saw Rs 3.21 billion worth of transactions. Out of this, transactions at ATMs were about 86.1 per cent, 9.2 per cent at PoS and 4.7 per cent at E-commerce, said the 1Lattice data.

In the past four years, debit and credit card transactions have grown at a CAGR of 20 per cent and 19 per cent respectively. There is said to be 71 million active credit cards in FY22, a recent report by PWC India highlighted.

It is expected that card-based transactions will continue to witness steady growth, at almost 16 per cent year on year for the next four years.

Credit Card transactions witness uptick

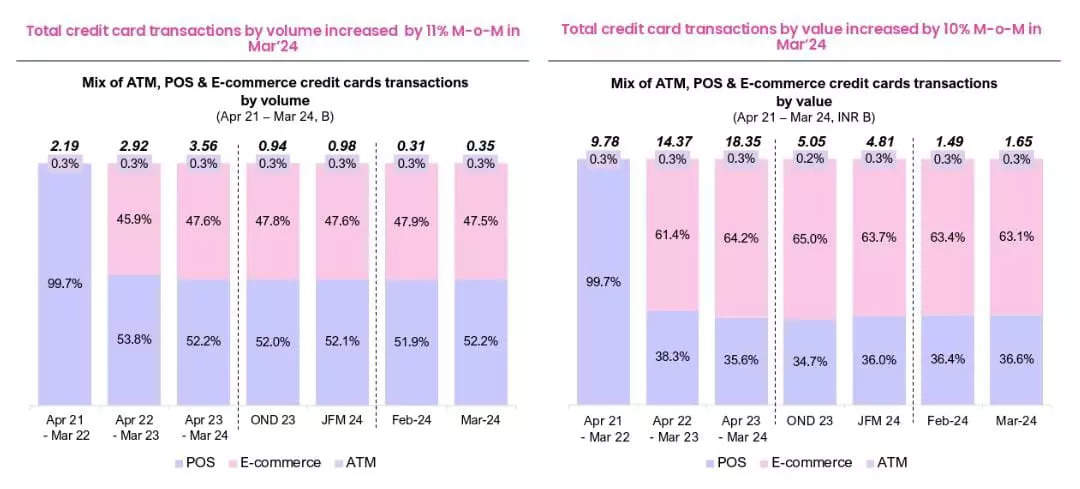

On a year on year basis, credit card transactions volume has witnessed a massive uptick by 22 per cent while the value has also increased by a whopping 28 per cent in March 2024. However, month-on-month the total credit cards transaction volume increased by 11 per cent in March 2024, while the value increased by 10 per cent during the same month.

Approximately 0.35 billion credit card transactions in volume were carried out in March 2024, with 52.2 per cent of it constituting PoS transactions, 47.5 per cent in E-commerce and 0.3 per cent in ATMs. The number has marginal difference to that recorded in February 2024.

In comparison to the volume of transactions, the month of March saw 1.65 billion worth of transactions. Out of this, transactions at PoS were about 36.6 per cent, 63.1 per cent at Ecommerce and 0.3 per cent at ATMs, the data added.