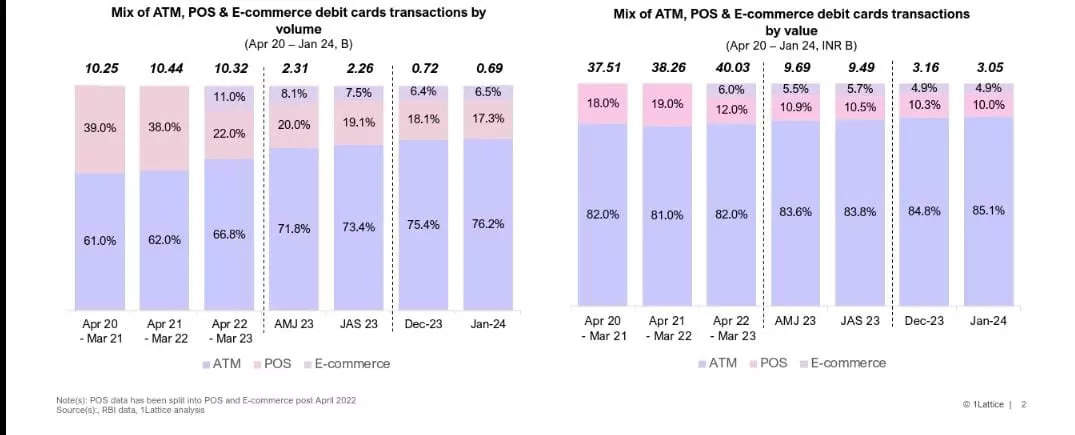

According to latest data by 1Lattice, on a year on year basis, debit cards transaction volume has decreased by a massive 16 per cent while the value decreased by approximately 7 per cent in January 2024. However, month-on-month, the total debit cards transaction volume witnessed a slight decline by 3.9 per cent in January 2024, while the value decreased by 3.5 per cent during the same month.

About 0.69 billion debit card transactions were carried out in January 2024, with 76.2 per cent of it constituting ATM transactions, 17.3 per cent in PoS and 6.5 per cent in Ecommerce. The numbers had a marginal difference compared to December 2023, with approximately 0.72 billion debit card transactions in December 2023, 75.4 per cent of it being ATM transactions, 18.1 per cent in PoS and 6.4 per cent in E-commerce.

In comparison to the volume of transactions, the month of January saw 3.05 billion worth of transactions. Out of this, transactions at ATMs were about 85.1 per cent, 10 per cent at PoS and 4.9 per cent at E-commerce, said the 1Lattice data.

In the past four years, debit and credit card transactions have grown at a CAGR of 20 per cent and 19 per cent respectively. There is said to be 71 million active credit cards in FY22, a recent report by PWC India highlighted.

It is expected that card-based transactions will continue to witness steady growth, at almost 16 per cent year on year for the next four years.

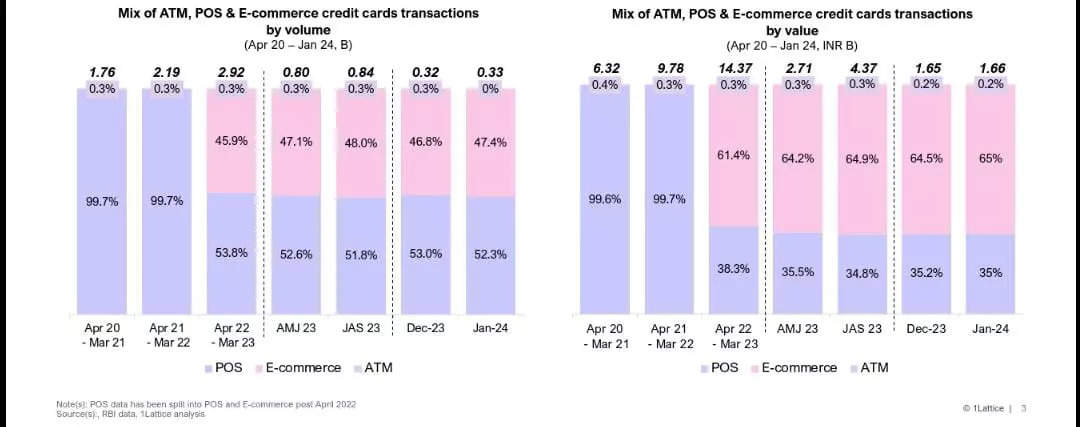

Credit Card transactions witness uptick

On a year on year basis, credit card transactions volume has witnessed an uptick by a massive 27 per cent while the value has also increased by a whopping 30 per cent in January 2024. Month on month, the total credit cards transaction volume increased by 2.3 per cent in January 2024, while the value increased by 0.8 per cent during the same month.

Approximately 0.33 billion credit card transactions in volume were carried out in January 2024, with 52.3 per cent of it constituting PoS transactions, 47.4 per cent in E-commerce and 0.3 per cent in ATMs. The number has marginal difference to that recorded in December 2023 with 53 per cent of it being PoS transactions, 46.8 per cent in E-commerce and 0.2 per cent in ATMs.

In comparison to the volume of transactions, the month of January saw 1.66 billion worth of transactions. Out of this, transactions at PoS were about 35 per cent, 65 per cent at Ecommerce and 0.2 per cent at ATMs, the data added.