In June 2024, the total number of demat accounts in India reached 162 million, witnessing a significant jump of 4.2 million new accounts, with an average of 3.4 million accounts added monthly so far in FY25, according to Motilal Oswal Financial Services.

The Central Depository Services Limited (CDSL) continued to gain market share, increasing its overall share month-on-month. In contrast, the National Securities Depository Limited (NSDL) lost 420 basis points (bp) in total market share and 620bp in incremental demat accounts on a year-on-year (YoY) basis.

The number of active clients on the National Stock Exchange (NSE) rose by 3.1% month-on-month (MoM) to 44.2 million in June 2024. The top five discount brokers now account for 64.4% of total NSE active clients, up from 58.2% in June 2022.

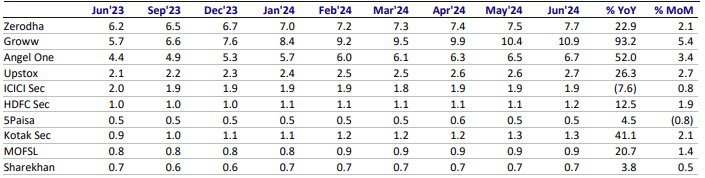

Performance of Discount Brokers

– Zerodha: Increased its client count by 2.1% MoM to 7.7 million, though its market share declined by 20bp to 17.3%.

– Groww: Saw a 5.4% MoM increase in clients to 10.9 million, with a 55bp rise in market share to 24.7%.

– Angel One: Client count rose by 3.4% MoM to 6.7 million, with a 5bp increase in market share to 15.2%.

– Upstox: Reported a 2.7% MoM increase in clients to 2.7 million, holding a market share of 6%.

Performance of Traditional Brokers

– ICICI Securities: Client count increased by 0.8% MoM to 1.9 million, with a 10bp drop in market share to 4.3%.

– IIFL Securities: Client count rose by 0.6% MoM to 0.4 million, with a 5bp dip in market share to 1%.

BSE’s F&O ADTO Increases

The total Average Daily Turnover (ADTO) on BSE increased by 15% MoM (up 92% YoY) to ₹499 trillion. The F&O ADTO rose by 15%, and Cash ADTO increased by 37.5% MoM. The BSE’s market share in the total cash turnover segment rose to ~7.2% in June 2024 from ~6.4% in May 2024. However, its market share in the options notional turnover segment declined to ~22% from ~23.2% in May 2024, and for options premium turnover, it declined to ~8.7% from ~9.7% in May 2024.

MCX Volume Decline

Total volumes on the Multi Commodity Exchange (MCX) declined by 10.7% MoM to ₹36.6 trillion in June 2024 (compared to ₹41.0 trillion in May 2024). Volumes in options futures (OPTFUT) declined by 9.7% MoM to ₹31.4 trillion. Overall ADTO increased by 2.7% MoM to ₹1.8 trillion; options ADTO rose by 3.9% MoM, while futures ADTO declined by 3.8% MoM.

The growth in demat accounts and active clients on NSE indicates a growing interest in stock market participation among Indian investors. The rise in market share for discount brokers and the increase in BSE’s ADTO highlight the shifting dynamics in the financial services sector. Despite the decline in MCX volumes, the overall trend points to a robust and expanding market.