Canadian Dollar weakens broadly in early US session, sparked by data indicating a stronger-than-anticipated progress in disinflation. Headline CPI fell below the 3% mark, accompanied by significant easing in core inflation measures. This development potentially opens the door for BoC to consider an interest rate cut sooner than anticipated, with the second quarter now appearing as a viable window for such a policy adjustment.

Conversely, Euro surges earlier today, buoyed by data from ECB’s wage tracker that reported only a marginal decrease in wage growth. Although this slight dip may be viewed as a positive sign, it does not sufficiently alleviate pressures to prompt an immediate rate cut in March. With wage pressures remaining on the higher side, a rate cut by ECB is more feasibly expected around June rather than April.

Despite Euro’s jump, it currently finds itself outperformed by both Australian and New Zealand Dollars in terms of currency strength. Dollar trails behind Canadian as the second weakest, followed by Japanese Yen, while Swiss Franc and Sterling are mixed.

Technically, EUR/CAD breaks through 55 D EMA with today’s strong rise. Focus is now back on 1.4733 resistance in the near term. Firm break there will argue that fall from 1.5041 has completed as a correction, with three waves down to 1.4457. That would revive the case that medium term consolidation from 1.5111 has completed at 1,.4155. In other words, if this bullish development realizes, EUR/CAD could then be ready to break through 1.5111 to resume the larger up trend.

In Europe, at the time of writing, FTSE is up 0.13%. DAX is don -0.13%. CAC is up 0.24%. UK 10-year yield is down -0.0376 at 4.072. Germany 10-year yield is down -0.017 at 2.397. Earlier in Asia, Nikkei fell -0.28%. Hong Kong HSI rose 0.57%. China Shanghai SSE rose 0.42%. Singapore Strait Times rose 0.56%. Japan 10-year JGB yield rose 0.0030 at 0.733.

Canada’s CPI slows to 2.9% yoy in Jan, ex-gasoline down to 3.2%

Canada’s CPI slowed from 3.4% yoy to 2.9% yoy in January, much lower than expectation of 3.3% yoy. The largest contributor to headline deceleration was lower year-over-year prices for gasoline (-4.0%). Excluding gasoline, CPI also fell from 3.5% yoy to 3.2% yoy. Food prices growth also fell from 4.7% yoy to 3.4% yoy. On a monthly basis, the CPI was unchanged, following a -0.3% mom decline in December.

Looking at the core measures, CPI median fell from 3.5% yoy to 3.3% yoy, below expectation of 3.6% yoy. CPI trimmed fell from 3.7% yoy to 3.4% yoy, below expectation of 3.6% yoy. CPI common fell from 3.9% yoy to 3.4% yoy, below expectation of 3.8% yoy.

BoE Bailey: Market’s rate cut outlook not unreasonable, yet unendorsed

In a session with the Treasury Select Committee today, BoE Governor Andrew Bailey acknowledged that It’s “not unreasonable” for the market to think about reductions in interest rates this year

However, he was quick to qualify this by stating that MPC “do not endorse the market curve” forecasting such cuts, adding that “we are not making a prediction of when or by how much” BoE cuts interest rates.

Bailey pointed to “encouraging signs” in key economic indicators, but stressed the importance of “sustained progress” in tackling inflation.

Addressing recent data indicating the UK’s entry into a technical recession in the latter half of the previous year, Bailey downplayed its impact, describing the downturn as “very weak” and pointing to “distinct signs of an upturn.”

ECB wage growth data: A glimpse of hope but no trigger for immediate rate cuts

ECB released data today indicating a slight decrease in negotiated wage growth to 4.46% in Q4, marking a downturn from the previous quarter’s record high of 4.69%. This development, though modest, is likely to be greeted positively by ECB policymakers, signaling a potential onset of wage growth deceleration anticipated throughout the year.

Despite the reduction, the magnitude of the drop is not substantial enough to prompt ECB to consider an immediate rate cut in March. The data presents a cautious optimism rather than a clear-cut rationale for policy easing. If ECB’s more hawkish members advocate for further evidence of wage growth deceleration, preferring to wait for the next wage data release in May, the likelihood shifts towards a rate cut in June, rather than April, as the more plausible timeline for monetary policy adjustment.

RBA minutes: High costs of persistent inflation may necessitate additional rate hike

RBA minutes from the February 5-6 meeting revealed that the Board considered both an 25bps rate hike and maintaining the current rate. The choice to hold rates was influenced by a perceived reduction in the risk that inflation would fail to revert to the target range “within a reasonable timeframe.” However, the potential repercussions of inflation not normalizing as anticipated were deemed “potentially very high,” leaving the door open for future rate increases.

Central to the decision was the observation that moderation in inflation over preceding months had been “slightly larger than previously expected”. Global experiences had also provided “additional confidence” on the disinflation trend. Additionally, incoming data suggested “weaker than previously expected” labor market conditions and consumer spending.

The assessment of risks surrounding the economic outlook as “broadly balanced”. RBA emphasized the importance of remaining vigilant, opting to monitor evolving risks closely before making further policy adjustments. The acknowledgment of the high “costs” associated with inflation remaining above target for too long underscores the cautious stance, with members unanimously agreeing on the necessity to “not to rule out a further increase” in the cash rate target.

China announces historic reduction in benchmark mortgage rates

In an effort to revitalize its beleaguered property sector and inject vitality into the broader national economy, China has taken larger than expected action by reducing a crucial reference rate for mortgage loans.

PBoC announced a significant cut in five-year loan prime rate to 3.95% from 4.20%. This move surpassed market expectations of a more modest reduction of 5 to 15 basis points. Notably, this adjustment also represents the largest cut in the five-year LPR since its inception in 2019 .

Conversely, one-year LPR, which serves as a barometer for market lending rates, was left unchanged at 3.45%.

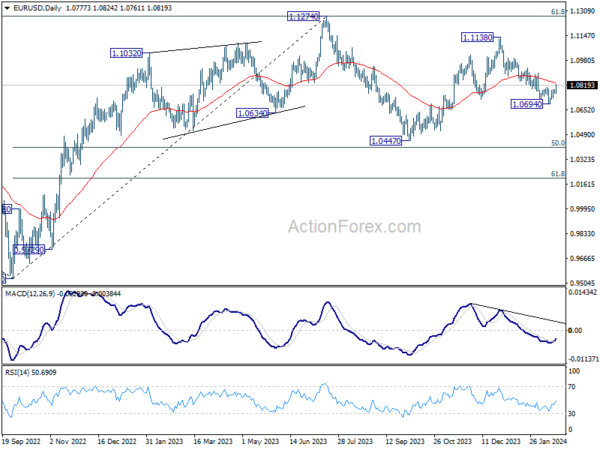

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0765; (P) 1.0777; (R1) 1.0792; More…

EUR/USD’s break of 1.0804 resistance suggests short term bottoming at 1.0694, on bullish convergence condition in 4H MACD. Intraday bias is back on the upside for stronger rebound. Sustained above 55 D EMA (now at 1.0833) will argue that fall from 1.1138 has completed and target this resistance. Meanwhile, rejection by 55 D EMA, followed by break of 1.0694, will resume the fall from 1.1138 to 1.0447 support.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 01:15 | CNY | PBoC 1Y Loan Prime Rate | 3.45% | 3.45% | 3.45% | |

| 01:15 | CNY | PBoC 5Y Loan Prime Rate | 3.95% | 4.10% | 4.20% | |

| 07:00 | CHF | Trade Balance (CHF) Jan | 4.74B | 2.35B | 1.25B | 1.27B |

| 09:00 | EUR | Eurozone Current Account (EUR) Dec | 31.9B | 20.3B | 24.6B | 22.5B |

| 13:30 | CAD | CPI M/M Jan | 0.00% | 0.40% | -0.30% | |

| 13:30 | CAD | CPI Y/Y Jan | 2.90% | 3.30% | 3.40% | |

| 13:30 | CAD | CPI Median Y/Y Jan | 3.30% | 3.60% | 3.60% | |

| 13:30 | CAD | CPI Trimmed Y/Y Jan | 3.40% | 3.60% | 3.70% | |

| 13:30 | CAD | CPI Common Y/Y Jan | 3.40% | 3.80% | 3.90% |