Not paying enough attention to tax matters can put you in a tight spot. Having coughed up a high tax for the past three months, Shilpa Bose knows this too well. The Delhi-based marketing professional submitted investment proof and other documents before the 15 January deadline, but still ended up paying a high tax. “The finance department didn’t take into account my tax-saving investments, medical insurance premium and home loan interest payments,” she says. That’s because Bose had not specified her choice of tax regime, which put her under the new tax regime by default and made her ineligible to claim many tax deductions and exemptions.

A lot of salaried taxpayers might be in the same boat. Last year’s Budget had made the new tax regime the default option for salaried taxpayers. The employees who did not inform their companies about the tax regime they preferred were automatically put in the new tax regime.

OLD REGIME

- SEC 80C INVESTMENTS

- HRA AND LTA

- NPS DEDUCTION

- HOME LOAN

- MEDICAL INSURANCE

NEW REGIME

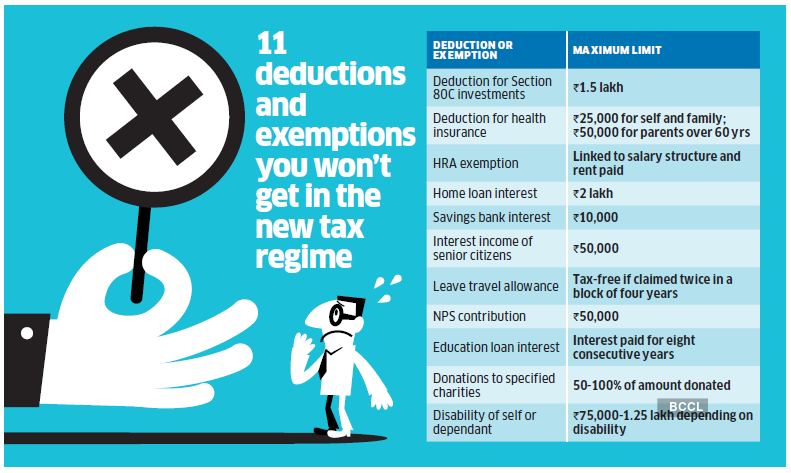

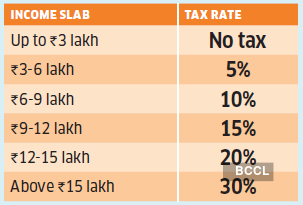

The new tax regime has a higher threshold for tax relief, wider tax slabs and lower tax rates, but very few deductions and exemptions. No exemption for house rent allowance (HRA) and leave travel allowance (LTA) or deduction for tax-saving investments, medical insurance and interest paid on home and education loans (see graphic).Old tax regime VS New tax regime

The old tax regime has four tax slabs.

Note1:If net income after all deductions and exemptions does not exceed `5 lakh, there is full tax relief under Section 87A.

Note2:Salaried taxpayers also get Rs.50,000 standard deduction.

The new regime has six tax slabs.

Note1:If net income does not exceed Rs.7 lakh, there is full tax relief under Section 87A.

Note2:Salaried taxpayers also get Rs.50,000 standard deduction

On the flipside, the taxpayer does not have to give any proof of investments and expenses. “The objective of the new tax regime is to simplify compliance by doing away with the maze of exemptions and deductions,” says Chartered Accountant Karan Batra.

Time to select tax regime

With the start of the new financial year, companies are reaching out to their employees to select the tax regime for 2024-25. This is an important decision because you can do it only once in a financial year. Once you make a choice, your income will be taxed as per the tax structure of that regime (see graphic). You can change the regime while filing your tax return next year, but tax will get deducted at source as per the selected regime.

“The choice of tax regime depends on several factors, including the salary structure, investments and financial needs of the individual,” says Sudhir Kaushik, CEO of tax filing portal TaxSpanner.com. “One should compare the two options carefully before making a choice,” he adds.

It also requires a good understanding of the various tax rules and financial regulations. Sourav Ghosh (see picture) opted for the new tax regime last year because the only deduction was the Rs.1.5 lakh tax-saving investments under Section 80C. That’s why he wants to continue with the new tax regime for the current financial year as well.

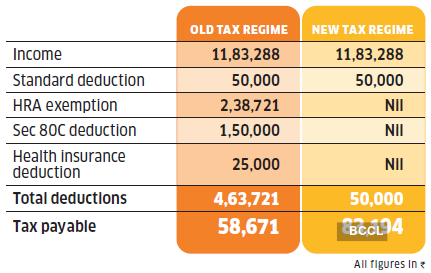

However, TaxSpanner found that Ghosh has not been claiming HRA exemption because he lives in his father’s house. If he pays rent to his father, he can claim an exemption for HRA and his tax under the old regime would be lower by more than Rs.24,000 (see graphic). The Rs.2.39 lakh rent received by his father is taxable after 30% standard deduction, but since his income is below the basic exemption for senior citizens, there will be no additional tax liability.

Don’t claim fake exemptions

While Ghosh can legally pay rent to his father, he needs to fulfill certain conditions for claiming the exemption. One, the property must be owned by the person who receives the rent. In this case, Ghosh’s father is the registered owner of the house. Two, Ghosh’s employer is likely to insist on seeing the rent agreement between the two parties and rent receipts before extending the exemption. Lastly, Ghosh must also mention his father’s PAN because the rent exceeds Rs.1 lakh in a year (Rs.8,333 per month).

Tax experts advise that the rent should be paid through cheque or by electronic transfer to show that the transaction is genuine. The tax department does not take cognisance of cash payments. The landlord also needs to declare the rental income in his tax return.

This is important because the tax department has recently discovered rampant misuse of HRA exemption. Rent receipts of around Rs.1 crore were linked to the same PAN. What’s more, the PAN holder said he was not a landlord and had no knowledge of any rental income. The tax department has also come across some 8,000-10,000 high-value cases where individuals have claimed HRA exemption though not living on rent.

Financial transactions are linked to PAN and the use of data analytics makes it fairly easy for the tax authorities to spot fake claims. “Fake rent claims may not only entail penalties and penal interest later, but can even lead to prosecution in extreme cases,” warns Kuldip Kumar, partner at Mainstay Tax Advisors.

Sourav Ghosh, 38 years, Kolkata

Our suggestion

Stay with the old tax regime because you can claim higher deductions and exemptions and save Rs.24,523 in tax.

Which regime suits you?

Under the old tax regime, if the net taxable income after all deductions and exemp tions does not exceed Rs.5 lakh, then the taxpayer gets full tax relief under Section 87A. “There are plenty of tax-saving opportunities under the old tax regime. By utilising all the exemptions and deductions, a taxpayer with an annual income of even up to Rs.10 lakh can reduce his tax to zero,” says Kaushik of TaxSpanner. To start with, there is a Rs.50,000 standard deduction. The investments under Section 80C offer Rs.1.5 lakh deduction. The home loan interest (or HRA exemption) takes care of another Rs.2 lakh. Then there is Rs.50,000 deduction for NPS contributions. Health insurance for self and parents can reduce the taxable income by another Rs.50,000. These 4-5 deductions combinedly bring down the taxable income to Rs.5 lakh and make the income completely tax-free.

The threshold for tax rebate is higher under the new tax regime. If the taxable income does not exceed Rs.7 lakh, there will be no tax. If you add the Rs.50,000 standard deduction, an individual with a taxable income of up to Rs.7.5 lakh will pay zero tax, without being forced to invest in tax-saving instruments. “The new tax regime particularly suits young earners who may not have enough investible surplus to lock in taxsaving instruments,” says Batra.

Ayush Gaikwad, 33 years, Pune

Our suggestion

Move to the new tax regime where the tax will be marginally lower by Rs.10,296 in tax. But if you put Rs.50,000 in the NPS and claim deduction under 80CCD(1b), the old regime will be more beneficial.

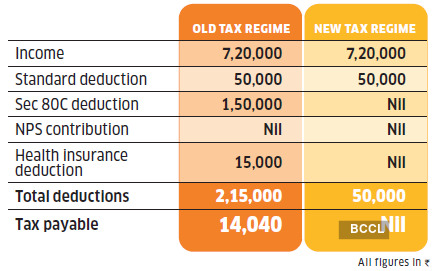

One such taxpayer is Noida-based finance professional Shuchi Gupta (see picture). Under the old tax regime, she is required to invest in the tax-saving options. Even after pouring Rs.1.5 lakh in tax-saving instruments under Section 80C and buying health insurance, she has to pay Rs.14,000 tax. “I don’t want to lock up money in the NPS just to save more tax,” she says.

If Gupta moves to the new tax regime, the standard deduction of Rs.50,000 will reduce her taxable income to less than Rs.7 lakh and render it completely tax-free. She will be eligible for full tax rebate under Section 87A.

Shuchi Gupta, 28 years, Noida

Our suggestion

Go for the new tax regime where there is no tax for an income up to Rs.7 lakh, thus saving you the entire Rs.14,040 in tax. If you put Rs.50,000 in the NPS and claim deduction under 80CCD(1b), there will be no tax under the old regime as well.

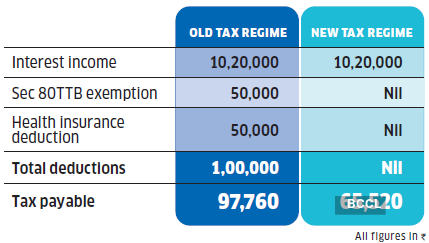

Ganesh Sahay, 74 years, Patna

Our suggestion

Move to the new tax regime. Even without the deduction for medical insurance and exemption under Sec 80TTB, your tax will be lower by Rs.32,240.

Young earners like Gupta are not the only ones who stand to gain from the freedom offered by the new tax regime. Even retirees like Ganesh Sahay (see picture) will find it beneficial. Sahay is 78 and has a modest income of Rs.10.2 lakh from deposits. Although he will forgo the Rs.50,000 tax exemption for interest income under Section 80TTB, and the health insurance premium deduction under Section 80D, he intends to go for the new regime where his tax outgo will be lower by more than Rs.32,000. “I don’t want to lock up money in tax-saving instruments at this stage of my life,” he says.

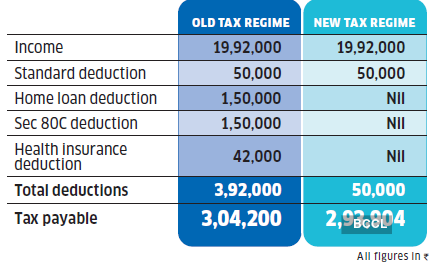

High income earners also gain

It would be incorrect to suggest that only those with low income and claiming very few deductions and exemptions should go for the new tax regime. Pune-based software engineer Ayush Gaikwad (see picture) earns well and claims exemptions and deductions of up to Rs.3.92 lakh, including home loan interest, Section 80C investments and health insurance for himself and his parents. Yet, he will pay less tax under the new tax regime, thanks to the lower tax rate for income up to Rs.15 lakh.

Many taxpayers might find that the new tax regime is more beneficial. The best part is that it gives individual taxpayers a lot of freedom. They can switch back to the old regime if they want at the time of filing returns. “Salaried taxpayers can switch from old to new tax regime, and vice versa, any number of times, but businesses can do so only once,” says Batra.

If you are switching to the new regime, you may want to let go of the tax-saving investments started in previous years. Though you won’t get any tax benefit from these under the new regime, some of these instruments may be serving other critical purposes in your financial plan (see box).

Don’t dump these in new tax regime

Many deductions are not available under the new tax regime, so many taxpayers may be thinking of discontinuing the tax-saving investments started in previous years. However, some of these investments should not be stopped just because these won’t fetch any tax benefit. These could be serving other critical purposes in your financial plan.

PPF: Continue investing to build tax-free corpus

In the past few years, many investment options have moved into the tax net, but the PPF remains completely tax-free. The small savings scheme is a good way to build a retirement corpus that earns tax-free interest and is tax-exempt on maturity. If you have investible surplus, keep investing in this taxadvantaged scheme.

Term insurance: Keep paying the premium for protection

Life insurance is not bought to save tax, but is meant to provide financial support if the policyholder dies. This is especially true for pure protection term insurance plans that give a large cover at a low price. Even if there is no tax benefit on the premium, do not stop paying the premium of your term insurance policy.

Medical insurance: Continue this critical cover irrespective of tax benefit

Continuing this cover is just as important as the term insurance policy. Don’t stop your medical cover because there is no deduction for the premium. As Covid showed us four years ago, the absence of medical insurance can ruin a household’s finances.

NPS: Invest under Sections that offer tax benefits

Even though there is no deduction under Section 80C under the new tax regime, the contributions to the NPS under Section 80CCD(2) will continue to enjoy tax benefits. If you have opted for the NPS through your employer, continue contributing to the scheme to get the tax benefit.