The forex markets are experiencing a lull today, with little movement in the absence of significant economic releases during European and early US sessions. The much-discussed non-farm payroll revision and the release of FOMC minutes later today are unlikely to spark significant volatility. Instead, markets are likely to remain subdued until tomorrow’s PMI data from major economies, which could prompt some brief moves. However, the primary event that traders are eagerly anticipating is Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium on Friday.

So far this week, Dollar remains the weakest performer, showing little sign of a sustainable recovery. Canadian Dollar is also under pressure, particularly after yesterday’s Canadian CPI data reinforced expectations for a rate cut by BoC in September. British Pound is the third worst-performing currency, though it may see a temporary boost if tomorrow’s UK PMI data surprises to the upside.

On the other hand, New Zealand Dollar has emerged as the strongest currency, continuing to recover from last week’s selloff following RBNZ’s rate cut. Swiss Franc and Japanese Yen are also performing well, likely benefiting from expectations of narrowing interest rate differentials with other major economies. Euro and Australian Dollar are trading in middle positions.

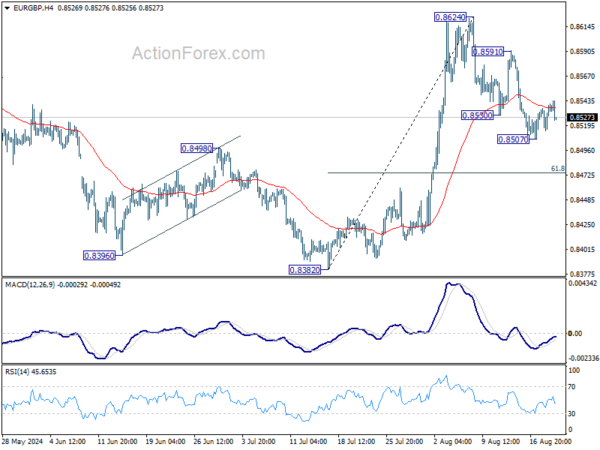

Technically, EUR/GBP’s recovery from 0.8507 appears to be losing momentum after failing to sustain above 55 4H EMA. Deeper fall from current level will put near term bias back to the downside. Further break of 0.8507 will resume the pullback from 0.8624 to 61.8% retracement of 0.8382 to 0.8624 at 0.8474. in the near term.

In Europe, at the time of writing, FTSE is up 0.22%. DAX is up 0.63%. CAC is up 0.56%. UK 10-year yield is down -0.0081 at 3.911. Germany 10-year yield is down -0.0072 at 2.212. Earlier in Asia, Nikkei fell -0.29%. Hong Kong HSI fell -0.69%. China Shanghai SSE fell -0.35%. Singapore Strait Times rose 0.10%. Japan 10-year JGB yield fell -0.0256 to 0.866.

ECB’s Panetta: End of monetary restriction has already begun

ECB Governing Council member Fabio Panetta indicated today that the central has entered entering a phase of monetary easing following the rate cut in June. Speaking at an event, Panetta remarked, “The end of monetary restriction has already begun,” adding that discussions are ongoing regarding the ECB’s next steps in September.

While Panetta refrained from sharing his specific views on the upcoming decision, he suggested that ECB is likely to continue easing monetary conditions.

“I believe it is reasonable to expect that from now on, we will move towards a phase of easing of monetary conditions,” he noted, pointing to falling inflation and a slowing global economy as key factors driving this shift.

Japan’s July exports value reaches record amid yen weakness

Japan’s exports surged 10.3% yoy in July, reaching JPY 9,619B—a record high for the month. The growth of export value was was largely driven by the weaker yen, which marked a -12.3% depreciation from a year ago. On volume basis, exports actually declined by -5.2% yoy.

Regionally, Japan’s exports to the US grew by 7.3%, a slight deceleration from the previous month. Exports to China remained steady with a 7.2% increase, while shipments to the EU saw a decline of -5.3%.

On the import side, Japan recorded a 16.6% yoy increase, bringing the total to JPY 10,241B—the largest ever for July. As a result, the trade balance showed a deficit of JPY -622 B.

In seasonally adjusted terms, exports rose 1.7% mom to JPY 9,137B, while imports increased by 0.9% mom to JPY 9,893B, leading to a seasonally adjusted trade deficit of JPY -755B.

Australia’s Westpac leading index points to modest growth, but sustainability in doubt

Australia’s six-month annualized growth rate in the Westpac–Melbourne Institute Leading Index inched up to +0.06%, signaling a slight improvement in economic momentum.

However, Westpac cautioned that this positive signal may not be sustained due to “sharp falls in commodity prices.” The detailed report highlights that the economy is facing “significant cross-currents,” with economic activity improving but expected to remain “below trend into early 2025.”

As RBA gears up for its next meeting on September 23–24, Westpac emphasized the importance of the upcoming June quarter national accounts, set to be released on September 4. These figures are expected to shed light on the strength of domestic demand and could ease some of the RBA’s concerns regarding productivity growth.

However, Westpac noted that there is little chance of a policy shift at the September meeting, as the next quarterly CPI update isn’t due until October 30.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1090; (P) 1.1112; (R1) 1.1151; More….

Intraday bias in EUR/USD remains on the upside for the moment. Firm break of 1.1138 resistance will target 161.8% projection of 1.0665 to 1.0947 from 1.0776 at 1.1232. On the downside, below 1.1071 minor support will turn intraday bias neutral and bring consolidations first. But outlook will now remain bullish as long as 1.0948 support holds.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s could still extend. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). However, break of 1.0776 support will extend the correction with another falling leg back towards 1.0447 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Jul | -0.76T | -0.76T | -0.82T | |

| 01:00 | AUD | Westpac Leading Index M/M Jul | 0.00% | 0.00% | ||

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Jul | 2.2B | 0.5B | 13.6B | 12.6B |

| 12:30 | CAD | Industrial Product Price M/M Jul | 0.00% | -0.50% | 0.00% | |

| 12:30 | CAD | Raw Material Price Index Jul | 0.70% | -0.90% | -1.40% | |

| 14:30 | USD | Crude Oil Inventories | -2.0M | 1.4M | ||

| 18:00 | USD | FOMC Minutes |