Investor sentiment was buoyed strongly by Fed’s projection of three rate cuts in the upcoming year. This significant dovish turn by the Fed has sparked a wave of investor optimism, propelling the DOW to record-breaking high. This buoyant mood has largely permeated the Asian markets, although Japan has remained an outlier in this trend.

Dollar declined broadly after FOMC announcement, and stays as the worst performer in the week. On the other hand, Yen has capitalized further on the falling treasury yields in the US and Europe, emerging as the strongest performer for the week so far. Australian Dollar also found support in the wake of strong Australian employment data, ranking as the second strongest currency following the Yen.

On the European front, despite making gains against the weakening greenback, both Sterling and Euro have exhibited relative weakness elsewhere. The impending monetary policy decisions from SNB, BoE, and ECB are now the center of attention. In light of Fed’s dovish shift, there is heightened speculation among traders and investors that these European central banks might also hint at policy easing in the coming year, thus capping their rallies.

Technically, both USD/JPY and GBP/JPY have breached last week’s lows of 141.59 and 178.58, suggesting that Yen might be ready to resume its near term rebound. Focus will turn to corresponding levels in other Yen crosses to confirm, including 153.15 support in EUR/JPY, 104.19 support in CAD/JPY, 93.70 support in AUD/JPY and 162.20 support in CHF/JPY. Concurrent break of these level will set the stage for broad based rally in Yen, leading to next week’s BoJ meeting.

In Asia, at the time of writing, Nikkei is down -0.79%. Hong Kong HSI is up 1.02%. China Shanghai SSE is flat. Singapore Strait Times is up 0.76%. Japan 10-year JGB yield is down -0.0066 at 0.683.

Fed signals three rate cuts in 2024, policy easing on discussion table

US stocks surged, with DOW hitting new record, while treasury yields and the Dollar tumbled following Fed’s decision to leave interest rates unchanged at 5.25-5.50%. This decision, widely anticipated by the markets, was overshadowed by the Fed’s indication of potential rate cuts in 2024. Fed suggested that three 25 bps cuts could be implemented next year, to bring federal funds rate back to 4.50-4.75%.

Fed Chair Jerome Powell, in the post-meeting press conference, acknowledged the emerging discussion within about reducing policy restraint. Powell stated, “The question of when it will be appropriate to begin dialing back the amount of policy restraint in place begins to come into view, and is clearly a topic of discussion out in the world and also of discussion for us at our meeting today.” He further noted the general expectation that this issue will be a key focus for Fed going forward.

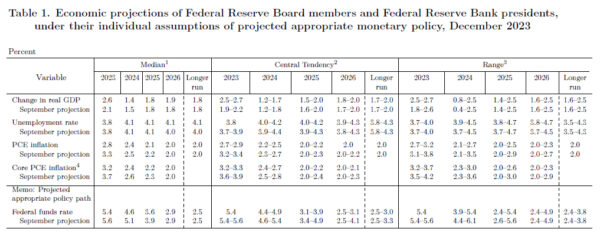

The new economic projections present a detailed outlook. The median forecasts indicate that federal funds rate will decrease from the current 5.4% to 4.6% in 2024, further reducing to 3.6% in 2025, and eventually to 2.9% in 2026. The longer-run federal funds rate is held steady at 2.50%. The central tendency for 2024 is at 4.4-4.9%, suggesting a relatively narrow range, and stable rate expectation.

The projections for GDP growth show a slowdown from 2.6% in 2023 to 1.4% in 2024, followed by a rebound to 1.8% in 2025 and 1.9% in 2026. The unemployment rate is expected to increase from 3.8% in 2023 to 4.1% in 2024 and then stabilize at this level through 2026.

Regarding inflation, headline PCE inflation is forecasted to decrease from 2023’s 2.8% to 2.4% in 2024, 2.1% in 2025, and 2.0% in 2026. Similarly, core PCE inflation is projected to slow down from 3.2% in 2023 to 2.4% in 2024, and then to 2.2% in 2025 and 2.0% in 2026.

Some FOMC reviews here.

DOW hits new record post-FOMC, 10-year yield presses 4%

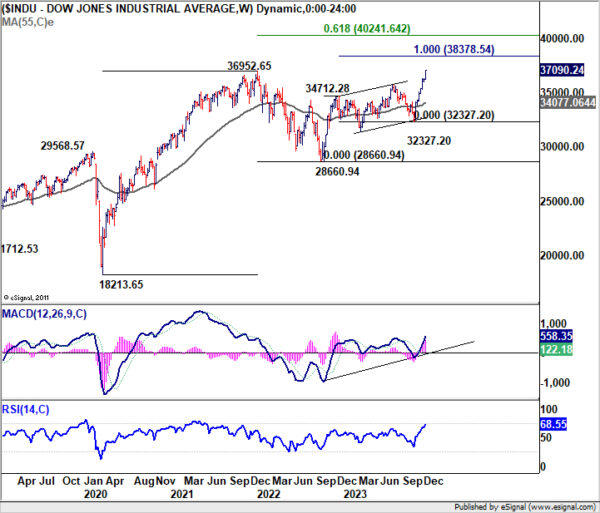

DOW surged 1.40% to close at new record high at 37090.24 overnight, after Fed outlined the path for interest rate cuts next year. While some volatility may be expected following this sharp increase, near term outlook will stay bullish as long as 36010.85 support holds. Next near term target is 100% projection of 28660.94 to 34712.28 from 32327.20 at 38378.54.

For the medium term, DOW would be looking at 61.8% projection of 18213.65 (2020 low) to 36952.65 (2022 high) from 28660.94 (2022 low) at 40241.64, which is close to 40k psychological level.

In contrast, 10-year yield lost -0.173 to 4.033, after hitting as low as 4.009, just managed to defend 4% handle. Some support could be seen from current level which is close to 55 W EMA (now at 3.956) and the long term trend line support to bring interim rebound. However, TNX should have completed the five wave rally from 0.398 (2020 low), and a correction to this up trend is underway. Sustainable support might only be found at 3.253 cluster support level, which is close to 38.2% retracement of 0.398 to 4.997 at 3.240.

New Zealand’s Q3 GDP falls unexpectedly by -0.3%, manufacturing sector leads decline

New Zealand’s GDP unexpectedly contracted by -0.3% qoq in Q3, a significant deviation from the anticipated 0.2% qoq growth. Notably, GDP per capita saw a more pronounced decrease of -0.9%. This downturn in economic activity was primarily led by -2.6% decline in the goods-producing industries. However, there were some positive aspects, with service industries experiencing growth of 0.4%, and primary industries seeing rise of 0.6%.

Ruvani Ratnayake, national accounts industry and production senior manager, pointed out, “All goods producing industries were down this quarter, led by a fall in manufacturing.”

Despite the general decline in GDP, there was a silver lining as 8 out of 11 service industries recorded growth during the quarter. The most substantial improvements were observed in healthcare and social assistance, along with rental, hiring, and real estate services.

On the consumer front, household spending decreased by -0.6% during the quarter. This reduction was across all categories, with notable decline in durable goods. The fall in spending on motor vehicles, which came after a period of higher spending, was a significant factor in this overall decrease.

Australia’s employment rises 61.5k in Nov, unemployment rate ticks up

Australia’s employment sector grew significant by 61.5k in November substantially surpassing the expected 10.0k. This growth was primarily in full-time employment, which saw an increase of 47k, while part-time employment also rose by 14.5k.

Despite these positive developments in job creation, the unemployment rate edged up slightly to 3.9%, against expectations of remaining at 3.8%. Participation rate increased by 0.2% to reach 67.2%, and monthly hours worked were flat at 0.0%.

Bjorn Jarvis, ABS head of labour statistics, stated, “The combination of strong growth in both employment and unemployment in November saw the employment-to-population ratio return to a record high of 64.6 percent and the participation rate reach a new high of 67.2 percent.”

Jarvis also noted that the slowing in hours worked suggests that the overall growth rates in employment and hours worked have become more aligned over the past 18 months. This convergence indicates a “less tight” labor market than previously experienced.

Will SNB, BoE, and ECB hint at upcoming rate cuts?

Three major central banks – SNB, BoE and ECB – are set to announce their policy decisions. All three will keep their interest rates unchanged. This comes in the wake of Fed’s outlined plans for rate cuts in 2024 in the dot plot released overnight. Now, that raises questions about whether these central banks will follow and signal policy loosening for the next year.

SNB is expected to hold its key policy rate steady at 1.75%. This decision is supported by forecasts from Swiss State Secretariat for Economic Affairs released yesterday, projecting a slowdown in inflation to 1.9% in 2024 and further to 1.1% in 2025. Economic growth in Switzerland is also expected to decelerate to 1.1% in 2024 before rebounding to 1.7% in 2025.

BoE is anticipated to maintain interest rates at 5.25%. Traders have increased their bets on the BoE cutting rates following the unexpectedly sharp contraction in UK’s monthly GDP for October. The market has fully priced in 100bps easing in monetary policy for 2024, bringing borrowing costs down to 4.25%. The first rate cut is anticipated in June. Today’s voting pattern and accompanying statement from BoE will be under close scrutiny.

Similarly, the ECB is expected to keep its main refinancing rate at 4.50% and deposit rate at 4.00%. The focus will likely be on new DP and inflation forecasts and their implications for the rate path in the coming year. Money markets are currently pricing in almost 150bps of rate cuts for the next year.

In terms of currency performance, Swiss Franc appears to be the firmer one for the near term. As long as 0.9543 resistance holds, outlook in EUR/CHF remains bearish. Decisive break of 0.9402 support will resume larger down trend to 61.8% projection of 0.9995 to 0.9416 from 0.9683 at 0.9325.

GBP/CHF’s fall from 1.1153 resumed this week, and should be on track to 100% projection of 1.1153 to 1.0978 from 1.1085 at 1.0910. Sustained break there could prompt downside acceleration to 1.0779 and below, to resume larger down trend from 1.1574.

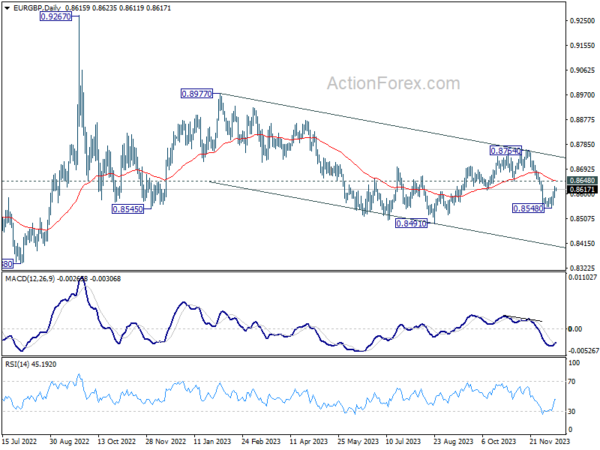

While Euro appears to be light strong then Sterling in the past few days, risk in EUR/GBP remains on the downside as long as 0.8648 resistance holds. Break of 0.8548 will likely bring deeper decline through 0.8491 to resume the medium term down trend.

On the data front

Swiss PPI will be released in European session. Canada wil publish manufacturing sales in North American session. US retail sales, jobless claims, import price index and business inventories will also be featured.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 144.74; (P) 145.47; (R1) 146.19; More…

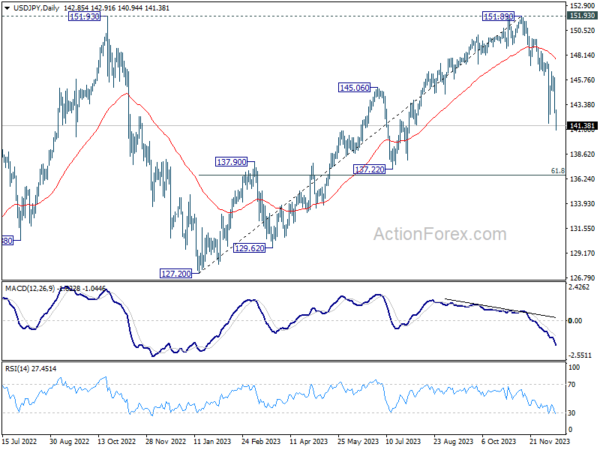

USD/JPY’s decline from 151.89 resumed by breaking through 141.59 support. Intraday bias is back on the downside. Further fall should be seen to next fibonacci level at 136.63. On the upside, above 142.91 minor resistance will turn intraday bias neutral first. But recovery should be limited well below 146.58 resistance to bring another decline.

In the bigger picture, current fall from 151.89 is seen as the third leg of the corrective pattern from 151.93 (2022 high). Deeper decline would be seen to 61.8% retracement of 127.20 to 151.89 at 136.63, sustained break there will pave the way to 127.20 support (2022 low). This will now remain the favored as long as 146.58 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q3 | -0.30% | 0.20% | 0.90% | 0.50% |

| 23:50 | JPY | Machinery Orders M/M Oct | 0.70% | -0.50% | 1.40% | |

| 00:00 | AUD | Consumer Inflation Expectations Dec | 4.50% | 4.90% | ||

| 00:01 | GBP | RICS Housing Price Balance Nov | -43% | -58% | -63% | |

| 00:30 | AUD | Employment Change Nov | 61.5K | 10.0K | 55.0K | 42.7K |

| 00:30 | AUD | Unemployment Rate Nov | 3.90% | 3.80% | 3.70% | 3.80% |

| 04:30 | JPY | Industrial Production M/M Oct F | 1.30% | 1.00% | 1.00% | |

| 07:30 | CHF | Producer and Import Prices M/M Nov | 0.10% | 0.20% | ||

| 07:30 | CHF | Producer and Import Prices Y/Y Nov | -0.90% | |||

| 08:30 | CHF | SNB Interest Rate Decision | 1.75% | 1.75% | ||

| 09:00 | CHF | SNB Press Conference | ||||

| 12:00 | GBP | BoE Interest Rate Decision | 5.25% | 5.25% | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 2–0–7 | 3–0–6 | ||

| 13:15 | EUR | ECB Interest Rate Decision | 4.50% | 4.50% | ||

| 13:30 | CAD | Manufacturing Sales M/M Oct | 0.30% | 0.40% | ||

| 13:30 | USD | Initial Jobless Claims (Dec 8) | 221K | 220K | ||

| 13:30 | USD | Retail Sales M/M Nov | -0.10% | -0.10% | ||

| 13:30 | USD | Retail Sales ex Autos M/M Nov | -0.10% | 0.10% | ||

| 13:30 | USD | Import Price Index M/M Nov | -0.80% | -0.80% | ||

| 13:45 | EUR | ECB Press Conference | ||||

| 15:00 | USD | Business Inventories Oct | 0.00% | 0.40% | ||

| 15:30 | USD | Natural Gas Storage | -60B | -117B |