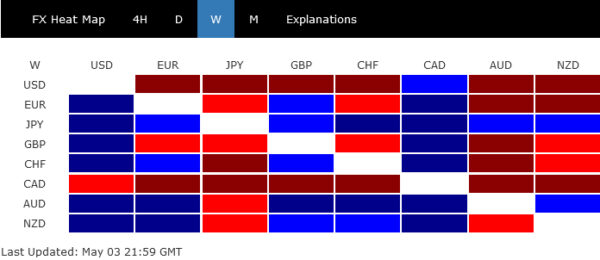

Dollar concluded last week with significant losses, influenced by a set of factors that realigned market expectations and investor sentiment. A pivotal moment came with Fed Chair Jerome Powell’s much less-hawkish-than-feared remarks at the FOMC press conference, coupled with disappointing US employment figures. These developments led markets back to anticipate two Fed rate cuts by year-end. This recalibration in interest rate expectations spurred a rally in US stocks and a marked reduction in Treasury yields, which in turn exerted additional downward pressure on the Dollar.

Compounding Dollar’s decline was Japan’s purported intervention in the currency markets. Substantial buying in Yen, after it breached a significant psychological level against Dollar, helped boosted Yen to the top for the week. This intervention appeared timed strategically around key market shifts, echoing Japan’s readiness to engage in currency markets any time of the day.

Meanwhile, Dollar was only the week’s second worst casualty. Canadian Dollar ended as the weakest among major currencies, suffering from dual pressures: markets’ increased predictions of a near-term rate cut by BoC and the protracted downturn in oil prices, which was somewhat alleviated by emerging hopes for ceasefire between Israel and Hamas.

Conversely, Australian Dollar secured its position as the second-strongest currency, benefiting from delayed expectations of interest rate cut by RBA. Additionally, a renewed risk-on mood, particularly around Hong Kong and China’s financial markets, further uplifted the Aussie. New Zealand Dollar followed closely, buoyed by similar risk-on sentiments.

In Europe, Swiss Franc distinguished itself among its peers, rallying robustly against other major European currencies following unexpectedly high inflation readings.

US Investor Sentiment Buoyed by Fed Powell’s Guidance and Softer Payroll Data

The US financial markets witnessed a U-turn last week, with surging stocks while treasury yields and Dollar plummeted. A solid foundation for market optimism was laid down by Fed Chair Jerome Powell’s much less hawkish than feared post-FOMC press conference. There he explicitly dismissed the possibility of further rate hikes, stating that the next move by the Fed would likely involve “cutting” or “not cutting” rates, rather than increasing them. This clarification has helped alleviate investor anxieties about more monetary tightening.

Nevertheless, the direct catalyst for the strong rally in US stocks was the goldilocks non-farm payroll report. While showing a headline job growth of 175k in April, markedly below the anticipated figures, the average job growth of 242k in the past three months ( 236k in February and 315k in March) still aligned with the average monthly job growth over the past year.

This underscores a stable and healthy employment environment rather than an overheated labor market. Additionally, a slight rise in the unemployment rate to 3.9% and still decent wage growth of 0.2% mom are seen as positive signs that the labor market is cooling without destabilizing. The set of figures suggest a balanced scenario that supports Powell’s stance against immediate rate hikes.

While the initial reaction to the payroll data has been largely positive, interpreting it as a ‘Goldilocks’ scenario—neither too hot nor too cold—some economists are voicing caution. They suggest that the softening numbers could herald the beginning of a broader economic slowdown, especially when considered alongside contractions in both ISM manufacturing and service sector PMIs. This perspective, though currently less dominant, could gain traction if future data trends support a more bearish economic outlook.

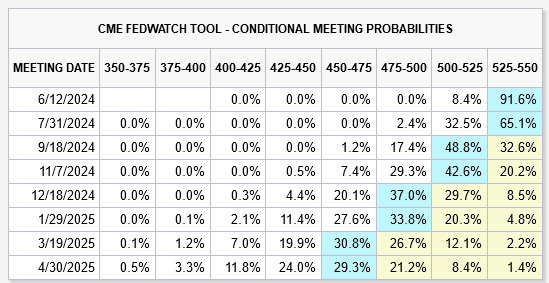

Current expectations for future monetary policy, as indicated by fed fund futures, now show a 67.4% probability of a rate cut by September, with the likelihood of two rate reductions by year-end estimated at 61.8%.

DOW’s strong break of 55 D EMA (now at 38402.19) should confirm that pullback from 39899.05 high has completed at 37611.56 already. The corrective pattern from there is now in its second leg. Further rise is likely for retesting 39889.05. In case of another fall, as the corrective pattern starts its third leg, downside should be contained by 38.2% retracement of 32327.20 to 39889.05 at 37000.42.

10-year yield’s steep pull back on Friday confirmed short term topping at 4.730. Focus is back on 38.2% retracement 3.780 to 4.730 at 4.367. Strong support from there would maintain near term bullishness. That is, rise from 3.780 would resume through 3.730 to retest 4.997 at a later stage. However, firm break of 4.367 will argue that rebound from 3.780 has completed. TNX should then be in the third leg of the pattern from 4.997. In this bearish case, deeper fall would be seen back to 61.8% retracement at 4.142 and below.

Dollar index’s steep decline and break of 104.97 resistance turned support also confirmed short term topping at 106.51. Some more consolidations would be seen with risk of deeper retreat. Nevertheless, as long as lower channel support (now at 103.75) holds, rise from 100.61 is still in favor to continue to 107.34 and above. However, sustained break of the channel will argue that rebound from 100.61 has completed as a three-wave corrective move. Deeper fall would then be seen through 102.35 support in this bearish case.

Dollar’s Misfortune Intensified by Suspected Japanese Market Interventions

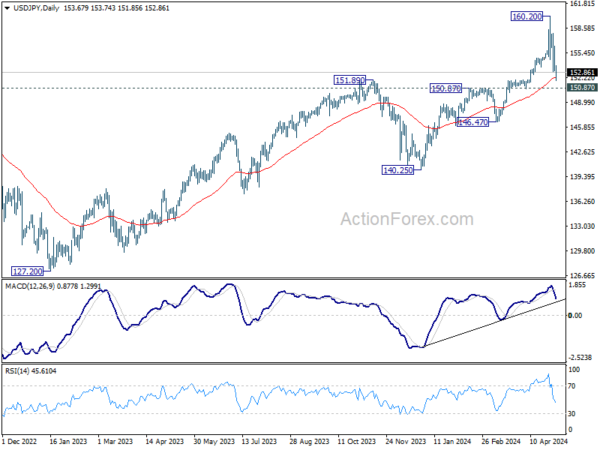

Adding to Dollar’s woe last week was alleged currency market interventions by Japan on two occasions, which were not confirmed by the government. USD/JPY eventually closed the week down -3.5%.

The first intervention is believed to have occurred just as after USD/JPY breack through the significant psychological mark of 160 during Monday’s Asian trading session. The second intervention reportedly took place on Wednesday, shortly after the post-FOMC press conference, which had already placed some pressure on Dollar.

These actions align with recent statements from Masato Kanda, Japan’s top currency diplomat, who emphasized Japan’s readiness to engage in currency market interventions “24 hours a day,” regardless of the global financial market hours, be it London, New York, or Wellington.

Estimates suggest that Japan may have spent approximately USD 35B in Monday’s intervention alone. With analysts speculating that Japan’s total intervention war chest could be around USD 300B, this substantial reserve allows Japan to maintain an active presence in the currency markets.

Technically, while the pull back from 160.20 was steep, it’s still seen as developing into a corrective pattern only. 150.87 resistance turned support should contain downside to set the range for a sideway pattern, probably in form of a triangle. Break of 160.20 could still be seen before rise 140.25 completes a five-wave move.

However, if US treasury yield extends last week’s decline with acceleration, that would put additional pressure on USD/JPY through 150.87. That could trigger more selloff in the pair and indicate that rise from 140.25 has indeed finished at 160.20. In this bearish case, larger scale correction is already underway.

Canadian Dollar’s Challenges: June BoC Cut Expectations and Falling Oil Prices

Canadian Dollar performed even more poorly than the greenback over the past week. This was partly influenced by growing market expectations for BoC rate cut in June following disappointing GDP growth data. The money markets are now pricing in 60% probability that BoC will reduce its benchmark interest rate at the upcoming policy meeting on June 5. Furthermore, expectations are set around a total of 60bps of easing from the central bank by the end of 2024.

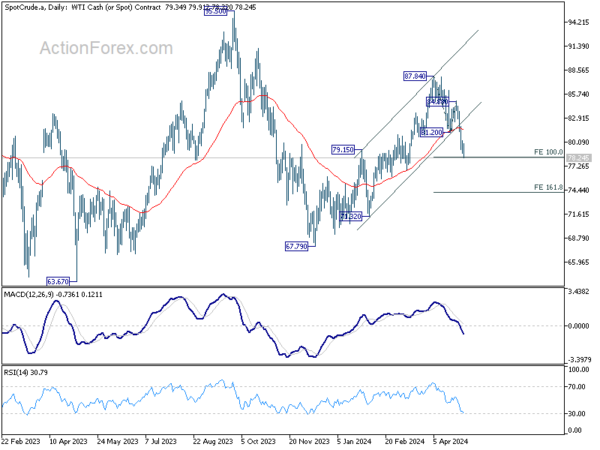

The extended decline in oil prices has possibly added to Loonie’s troubles too. The geopolitical risk premiums that spiked due to the Israel-Hamas conflict have begun to subside as both parties show openness to negotiations, with talks potentially leading to a temporary ceasefire. Hamas has announced plans to send a delegation to Cairo for discussions that could pave the way for a truce and the release of hostages in Gaza.

The strong break of channel support in WTI crude oil argues that rebound from 67.79 has completed with three waves at 87.84 already. Immediate focus is now on 100% projection of 87.84 to 81.20 from 84.88 at 78.24. Decisive break there could prompt downside acceleration to 161.8% projection at 74.13. That would also strengthen the case of bearish trend reversal, and open up deeper fall back to 67.79 support.

Aussie Strengthens as Rate Cut Expectations Push to November

Australian Dollar has charted a markedly different course compared to its Canadian counterpart, buoyed by shifts in monetary policy expectations and positive market sentiment abroad. Australia’s leading financial institutions, the “Big Four” banks, have now adjusted their forecasts, pushing the expected RBA rate cut from September to November. This revision also reflects a more cautious and extended easing cycle, primarily due to persistently high inflation rates within the country.

A senior economist at Commonwealth Bank highlighted that strong net overseas immigration is exerting upward pressure on certain components of CPI. This demographic pressure complicates RBA’s efforts to steer inflation back to its target, necessitating a more gradual and deliberate rate cutting strategy.

Simultaneously, Aussie is drawing strength from a surge in optimism in the Hong Kong stock markets, which are currently experiencing their longest winning streak since 2018. Following a near 40% drop over the previous four years, the Hang Seng Index’s low valuations have attracted significant investment, fueling a rally that could potentially encourage further inflows from investors eager not to miss out. This optimism appears to overshadow concerns about China’s economic fluctuations and geopolitical uncertainties, at least for the moment.

Technically, the strong break of 38.2% retracement of 22700.85 to 14794.16 at 17814.51 now suggests that HSI is reversing whole down trend from 22700.85. Near term outlook will stay bullish 17214.67 resistance turned support holds. Next target is 61.8 retracement at 19680.49. Also, considering that current rise is likely the third leg of the pattern from 14597.31, decisive break of 19680.49 will pave the way back to 22700.85.

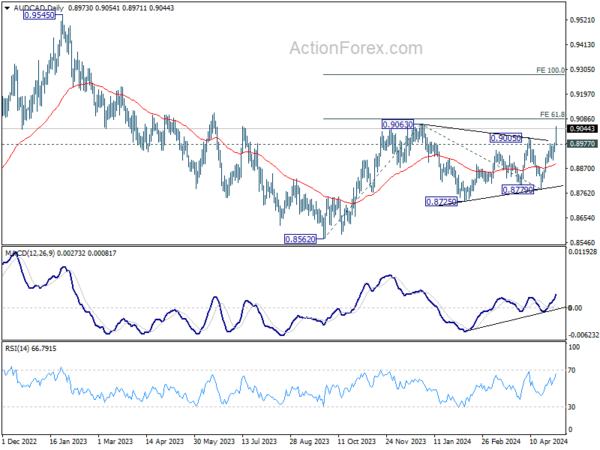

AUD/CAD’s strong rally and break of 0.9005 resistance suggests that consolidation pattern from 0.9063 has completed at 0.8779 already. Further is expected as long as 0.8997 resistance turned support holds, to resume the whole rebound from 0.8562. Key focus is on 61.8% projection of 0.8562 to 0.9063 from 0.8779 at 0.9089. Firm break there will add to the case that it’s reversing whole down trend from 0.9545 rather than correcting it. Next target will be 100% projection at 0.9280.

EUR/USD Weekly Outlook

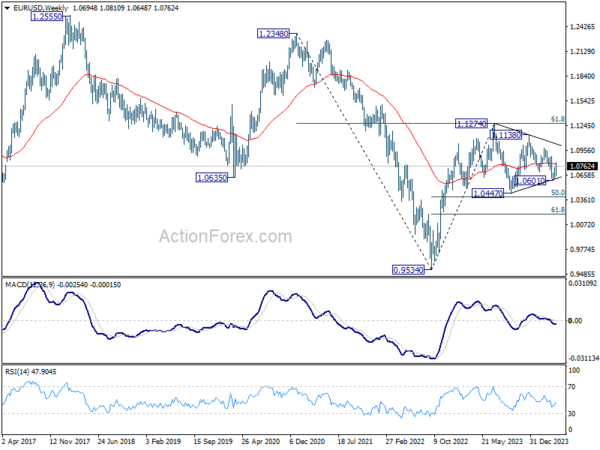

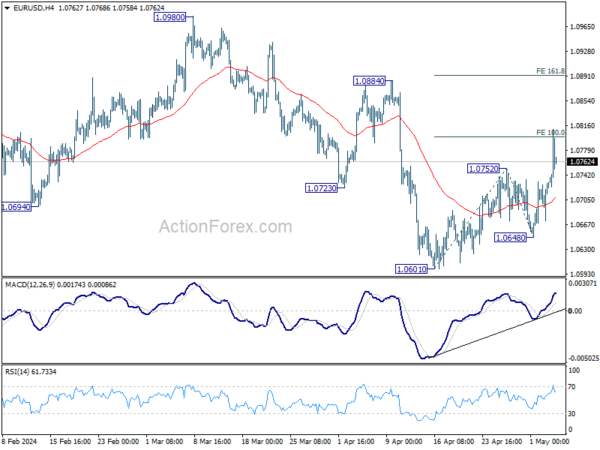

EUR/USD’s rise from 1.0601 resumed last week and the strong break of 55 D EMA argues that fall from 1.1138 might have completed. Initial bias stays on the upside this week. Firm break of 100% projection of 1.0601 to 1.0752 from 1.0648 at 1.0799 will pave the way to 161.8% projection at 1.0892. For now, risk will stay on the upside as long as 1.0648 support holds, in case of retreat.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern. Fall from 1.1138 is seen as the third leg and could have completed. Firm break of 1.1138 will argue that larger up trend from 0.9534 (2022 low) is ready to resume through 1.1274 high. On the downside, break of 1.0601 will extend the corrective pattern instead.

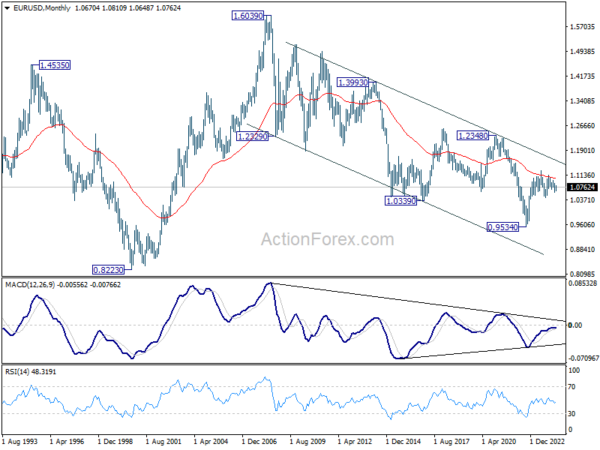

In the long term picture, a long term bottom is in place at 0.9534 on bullish convergence condition in M MACD. It’s still early to call for bullish trend reversal with the pair staying inside falling channel in the monthly chart. Nevertheless, sustained trading above 55 M EMA (now at 1.1027) and break of 1.1274 resistance will raise the chance of reversal and target 1.2348 resistance for confirmation.