Dollar stages a notable recovery in the early US session, buoyed by stronger than expected January PPI figures. The highlight was PPI excluding foods, energy, and trade services, which saw its largest monthly increase in a year, hinting at persistent underlying inflationary pressures upstream. Despite the current rebound rebound, Dollar has yet to surpass the highs against major currencies seen earlier this week. Nevertheless, the current development at least indicates that the selloff triggered by the previous day’s retail sales data should have run its course.

Also, Dollar’s resurgence should be able to cement its position as the top performer for the week. Canadian and Australian Dollars are trailing behind in strength. Meanwhile, Swiss Franc, Japanese Yen, and New Zealand Dollar languish at the lower end of the performance spectrum, with the Euro and Sterling showing mixed results. The Pound, despite an initial surge from unexpectedly robust retail sales figures earlier today, saw its momentum wane swiftly.

In Europe, at the time of writing, FTSE is up 1.30%. DAX is up 0.46%. CAC is up 0.33%. UK 10-year yield is up 0.0644 at 4.122. Germany 10-year yield is up 0.049 at 2.414. Earlier in Asian, Nikkei rose 0.86%. Hong Kong HSI rose 2.48%. Singapore Strait Times rose 1.42%. Japan 10-year yield fell -0.0001 to 0.730.

US PPI up 0.3% mom, 0.9% yoy in Jan

US PPI rose 0.3% mom in January above expectation of 0.1% mom. PPI goods declined -0.2% mom while PPI services rose 0.6% mom. PPI less foods, energy, and trade services rose 0.6% mom, the largest advance since January 2023.

For the 12-month period, PPI slowed from 1.0% yoy to 0.9% yoy, above expectation of 0.7% yoy. PPI less foods, energy, and trade services was unchanged at 2.6% yoy.

ECB’s Schnabel warns of premature policy ease amid wage-driven inflation pressures

In a speech today, ECB Executive Board member Isabel Schnabel noted the role of “persistently low, and recently even negative, productivity growth” in exacerbating the inflationary pressures from the current strong growth in nominal wages.

She pointed out that this scenario increases the likelihood of firms passing higher wage costs onto consumers, thus “delaying inflation returning to our 2% target.”

With the backdrop of a prolonged period of high inflation, Schnabel argued for the necessity of maintaining restrictive monetary policy stance until there is clear confidence that inflation will sustainably return to ECB’s medium-term objective.

She warned against premature policy adjustments, suggesting that to avoid a “stop-and-go policy” reminiscent of the 1970s, a cautious approach is essential.

“We must be cautious not to adjust our policy stance prematurely,” she said.

UK retail sales rises 3.4.% mom in Jan, largest since April 2021

UK retail sales volume rose 3.4% mom in January, well above expectation of 1.5% mom. That was the largest monthly rise since April 2021, reversing the deep decline of -3.3% mom in December.

Sales volumes in all subsectors except clothing stores increased over the month, with food stores such as supermarkets contributing most to the increase.

Sales value rose 3.9% mom, largest rise since January 2021. Sales volume rose 0.7%

RBNZ’s Orr stresses continued effort needed to anchor inflation expectations

In a forum today, RBNZ Governor Adrian Orr indicated that the central bank’s primary challenge lies in firmly anchoring inflation expectations around the 2% target, a goal that remains elusive despite significant progress.

This “tail end” of the inflation fight, as Orr describes, requires meticulous attention to both “capacity pressures” within the economy and the public’s “inflation expectation”s.

“We’ve got more work to do to have inflation expectations truly anchored at that 2% level, he added.

“We observe headline but we are targeting in a large sense core inflation,” Orr stated, emphasizing the importance of these metrics in shaping the central bank’s policy decisions.

NZ BNZ manufacturing rises to 47.3, still someway off to expansion

New Zealand BusinessNZ Performance of Manufacturing Index rose from 43.4 to 47.3 in January, hitting the highest level since June last year. Despite this uptick, it’s important to note that the manufacturing sector remained in contraction for eleven straight months.

BusinessNZ’s Director of Advocacy, Catherine Beard noted that while there are signs of improvement, “the sector is still someway off returning to expansion.”

Looking at some details, production rose from 40.5 to 42.1. Employment rose from 47.0 to 51.3. New orders rose from 44.0 to 47.7. Finished stocks rose from 45.9 to 47.3. Deliveries rose from 43.7 to 49.3.

However, the persistence of negative sentiment among businesses cannot be overlooked. The proportion of negative comments in January rose to 63.2%, up from 61% in December and 58.7% in November, reflecting concerns over seasonal factors such as holiday disruptions and a sustained lack of demand or orders.

USD/JPY Mid-Day Outlook

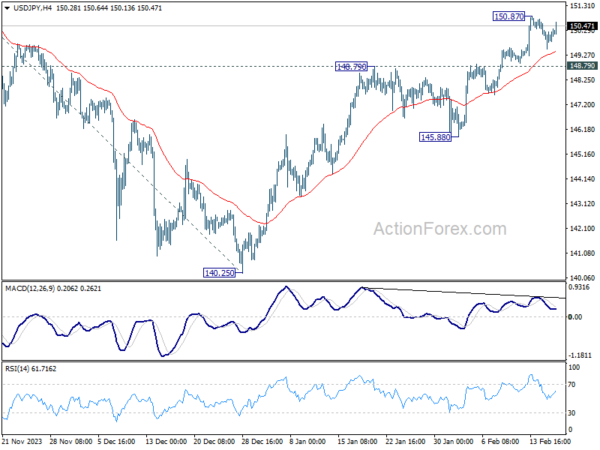

Daily Pivots: (S1) 149.47; (P) 150.02; (R1) 150.50; More…

USD/JPY recovers in early US sessions but stays in range below 150.87. Intraday bias remains neutral and more consolidation would be seen. But in case of another retreat, downside should be contained by 148.79 resistance turned support to bring another rally. Above 150.87 will resume the rise from 140.25 to 151.89/93 key resistance zone. Decisive break there will confirm larger up trend resumption of 155.50 projection level next. However, firm break of 148.79 will turn bias to the downside for 145.88 support.

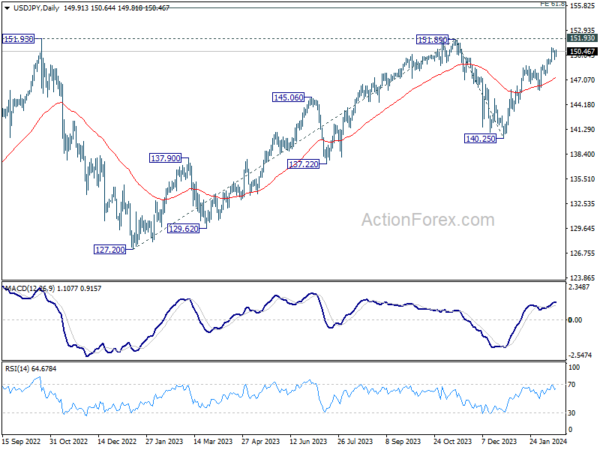

In the bigger picture, fall from 151.89 is seen as a correction to the rally from 127.20, which might have completed at 140.25 already. Firm break of 151.89/93 resistance zone will confirm up trend resumption, and next target will be 61.8% projection of 127.20 to 151.89 from 140.25 at 155.50. This will now remain the favored case as long as 140.25 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Jan | 47.3 | 43.1 | 43.4 | |

| 04:30 | JPY | Tertiary Industry Index M/M Dec | 0.70% | 0.20% | -0.70% | -1.40% |

| 07:00 | GBP | Retail Sales M/M Jan | 3.40% | 1.50% | -3.20% | -3.30% |

| 13:30 | CAD | Wholesale Sales M/M Dec | 0.30% | 0.70% | 0.90% | |

| 13:30 | USD | Building Permits Jan | 1.47M | 1.52M | 1.49M | |

| 13:30 | USD | Housing Starts Jan | 1.33M | 1.47M | 1.46M | |

| 13:30 | USD | PPI M/M Jan | 0.30% | 0.10% | -0.10% | |

| 13:30 | USD | PPI Y/Y Jan | 0.90% | 0.70% | 1.00% | |

| 13:30 | USD | PPI Core M/M Jan | 0.50% | 0.10% | 0.00% | -0.10% |

| 13:30 | USD | PPI Core Y/Y Jan | 2.00% | 1.70% | 1.80% | |

| 15:00 | USD | Michigan Consumer Sentiment Index Feb P | 80 | 79 |