Dollar bounces higher in early US session, buoyed by stronger-than-expected retail sales data. This resilience in consumer spending comes despite the persistent high inflation and elevated interest rates. The robust retail sales figures lend support to Fed’s soft landing scenario, where the economy slows down without falling into a recession. However, there are concerns that such strong consumer demand might impede the ongoing disinflation process, which is crucial for Fed to consider lowering interest rates in the future.

Conversely, Loonie, is facing some pressure following weaker-than-expected inflation data, especially in core measures. Despite this, Loonie is holding up relatively well against most other currencies. The markets are likely to take some time to fully digest the implications of the latest inflation readings and their impact on BoC’s rate decision next week.

Currently, Dollar stands as the strongest performer of the day, followed by Euro and Loonie. Aussie is the worst performer, lagging even behind Yen, with Kiwi trailing closely. Sterling and Swiss franc are positioned in the middle of the performance spectrum.

Technically, Gold is on the verge of making new record high. Decisive break of 2449.83 will resume larger up trend. Next target is 161.8% projection of 1614.60 to 2062.95 from 1810.26 at 2535.96. However, break of 2392.78 support will indicate rejection by 2449.83 and extend the medium term consolidation pattern with another fall.

In Europe, at the time of writing, FTSE is down -0.56%. DAX is down -0.51%. CAC is down -0.77%. UK 10-year yield is down -0.0289 at 4.075. Germany 10-year yield is down -0.034 at 2.442. Earlier in Asia, Nikkei rose 0.20%. Hong Kong HSI fell -1.60%. China Shanghai SSE rose 0.08%. Singapore Strait Times fell -0.34%. Japan 10-year JGB yield fell -0.0259 to 1.024.

Canada CPI slows to 2.7% yoy in June, down-0.1% mom

Canada’s CPI slowed from 2.9% yoy to 2.7% yoy in May. The deceleration was largely the result of slower year-over-year growth in gasoline prices, which rose 0.4% in June following a 5.6% increase in May. Excluding gasoline, the CPI rose 2.8% yoy.

Looking at the core measures, CPI median fell from 2.7% yoy to 2.6% yoy. CPI trimmed was unchanged at 2.9% yoy. CPI common slowed from 2.4% yoy to 2.3% yoy.

On a monthly basis, CPI fell -0.1% mom in June, following a 0.6% mom increase in May. The monthly decrease was driven by lower prices for travel tours (-11.1%) and gasoline (-3.1%).

US retail sales steady in Jun, ex-auto sales up 0.4% mom

US retail sales was steady mom at USD 704.3B in June, above expectation of -0.20% mom. Ex-auto sales rose 0.4% mom to USD 573.6B, above expectation of 0.1% mom. Ex-gasoline sales rose 0.2% mom to USD 652.4B. Ex-auto and gasoline sales rose 0.8% mom to USD 507.1B.

Total sales for the April through June period were up 2.5% from the same period a year ago.

German ZEW falls to 41.8, first decline in a year

Germany ZEW Economic Sentiment fell from 47.5 to 41.8 in July, below expectation of 44.3. That’s also the first decline in a year since July 2023. Current Situation Index rose from -73.8 to -68.9, above expectation of -73.0.

Eurozone ZEW Economic Sentiment fell from 51.3 to 43.7, below expectation of 50.2. Current Situation Index rose 2.5 pt to -36.1.

“The economic outlook is worsening. For the first time in a year, economic expectations for Germany are falling. The fact that German exports decreased more than expected in May, the political uncertainty in France and the lack of clarity regarding the future monetary policy by the ECB have contributed to this development,” comments ZEW President Professor Achim Wambach.

Eurozone goods exports fall -0.5% yoy in May, imports down -6.4% yoy

Eurozone goods exports fell -0.5% yoy to EUR 241.5B in May. Goods imports fell -6.4% yoy to EUR 227.6B. Trade balance showed a EUR 13.9B surplus. Intra-Eurozone trade fell -5.6% yoy to EUR 216.0B.

In seasonally adjusted term, goods exports fell -2.6% mom to EUR 237.4B. Goods imports fell -0.1% mom to EUR 225.1B. Trade balance recorded EUR 12.3B surplus, smaller than expectation of EUR 20.3B. Intra-Eurozone trade fell -2.8% mom to EUR 210.4B.

EUR/USD Mid-Day Outlook

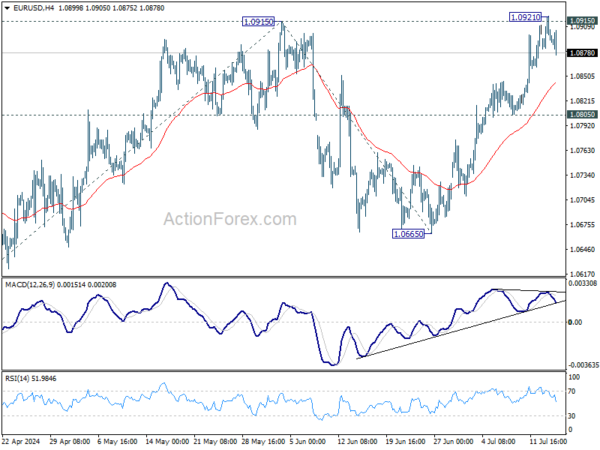

Daily Pivots: (S1) 1.0877; (P) 1.0900; (R1) 1.0916; More….

EUR/USD’s retreat from 1.0921 extends lower today but stays well above 1.0805 support so far. Intraday bias remains neutral first. Some more consolidations would be seen but further rally is in favor. Firm break of 1.0915/21 will will resume whole rise from 1.0601 to 100% projection of 1.0601 to 1.0915 from 1.0665 at 1.0979. However, break of 1.0805 will turn bias back to the downside for deeper pullback.

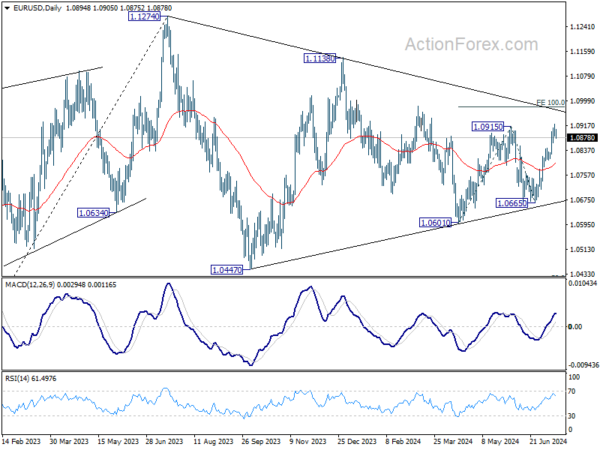

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern, possibly a triangle, that’s still be in progress. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). This will now remain the favored case as long as 1.0601 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Tertiary Industry Index M/M May | -0.40% | 0.20% | 1.90% | 2.20% |

| 09:00 | EUR | Eurozone Trade Balance (EUR) May | 12.3B | 20.3B | 19.4B | |

| 09:00 | EUR | Germany ZEW Economic Sentiment Jul | 41.8 | 44.3 | 47.5 | |

| 09:00 | EUR | Germany ZEW Current Situation Jul | -68.9 | -73 | -73.8 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Jul | 43.7 | 50.2 | 51.3 | |

| 12:15 | CAD | Housing Starts Y/Y Jun | 242K | 259K | 265K | |

| 12:30 | CAD | CPI M/M Jun | -0.10% | 0.10% | 0.60% | |

| 12:30 | CAD | CPI Y/Y Jun | 2.70% | 2.90% | ||

| 12:30 | CAD | CPI Median Y/Y Jun | 2.60% | 2.70% | 2.80% | 2.70% |

| 12:30 | CAD | CPI Trimmed Y/Y Jun | 2.90% | 2.80% | 2.90% | |

| 12:30 | CAD | CPI Common Y/Y Jun | 2.30% | 2.40% | 2.40% | |

| 12:30 | USD | Retail Sales M/M Jun | 0.00% | -0.20% | 0.10% | |

| 12:30 | USD | Retail Sales ex Autos M/M Jun | 0.40% | 0.10% | -0.10% | |

| 12:30 | USD | Import Price Index M/M Jun | 0.00% | 0.20% | -0.40% | |

| 14:00 | USD | Business Inventories May | 0.30% | 0.30% | ||

| 14:00 | USD | NAHB Housing Market Index Jul | 44 | 43 |