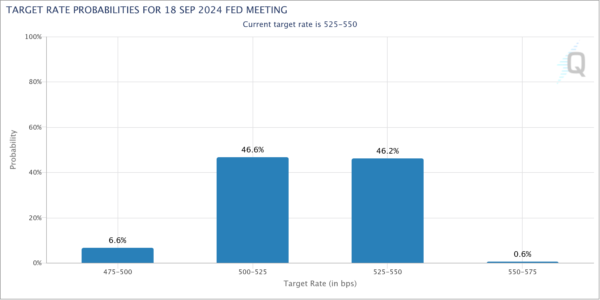

Dollar’s rebound is gathering momentum, as fueled by yesterday’s data indicating a resurgence in the services sector, which could impede disinflation progress. While fed fund futures still reflect over 50% probability of a rate cut in September, there is now a 0.6% chance of a rate hike—an occurrence not seen for quite some time. Currently, the Dollar is the week’s strongest performer, with the upcoming durable goods orders report likely to influence its next move.

Sterling follows as the second strongest currency this week, supported by higher-than-expected inflation data, which quashed hopes for a June rate cut by BoE. The focus now shifts to the upcoming UK retail sales data for further direction. Euro is also performing well as the third strongest, bolstered by strong Eurozone PMI data.

In contrast, Australian Dollar is the worst performer this week, dragged down by pullback in global risk sentiment. Yen is the second weakest, followed by New Zealand Dollar. Swiss Franc and Canadian Dollar are positioned in the middle.

Technically, EUR/GBP remains a major focus for the rest of the week. It’s now eyeing 0.8491/97 support zone. Decisive break there will confirm resumption of whole down trend from 0.9267 (2022 high). Next target is 100% projection of 0.8764 to 0.8497 from 0.8643 at 0.8376.

In Asia, at the time of writing, Nikkei is down -0.97%. Hong Kong HSI is down -1.24%. China Shanghai SSE is down -0.35%. Singapore Strait Times is down -0.37%. Japan 10-year JGB yield is up 0.006 at 1.009. Overnight, DOW fell -1.53%. S&P 500 fell -0.74%. NASDAQ fell -0.39%. 10-year yield rose 0.041 to 4.475.

Japan’s core CPI eases to 2.2% in Apr, marking second month of slowdown

Japan’s CPI core, which excludes food, decelerated from 2.6% yoy to 2.2% yoy in April. This aligns with market expectations and marks the second consecutive month of decline from February’s 2.8%. Despite the slowdown, core inflation has remained at or above BoJ’s 2% target for the 25th straight month.

CPI core-core, which strips out both food and energy costs, also showed signs of easing, slowing from 2.9% yoy to 2.4% yoy. This is the slowest pace of increase since September 2022. Meanwhile, headline CPI, which includes all items, fell from 2.7% yoy to 2.5% yoy.

A closer look at the major components reveals varied trends. Food prices rose by 3.5% yoy, but this was a moderation from 4.6% yoy increase seen in March. The surge in accommodation fees, up 18.8% yoy, was driven by a revival in inbound tourism. Energy prices edged up slightly by 0.1% yoy, with increases in kerosene and gasoline prices leading the way. Service prices also showed a deceleration, rising by 1.7% yoy compared to 2.1% yoy increase in the previous month.

RBNZ stresses vigilance on inflation, prepared to raise rates if necessary

In an interview today, RBNZ Assistant Governor Karen Silk highlighted the central bank’s readiness emphasized that there are “risks still to the upside in the near term” regarding inflation. She stated that RBNZ is “absolutely” prepared to raise interest rates if necessary, adding, “Right now we are saying that the level of restrictiveness is there, but we are awake at the wheel.”

Silk pointed out that the central bank’s primary concern is domestic inflation, particularly noting the significant miss last quarter when non-tradables inflation hit 5.8%, compared to RBNZ’s forecast of 5.3%. “Our concern is in that near term, around what are we really seeing in terms of domestic aligned inflation,” she explained.

Separately, Deputy Governor Christian Hawkesby reinforced the cautious stance, stating that “cutting interest rates is not part of near-term discussion.” He acknowledged the near-term inflation risks are to the upside but expressed confidence that medium-term inflation is returning to target.

Hawkesby emphasized that no single data point will trigger a rate hike, but the bank is closely watching domestic inflation pressures and expectations. He also noted the significant uncertainty surrounding tradable inflation moving forward.

RBNZ’s central projection is for headline inflation to fall back into its 1-3% target band by the fourth quarter of this year. However, the bank now projects that it won’t achieve its 2% goal until mid-2026.

New Zealand’s exports falls -2.6% yoy in Apr, imports down -0.7% yoy

In April, New Zealand’s goods exports fell by -2.6% yoy to NZD 6.4B, while goods imports decreased by -0.7% yoy to NZD 6.3B. Contrary to expectations of a NZD -202m deficit, trade balance recorded a surplus of NZD 92m.

Examining the top monthly export movements by country, exports to China decreased by NZD -206m (-11% yoy), and exports to Australia fell by NZD -17m (2.4% yoy). In contrast, exports to the US increased by NZD 35m (4.9% yoy), exports to EU rose by NZD 62m (13% yoy), and exports to Japan surged by NZD 91m (26% yoy).

On the import side, imports from China increased by NZD 120m (10% yoy), and imports from South Korea soared by NZD 371m (119% yoy). However, imports from the EU decreased by NZD -79m (-8.1% yoy), and imports from the US dropped by NZD -154m (24% yoy). Imports from Australia grew modestly by NZD 9.8m (1.4% yoy).

Fed’s Bostic: Inflation not yet at safe point for rate cuts

Atlanta Fed President Raphael Bostic emphasized caution regarding interest rate cuts, stating that the US economy is not yet past the “worry point” for inflation to return to the target of 2%.

Speaking at an event overnight, Bostic highlighted the robustness of job growth, describing it as “a lot of energy in the economy.” This robust job growth gives him confidence in maintaining a “more restrictive level” of monetary policy, as he doesn’t believe there’s a risk of “falling into a contractionary environment.”

Bostic also mentioned the need to be “a little more patient” and ensure inflation is on a clear path to 2% before considering rate cuts.

He underscored the importance of moving in “one direction only” to avoid the uncertainty that would come from cutting rates only to raise them again. This approach, he believes, would prevent creating “policy uncertainty.”

Looking ahead

UK retail sales and Germany GDP final are the focuses in European session. Later in the day, Canada will release retail sales. US will publish durable goods orders.

USD/CAD Daily Outlook

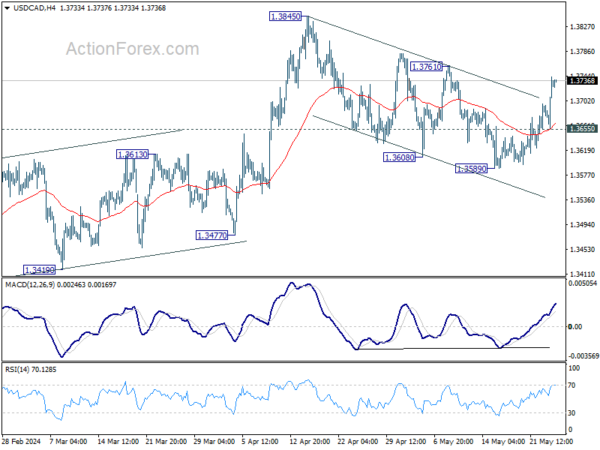

Daily Pivots: (S1) 1.3676; (P) 1.3710; (R1) 1.3763; More…

USD/CAD’s rebound from 1.3589 extended higher today. The development indicates that correction from 1.3845 has completed with three waves down to 1.3589. Intraday bias is back on the upside for 1.3761 resistance first. Break there will bring retest of 1.3845 high. On the downside, below 1.3655 minor support will dampen this bullish case and turn intraday bias neutral again first.

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern. In case of another fall, strong support should emerge above 1.2947 resistance turned support to bring rebound. Firm break of 1.3976 will confirm up resumption of whole up trend from 1.2005 (2021 low). Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3176 at 1.4149.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Apr | 91M | -202M | 588M | 476M |

| 23:01 | GBP | GfK Consumer Confidence May | -17 | -18 | -19 | |

| 23:30 | JPY | National CPI Y/Y Apr | 2.50% | 2.70% | ||

| 23:30 | JPY | National CPI ex Fresh Food Y/Y Apr | 2.20% | 2.20% | 2.60% | |

| 23:30 | JPY | National CPI ex Food & Energy Y/Y Apr | 2.40% | 2.90% | ||

| 06:00 | GBP | Retail Sales M/M Apr | -0.60% | 0.00% | ||

| 06:00 | EUR | Germany GDP Q/Q Q1 F | 0.20% | 0.20% | ||

| 12:30 | CAD | Retail Sales M/M Mar | -0.10% | -0.10% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Mar | -0.20% | -0.30% | ||

| 12:30 | USD | Durable Goods Orders Apr | 0.50% | 2.60% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Apr | 0.10% | 0.20% | ||

| 14:00 | USD | Michigan Consumer Sentiment May | 67.4 | 67.4 |