Dollar saw only a temporary uplift from stronger-than-expected CPI figures from the US. The greenback reverted to pre-release levels, while stock futures rebounded. Traders appeared to be refraining from taking decisive bets. This reaction suggests that the inflation data, despite being higher than anticipated, may not be sufficiently influential to deter Fed from cutting interest rate in June. The core inflation rate’s modest cooling, alongside perceptions of energy driven headline inflation rise as “transitory,” has seemingly tempered immediate concerns over persistent inflationary pressures.

In the UK, Pound faced slight selling pressure following reports of weaker-than-expected wage growth and a slight uptick in the unemployment rate. This economic backdrop is unlikely to prompt BoE to delay its anticipated interest rate cut beyond August. However, the lackluster progress on the wages front does not necessitate an accelerated policy easing from BoE either. With the central bank not under immediate pressure to adjust its policy stance, it will continue its patient approach and wait for more data first.

Across the currency spectrum, Yen emerged as the day’s weakest, with enthusiasm regarding next week’s potential BoJ rate hike cooled. Sterling is the second weakest followed by Dollar. Australian Dollar is now the strongest, followed by Swiss Franc and New Zealand Dollar. Euro and Canadian are mixed.

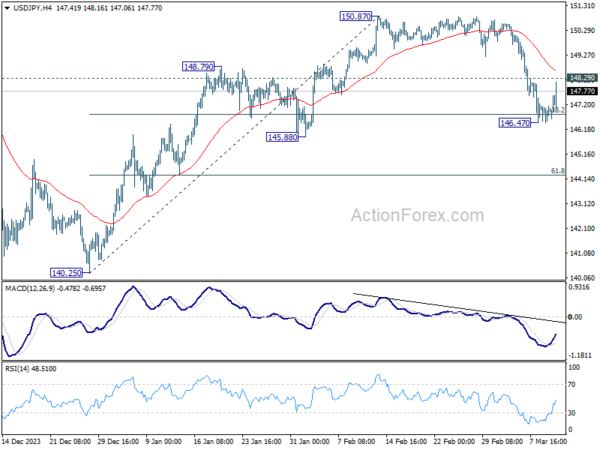

Technically, as USD/JPY stabilized around 38.2% retracement of 140.25 to 150.87 at 146.81 focus is now on the strength of the rebound from 146.47. Decisive break of 148.29 minor resistance will argue fall from 150.87 has completed after defending 146.81. That would retain near term bullish in the pair for rising through 150.87 at a later stage.

In Europe, at the time of writing, FTSE is up 1.23%. DAX is up 0.56%. CAC is up 0.23%. UK 10-year yield is down -0.0563 at 4.009. Germany 10-year yield is up 0.002 at 2.308. Earlier in Asian, Nikkei fell -0.06%. Hong Kong HSI rose 3.05%. China Shanghai SSE fell -0.41%. Singapore Strait Times rose 0.10%. Japan 10-year JGB yield rose 0.0014 to 0.768.

US CPI rises to 3.2% yoy in Feb, CPI core down to 3.7% yoy, both above expectations

US CPI rose 0.4% mom in February, matched expectations. CPI core (ex-food and energy) rose 0.4% mom, above expectation of 0.3% mom. Food index was unchanged whole energy index rose 2.3% mom.

Over the 12-month period, headline CPI accelerated from 3.1% yoy to 3.2% yoy, above expectation of 3.1% yoy. CPI core slowed from 3.9% yoy to 3.8% yoy, above expectation of 3.7% yoy. Energy index was down -1.9% yoy while good index was up 2.2% yoy.

UK wages growth slows more than expected in Jan

In February, UK payrolled employment rose 20k or 0.1% mom. Median monthly pay increased by 5.5% yoy. Annual growth in median pay was highest in the other service activities sector, with an increase of 7.4% yoy, and lowest in the finance and insurance sector, with a decrease of -0.3% yoy.

In the three months to January, unemployment rate ticked up to 3.9%, above expectation of 3.8%. Average earnings including bonus rose 5.6% yoy, slowed from 5.8% yoy, below expectation of 5.7% yoy. Average earnings excluding bonus rose 6.1% yoy, down from 6.2% yoy, below expectation of 6.2% yoy.

BoJ’s Ueda: Economy recovering gradually despite some signs of weakness

In a parliamentary address today, BoJ Governor Kazuo Ueda noted that Japan’s economy is “still recovering gradually”, despite acknowledging some recent “signs of weakness”.

Ueda highlighted a concerning trend of weakening consumption in food and daily necessities amid rising prices. However, he also pointed out a silver lining with moderate improvements in household spending, fueled by expectations of wage increases.

The anticipation around a rate hike by BoJ has garnered significant attention recently, with Ueda reiterating the bank’s focus on the emergence of a “positive wage-inflation cycle.” This perspective is crucial for determining the viability of reaching BoJ’s inflation targets sustainably and stably.

“Various data have come out since January and we’ll likely have additional data come out this week. We will look comprehensively at such data, and make an appropriate monetary policy decision,” he said.

Australia NAB business confidence falls to 0, cost pressures clearly remain elevated

Australia’s NAB Business Confidence ticked down from 1 to 0 in February. Business Conditions rose from 7 to 10. Trading conditions rose form 9 to 14. Profitability conditions rose from 6 to 9. Employment conditions rose from 5 to 6.

Cost pressures remain a significant concern. Labor (2.0% in quarterly equivalent terms) and purchase cost (1.8%) growth stayed constant. Product price growth rose from 1.1% to 1.3% while retail price growth surged from 0.9% to 1.4%.

Alan Oster, NAB’s Chief Economist, pointed out that cost pressures “clearly remain elevated”, and there’s scope for firms to pass this through to output prices.”

He emphasized the role of global supply improvements in driving the progress on disinflation so far, cautioning that future advancements is “unlikely to be linear.”

According to Oster, the path to returning inflation within RBA’s target band by 2025 is fraught with uncertainties. He predicts a “cautious approach” from RBA, with interest rates to be “on hold for most of this year.”

RBA’s Hunter: Data broadly in line with expectations

RBA Assistant Governor Sarah Hunter noted that the incoming data were “broadly in line with what we were anticipating.” Nevertheless, she emphasized that the central bank is “monitoring and looking” and will be updating the economic forecasts in May.

Hunter also touched on the challenges posed by interest rate hikes, particularly for households finding such adjustments difficult. However, she emphasized that “inflation is the single biggest drag”, highlighting RBA’s primary focus on managing inflation to ensure economic stability and growth.

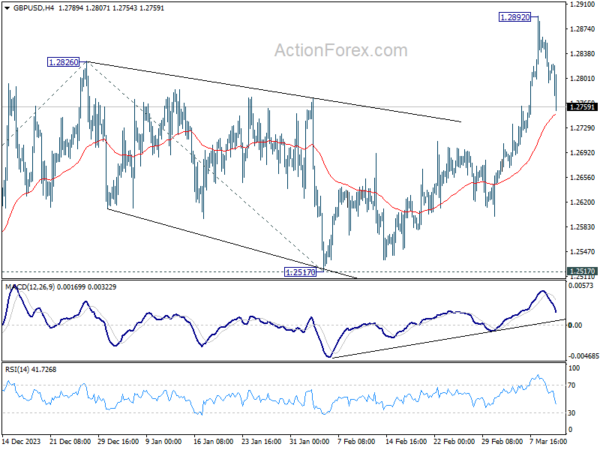

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2784; (P) 1.2825; (R1) 1.2855; More…

GBP/USD’s retreat from 1.2892 extends lower today. But still, further rally will remain in favor as long as 55 4H EMA (now at 1.2746) holds. On the upside, above 1.2892 will resume larger rise from 1.2063 and target 61.8% projection of 1.2036 to 1.2826 from 1.2517 at 1.3005. However, sustained break of 55 4H EMA will bring deeper fall back towards 55 D EMA (now at 1.2662), and possibly further to 1.2517 structural support.

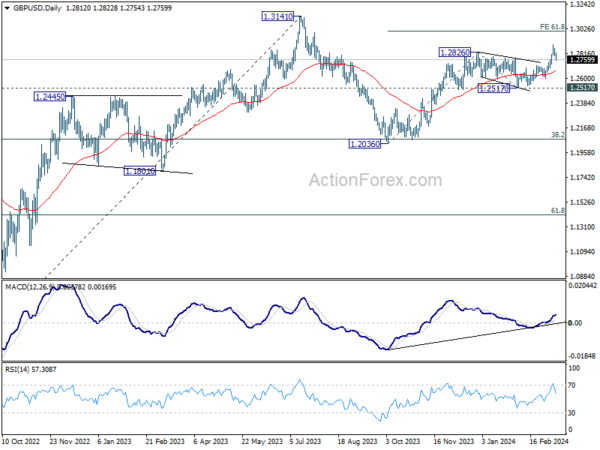

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg, which is still in progress. But upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2517 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Feb | 0.60% | 0.50% | 0.20% | |

| 23:50 | JPY | BSI Large Manufacturing Index Q1 | -6.7 | 6.2 | 5.7 | |

| 00:30 | AUD | NAB Business Confidence Feb | 0 | 1 | ||

| 00:30 | AUD | NAB Business Conditions Feb | 10 | 6 | ||

| 07:00 | EUR | Germany CPI M/M Feb F | 0.40% | 0.40% | 0.40% | |

| 07:00 | EUR | Germany CPI Y/Y Feb F | 2.50% | 2.50% | 2.50% | |

| 07:00 | GBP | Claimant Count Change Feb | 16.8K | 20.3K | 14.1K | 3.1K |

| 07:00 | GBP | ILO Unemployment Rate (3M) Jan | 3.90% | 3.80% | 3.80% | |

| 07:00 | GBP | Average Earnings Including Bonus 3M/Y Jan | 5.60% | 5.70% | 5.80% | |

| 07:00 | GBP | Average Earnings Excluding Bonus 3M/Y Jan | 6.10% | 6.20% | 6.20% | |

| 10:00 | USD | NFIB Business Optimism Index Feb | 89.4 | 90.7 | 89.9 | |

| 12:30 | USD | CPI M/M Feb | 0.40% | 0.40% | 0.30% | |

| 12:30 | USD | CPI Y/Y Feb | 3.20% | 3.10% | 3.10% | |

| 12:30 | USD | CPI Core M/M Feb | 0.40% | 0.30% | 0.40% | |

| 12:30 | USD | CPI Core Y/Y Feb | 3.80% | 3.70% | 3.90% |