The forex markets turned quieter in Asian session today with minimal movements. Dollar is consolidating this week’s strong gain but there is no sign of extended pullback for now. There is still prospect for more upside before weekly close, and U of Michigan consumer sentiment and inflation expectation would be a trigger for another round of buying.

Meanwhile, Sterling remains steady as investors await UK GDP data. Money markets have significantly trimmed their expectations for BoE rate cuts this year, reducing the projected total easing to just 49 bps, the lowest since October. That’s a stark contrast to more than 70 bps anticipated just a week ago. Moreover, the markets now price in the first full quarter-point reduction by September. Robust GDP data today could reinforce the belief that the UK has fully emerged from last year’s recession, affirming more conservative monetary policy easing ahead.

Overall in the currency markets, Dollar is currently the strongest one, with Kiwi a distant second, and then Sterling. Euro is the worst performer, followed by Yen and then Swiss Franc. Canadian and Aussie are positioned in the middle.

Technically, EUR/GBP’s outlook is staying bearish as it struggled to stay firm above 55 D EMA. Break of 0.8529 support will argue that larger fall from 0.8764 is ready to resume through 0.8491/7 support zone. Today’s UK GDP release will be pivotal in determining whether this downside breakout will materialize.

In Asia, at the time of writing, Nikkei is up 0.30%. Hong Kong HSI is down -1.73%. China Shanghai SSE is down -0.04%. Singapore Strait Times is down -0.29%. Japan 10-year JGB yield is down -0.0101 at 0.847. Overnight, DOW fell -0.01%. S&P 500 rose 0.74%. NASDAQ rose 1.68%. 10-year yield jumped 0.016 to 4.576.

Fed’s Collins signals reduced urgency for rate cuts and lesser easing in 2024

Boston Fed President Susan Collins suggested that the recent economic data do not necessitate an immediate adjustment in monetary policy, indicating that less easing might be required this year than previously anticipated.

At an even overnight, Collins highlighted that while recent data have not significantly altered her economic outlook, they but “highlight uncertainties related to timing” of economic developments. She stressed the importance of patience, acknowledging that “disinflation may continue to be uneven”.

“This also implies that less easing of policy this year than previously thought may be warranted,” she added.

Furthermore, “incoming data have eased my concerns about an imminent need to reassess the stance of monetary policy,” she explained. And, “it may just take more time than previously thought for activity to moderate, and to see further progress in inflation returning durably to our target.”

IMF Georgieva: Possible Fed rate cut in late 2024, but don’t hurry

In an interview with CNBC overnight, IMF Managing Director Kristalina Georgieva projected that by the end of the year, Fed would be positioned to lower interest rates. Nevertheless, She emphasized the importance of data-driven decisions, advising against premature action.

“We remain on our projection that we would see, by the end of the year, the Fed being in a position to take some action in a direction of bringing interest rates down,” adding, “But again, don’t hurry until the data tells you you can do it.”

Georgieva also highlighted reasons for optimism regarding the US economy’s future. She pointed out that the US is experiencing less upward pressure on labor costs compared to other regions, which helps in maintaining economic stability without the immediate threat of overheating.

NZ BNZ manufacturing falls to 47.1, 13th month of contraction

New Zealand BusinessNZ Performance of Manufacturing Index PMI fell from 49.1 to 47.1 from 49.1 in February, marking the lowest level since last December and indicating that the sector has been in contraction for 13 consecutive months.

Key components painted a concerning picture. Production experienced a notable decline from 49.1 to 45.7. Employment also fell from 49.2 to 46.8, suggesting that businesses are reducing their workforce in response to reduced demand. New orders, a critical indicator of future activity, decreased from 47.5 to 44.7.

Finished stocks were the only component of the index to show an increase, from 48.8 to 49.2. This could indicate that products are remaining in inventory longer due to lower sales volumes. Delivery times also worsened from 51.1 to 47.8, which could reflect logistical issues or supply chain disruptions.

The proportion of negative comments from survey respondents increased to 65% in March, up from 62% in February and 63.2% in January. Many cited a lack of orders and the general economic slowdown as major concerns.

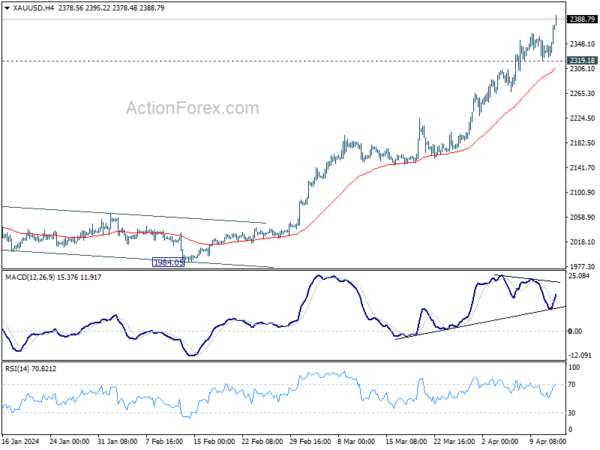

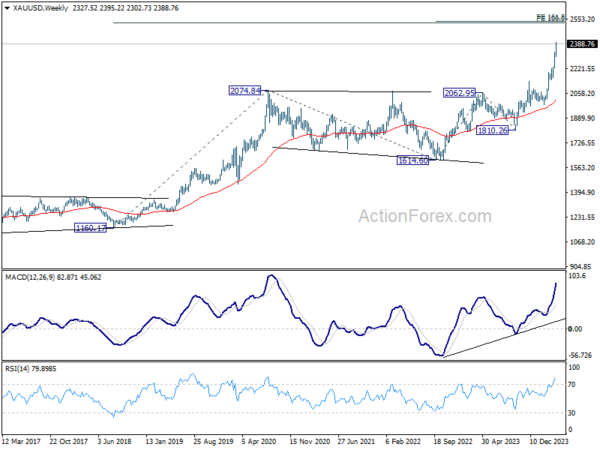

Gold surges to new record, but anticipates stiff resistance at 2500

Gold’s bullish momentum appears unstoppable for now as it surged to new record high in Asian session, now eyeing 2400 mark. This surge is driven by a confluence of factors that indicate broader market apprehensions, particularly about resurgence of inflation risks, with geopolitical tension in the background.

This shift in sentiment is evident in the sharp increase in benchmark treasury yields across various regions, including US, Europe, and even Japan. Concurrently, major stock indices are showing signs of a looming correction.

Judging from these developments, Gold’s rally is more fueled by safe-haven flows, partly as hedge against selloff in stocks and bonds, and partly on geopolitical risks.

Technically, near term outlook in Gold will stay bullish as long as 2319.18 support holds. Next target is 2500 psychological level. Strong resistance is expected there to limit upside, at least on first attempt, to bring a notable correction.

Overbought condition, as seen in weekly RSI is a factor that could limit Gold’s momentum ahead. More importantly, 2500 represents a cluster medium and long term projection levels. There lies 161.8% projection of 1614.60 to 2062.95 from 1810.26 at 2535.69, and 100% projection of 1160.17 to 2074.84 at 1614.60 at 2529.27.

Looking ahead

UK GDP is the main focus in European session, and trade balance will also be released. Germany will publish CPI final. Later in the day, US will release import price index and U of Michigan consumer sentiment.

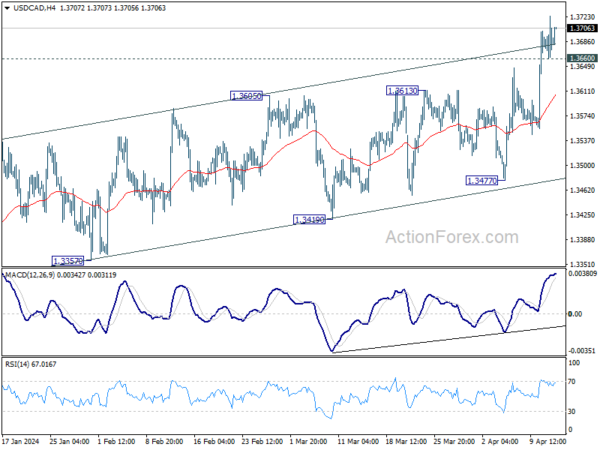

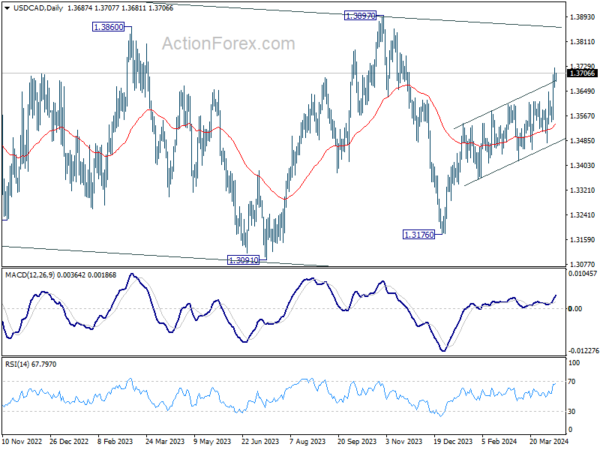

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3658; (P) 1.3692; (R1) 1.3723; More…

Intraday bias in USD/CAD remains on the upside for the moment. Current rise from 1.3176 is in progress, and further rally would be seen towards 1.3897 resistance. In the downside, below 1.3660 minor support will turn intraday bias neutral first and bring consolidations. But near term outlook will remain bullish as long as 1.3477 support holds.

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern only. In case of another fall, strong support should emerge above 1.2947 resistance turned support to bring rebound. Overall, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Mar | 47.1 | 49.3 | 49.1 | |

| 04:30 | JPY | Industrial Production M/M Feb F | -0.60% | -0.10% | -0.10% | |

| 06:00 | EUR | Germany CPI M/M Mar F | 0.40% | 0.40% | ||

| 06:00 | EUR | Germany CPI Y/Y Mar F | 2.20% | 2.20% | ||

| 06:00 | GBP | GDP M/M Feb | 0.10% | 0.20% | ||

| 06:00 | GBP | Manufacturing Production M/M Feb | 0.20% | 0.00% | ||

| 06:00 | GBP | Manufacturing Production Y/Y Feb | 2% | |||

| 06:00 | GBP | Industrial Production M/M Feb | 0.00% | -0.20% | ||

| 06:00 | GBP | Industrial Production Y/Y Feb | 0.50% | |||

| 06:00 | GBP | Goods Trade Balance (GBP) Feb | -14.5B | -14.5B | ||

| 11:00 | GBP | NIESR GDP Estimate Mar | 0.00% | |||

| 12:30 | USD | Import Price Index M/M Mar | 0.40% | 0.30% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Apr P | 79 | 79.4 |