Dollar is largely in a state of consolidation today, except with a minor uptick observed against Swiss Franc. In the absence of significant economic data from the US, market participants are poised to gauge the sentiment from forthcoming comments by Fed officials. However, the broader market dynamics, particularly the interplay with other financial markets, could play a more pivotal role in shaping the greenback’s next. 10-year yield, nearing the upper echelon of its near-term range at 4.2%, might begin to taper off, while the stock markets are teetering on the edge of a mild pullback after struggling to sustain their record runs. These factors of countering forces could keep trading in Dollar sluggish for a while.

In the wider forex arena, Australian Dollar emerges as the day’s strongest performer, albeit with a recovery that appears to lack conviction. Neither RBA’s marginally hawkish posture nor the uplift from Chinese stock markets seems to provide Aussie with lasting momentum. British Pound, on the other hand, is solidifying its position as the second strongest, seemingly undeterred by dovish remarks from a known BoE dove. Meanwhile, Euro and the Swiss Franc are languishing alongside Dollar, whereas Yen displays mixed performance. Economists see that Japan’s robust base pay growth could keep BoJ on a course towards rate hikes later in the year.

NZD/USD is worth some attention with New Zealand job data scheduled for the upcoming Asian session. The rejection by 55 D EMA is a near term bearish sign. Rebound from 0.5771 has possibly completed at 0.6368 already. Sustained break of 61.8% retracement of 0.5571 to 0.6368 at 0.5999 will strengthen that case that it’s trying to resume whole down trend from 0.6537. For now, risk will stay on the downside as long as 0.6172 resistance holds, in case of recovery.

In Europe, at the time of writing, FTSE is up 0.71%. DAX is up 0.26%. CAC is up 0.50%. UK 10-year yield is down -0.0126 at 3.994. Germany 10-year yield is up 0.010 at 2.330. Earlier in Asia, Nikkei fell -0.53%. Hong Kong HSI rose 4.04%. China Shanghai SSE rose 3.23%. Singapore Strait Times fell -0.27%. Japan 10-year JGB yield rose 0.0022 to 0.723.

BoE Dhingra urges not to take risk on the economy

In a Financial Times interview, BoE MPC member Swati Dhingra articulated her concerns regarding the UK’s economic outlook and inflationary trends. As the sole member to vote for a rate cut in the last meeting, she cautioned against underestimating the downside risks and and urged not to take a risk on them.

Dhingra expressed apprehension about the adverse impacts of past policy tightening on growth, emphasizing the paradox of experiencing “higher-than-historic rates” of wage growth against the backdrop of significantly weakened consumption, which has declined by 5.9% relative to pre-pandemic levels.

This stark drop in consumption, according to Dhingra, is expected to persist, highlighting the “lagged effects” of monetary policy tightening yet to materialize fully. She questioned the rationale behind risking further economic weakening by maintaining high-interest rates when inflation appears to be on a “sustainable path.”

The conversation further delved into the challenges posed by the current consumption weakness, which Dhingra believes is unlikely to reverse swiftly enough to trigger a “resurgence in inflation”.

Her comments reflect a deeper concern over underestimating the downside risks to the economy, especially as the financial cushion provided by pandemic-era savings begins to diminish. Additionally, the noticeable decline in job vacancies signals further strain on the real economy.

“I don’t see why we should be risking that,” Dhingra emphasized.

Eurozone retail sales falls -1.1%mom, EU down -1.0%

Eurozone retail sales fell -1.1% mom in December, worse than expectation of -1.0% mom. Volume of retail trade decreased by -1.6% mom for food, drinks and tobacco, by -1.0% mom for non-food products and by -0.5% mom for automotive fuels.

EU retail sales fell -1.0% mom. Among Member States for which data are available, the largest monthly decreases in the total retail trade volume were registered in Slovenia (-3.6%), Denmark (-3.2%) and Luxembourg (-3.1%). The highest increases were observed in Slovakia (+2.0%), Croatia and Hungary (both +1.4%) as well as in Portugal (+0.7%).

ECB consumer survey reveals declining inflation expectations

ECB’s Consumer Expectations Survey for December highlighted a noteworthy trend in consumer sentiment regarding inflation and economic growth.

In a positive development, consumers’ inflation expectations for the next 12 months have decreased for the third consecutive month, with median inflation expectation falling to 3.2%, a drop from November’s 3.5% and October’s 4.0%.

Conversely, the survey indicated a slight uptick in medium-term inflation expectations, with three-year ahead inflation expectations median rising marginally from 2.4% to 2.5%, although this figure remains below 2.6% observed in October.

On the economic growth front, the survey’s findings were relatively stable, with mean growth expectation for the next 12 months remaining unchanged at -1.3%. Furthermore, the survey revealed a slight improvement in unemployment outlook, with expected mean unemployment rate declining from 11.4% to 11.2%, compared to 11.6% in October.

RBA stands pat, eases hawkish stance without shifting to neutral

RBA maintained cash rate target at 4.35%, aligning with broad market expectations. The hawkish stance has seen a slight moderation, with the acknowledgment that “a further increase in interest rates cannot be ruled out,” hinting at a cautious approach rather than a definitive shift towards a neutral bias.

The updated economic forecasts paint a picture of gradual moderation in inflation pressures. Headline CPI is expected to decelerate from 4.1% at the end of 2023 to 3.2% by the close of 2024, reaching 2.8% at the end of 2025, and further softening to 2.6% by mid-2026.

Trimmed mean CPI mirrors this downward trend, projected to ease from 4.2% at the end of 2023 to 3.1% by the end of 2024, and gradually declining to 2.8% by December 2024, and then 2.6% by June 2026.

Additionally, RBA’s outlook for cash rate assumes a decrease to 3.9% by the end of 2024, followed by a further reduction to 3.4% by the end of 2025, and eventually reaching 3.2% by mid-2026. This assumption aligns with the expectations derived from surveys of professional economists and financial market pricing.

On the growth front, RBA projects a modest GDP expansion of 1.8% in 2024, with an improvement to 2.3% in 2025.

Japan’s labor cash earnings rises 1% yoy, with regular Pay at fastest pace since May

Japan saw a modest improvement in labor cash earnings in labor cash earnings, which increased by 1.0% yoy, accelerating from November’s 0.7% gain. Despite this uptick, the growth fell short of anticipated 1.3% yoy.

A notable positive development was observed in regular pay, which rose by 1.6% yoy, marking the highest reading since May 2023. Additionally, special payments saw a marginal increase of 0.5% yoy, although overtime pay experienced a decline of -0.7% yoy.

With CPI standing at 3.0% yoy, real wages saw a decline of -1.9% yoy, albeit at a slower pace compared to -2.5% yoy observed in the previous month. This marks the slowest decline in real wages since June 2023, suggesting a slight easing in the pressure on household incomes.

However, this positive note is tempered by the latest household spending figures, which saw a -2.5% yoy drop, worse than the expected -2.1% yoy.

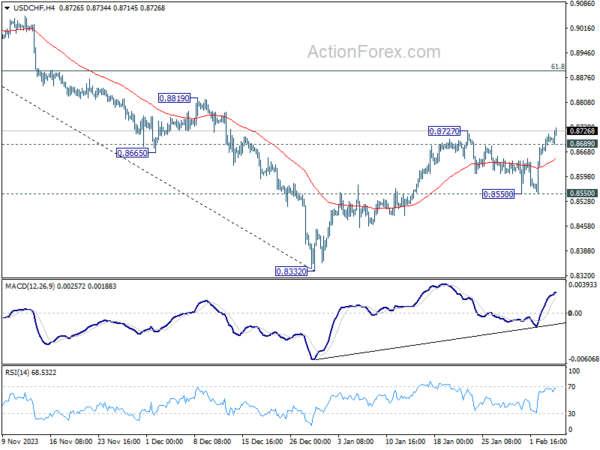

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8669; (P) 0.8694; (R1) 0.8731; More….

Break of 0.8272 resistance suggest that USD/CHF’s rebound from 0.8332 is resuming. Intraday bias is back on the upside. Further rally should be seen to 61.8% retracement of 0.9243 to 0.8332 at 0.8995 next. On the downside, below 0.8689 minor support will turn intraday bias neutral first. But risk will stay on the upside as long as 0.8550 support holds, in case of retreat.

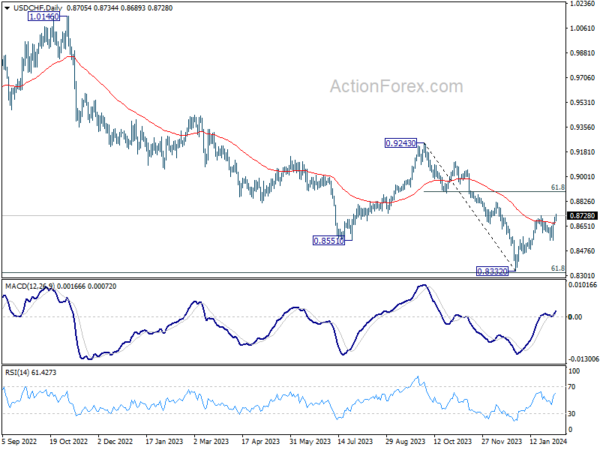

In the bigger picture, there is prospect of medium term bottoming at 0.8332 considering possible bullish convergence condition in W MACD, and the support from 0.8317 long term fibonacci support. Sustained trading above 55 D EMA (now at 0.8672) will affirm this case, and bring stronger rise back towards 0.9243 resistance, even as a corrective move.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Dec | 1.00% | 1.30% | 0.70% | |

| 23:30 | JPY | Household Spending Y/Y Dec | -2.50% | -2.10% | -2.90% | |

| 03:30 | AUD | RBA Interest Rate Decision | 4.35% | 4.35% | 4.35% | |

| 04:30 | AUD | RBA Press Conference | ||||

| 07:00 | EUR | Germany Factory Orders M/M Dec | 8.90% | 0.30% | 0.30% | 0.00% |

| 09:30 | GBP | Construction PMI Jan | 48.8 | 47.2 | 46.8 | |

| 10:00 | EUR | Eurozone Retail Sales M/M Dec | -1.10% | -1.30% | -0.30% | 0.30% |

| 13:30 | CAD | Building Permits M/M Dec | -14.00% | 1.20% | -3.90% | -5.00% |

| 15:00 | CAD | Ivey PMI Jan | 55 | 56.3 |