The dollar index fell on Thursday, following overall slightly better than US data and warning from Japan’s authorities about possible action against sharp fall of yen.

The US economy grew by 1.4% in Q1 vs expected 1.3% rise, weekly jobless claims fell below expectations and durable goods orders jumped well above forecast in May, while traders started to exit dollar longs on looming Japan’s intervention.

However, the pullback from the highest in nearly two months was so far mild and could be seen as a healthy correction, as dollar continues to benefit from growing political uncertainty in Europe and Fed’s narrative about holding the policy unchanged for extended period.

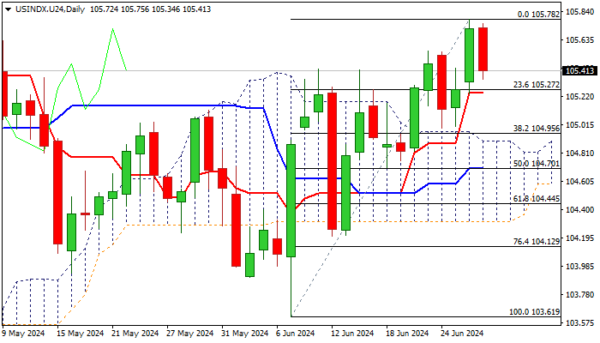

Fresh weakness faces initial support at 105.24 (daily Tenkan-sen) with deeper pullback likely to find firm ground above pivotal supports at 104.95/90 (Fibo 38.2% of 104.61/105.78 upleg / daily cloud top) to keep larger bulls in play.

Expect increased downside risk on loss of 104.90/70 pivots, which would open way for deeper correction.

Res: 105.78; 106.00; 106.22; 106.36.

Sup: 105.24; 104.90; 104.70; 104.31.