Dollar is recovering mildly overnight, as traders prepare for Fed Chair Jerome Powell’s highly anticipated two-day Congressional testimony. Powell is scheduled to address the Senate today and the House tomorrow. Fed’s latest dot plot suggests median expectation of just one rate cut this year. However, recent soft economic data from June, including non-farm payroll numbers, have led markets to bet on the possibility of two rate cuts. Market focus will be on how Powell addresses the balance between persistent inflation, economic slowdown, and weakening labor market conditions. Risk sentiment could improve if Powell hints that economic weakness is spreading through the US economy, and thus setting the stage for policy easing.

In the broader currency markets, Australian Dollar stands out as the strongest performer today at this point. Australian consumers are increasingly worried about more rate hikes from RBA, with expectations rising sharply. Meanwhile, business confidence remains solid. Together they suggested that both consumers and businesses are mentally bracing for potential rate increases. Euro follows as the second strongest currency, with Canadian dollar also showing strength.

On the flip side, Japanese Yen is the weakest performer, partly linked to strong risk-on sentiment in Japan, where Nikkei surged to new record highs. Swiss Franc and the New Zealand Dollar are also underperforming. Kiwi is particularly subdued ahead of RBNZ’s rate decision tomorrow. While it is too soon for RBNZ to hint at an earlier-than-expected rate cut given that Q2 inflation data will be released next week, there remains a slight dovish risk. Meanwhile,Dollar and British Pound are mixed in their performance.

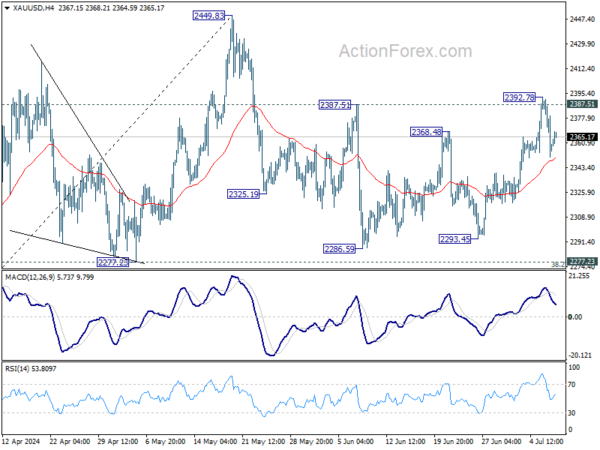

Technically, Gold’s firm attempt on 2387.51 resistance ended in failure as it retreated notably since then. Outlook is unchanged that corrective pattern from 2449.83 is extending. On the downside, firm break of 55 4H EMA (now at 2349.52) will bring another down leg back towards 2277.23 key support. However, break of 2392.78 resistance will resume the near term rebound to retest 2449.83 high.

In Asia, at the time of writing, Nikkei is up 2.31%. Hong Kong HSI is down -0.30%. China Shanghai SSE is up 0.26%. Singapore Strait Times is up 0.41%. Japan 10-year JGB yield is down -0.011 at 1.080. Overnight, DOW fell -0.08%. S&P 500 rose 0.10%. NASDAQ rose 0.28%. 10-year yield fell -0.003 to 4.269.

Australia Westpac consumer sentiment falls -1.1% mom, intensifying interest rate concerns

Australia’s Westpac Consumer Sentiment index dropped by -1.1% mom to 82.7 in July, reflecting increased concerns about persistent inflation and fears of interest rate hikes.

The Mortgage Rate Expectations Index, which measures consumer expectations for variable mortgage rates over the next 12 months, surged by 12.8% in July, marking the steepest monthly rise since early 2022. Over the past three months, the index has climbed by 30%, from a below-average 122.8 in April to 159.2 in July, well above historical average of 143.8. This marked increase is the sharpest observed in the past seven years, with detailed responses indicating that nearly 60% of consumers expect mortgage rates to rise over the next year.

RBA will meet on August 5–6. Westpac expects the RBA to hold interest rates steady, contingent on inflation continuing to decline as anticipated. The upcoming Q2 CPI and labor market data will be critical.

Australia’s NAB business confidence rebounds to 4, highest since early 2023

Australia’s NAB Business Confidence rose from -2 to 4 in June, marking its highest level since early 2023 and returning to positive territory. However, Business Conditions fell from 6 to 4, indicating some ongoing challenges. Trading conditions decreased slightly from 11 to 10, profitability conditions dropped from 3 to 2, and employment conditions fell sharply from 5 to 0.

Labor cost growth slowed to 1.8% on a quarterly basis, down from 2.3% in May, while purchase cost growth eased to 1.3% from 1.7%. Overall product price growth decreased to 0.7%, down from 1.1%. Retail price growth, however, held steady at 1.5%, and recreation and personal services prices declined to 0.7% from 1.1%.

Gareth Spence, NAB Head of Australian Economics, noted, the survey signals “another soft quarter” in Q2. Capacity utilisation remains “high with demand and supply yet to fully normalise”.

“Price pressures continue to ease in a trend sense though the data certainly remains bumpy,” Spence added.

USD/JPY Daily Outlook

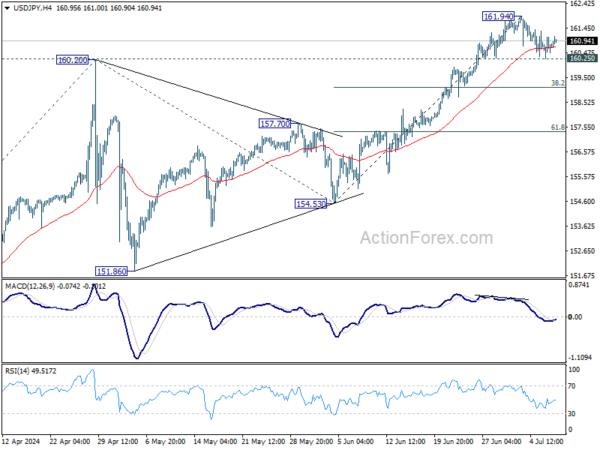

Daily Pivots: (S1) 160.28; (P) 160.84; (R1) 161.35; More…

Intraday bias in USD/JPY remains neutral for the moment, as range trading continues. Further rally is expected with 160.25 minor support intact. On the upside, break of 161.94 temporary top will resume larger up trend to 61.8% projection of 146.47 to 160.20 from 154.53 at 163.01. Nevertheless, break of 160.25 will turn bias to the downside for deeper pullback.

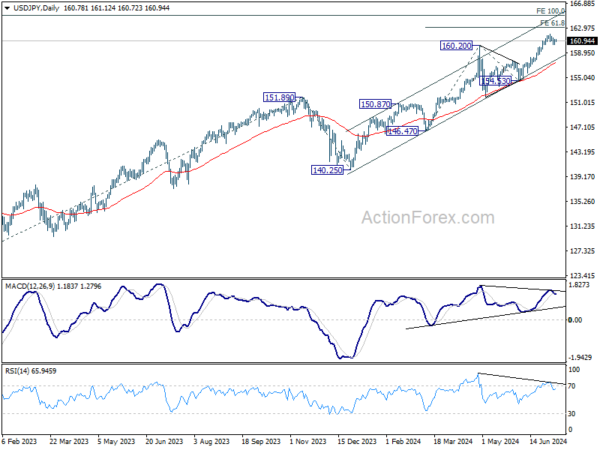

In the bigger picture, long term up trend is still in progress. Further rise is expected as long as 154.53 support holds. Next target is 100% projection of 127.20 (2023 low) to 151.89 (2023 high) from 140.25 at 164.94.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Jun | 1.50% | 2.00% | 1.90% | |

| 00:30 | AUD | Westpac Consumer Confidence Jul | 1.50% | 1.70% | ||

| 01:30 | AUD | NAB Business Conditions Jun | 4 | 6 | ||

| 01:30 | AUD | NAB Business Confidence Jun | 4 | -3 | -2 | |

| 06:00 | JPY | Machine Tool Orders Y/Y Jun P | 4.20% | |||

| 10:00 | USD | NFIB Business Optimism Index Jun | 89.5 | 90.5 |