Dollar’s pullback intensifies in early US session, prompted by unexpectedly poor retail sales data for January. This underwhelming performance is reigniting debates about the enduring strength of consumer spending, a critical factor in fueling inflation. Although a single data point does not dictate the broader economic narrative, it nonetheless re-introduces speculation about Fed’s potential rate cut in May, despite the improbability of a move in March.

Across the pond, Sterling suffered even greater losses, becoming today’s most underperforming currency. The Pound has unwound most of its gains from earlier in the week, following the release of GDP figures that confirmed the UK’s descent into recession. This, combined with CPI figures that came in below expectations, is likely to dial down the intensity of BoE’s hawkish voices. Market participants are recalibrating their expectations, turning back to anticipating three rate cuts within the year.

In contrast to Dollar and Pound, Swiss Franc emerged as the day’s standout performer, clawing back some of its losses from earlier in the week. New Zealand Dollar and Japanese Yen also ranked among the stronger currencies of the day, while Canadian Dollar lagged just behind Sterling and Dollar. Euro and Australian Dollar displayed mixed performances.

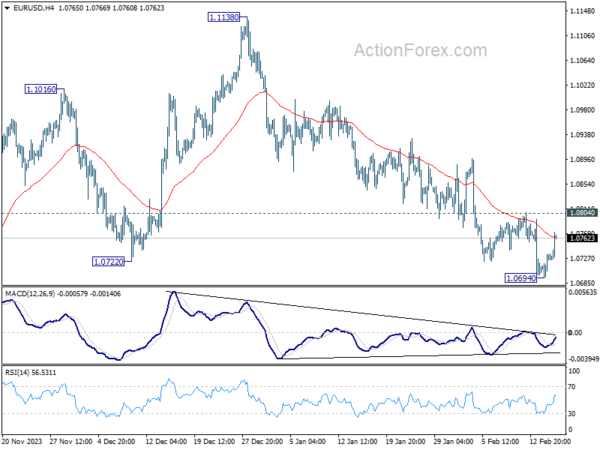

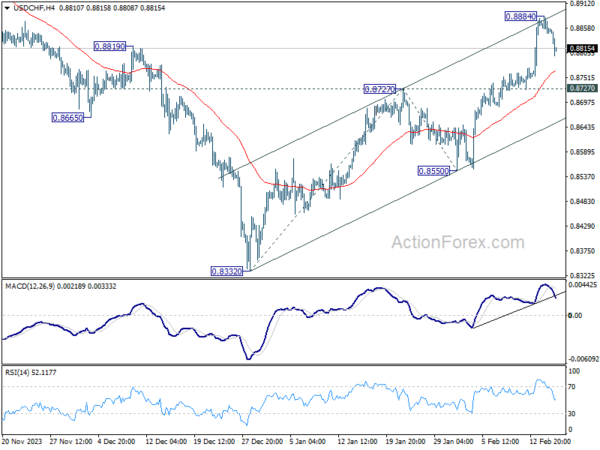

Technically speaking, Dollar’s retreat is notable, yet it crucially remains above pivotal near-term support levels against other major currencies. Key levels to watch includes 1.0804 resistance in EUR/USD, 0.8727 support in USD/CHF, and 148.79 support in USD/JPY. As long as these levels hold, Dollar’s near term rally is still in favor to resume at a later stage.

In Europe, at the time of writing, FTSE is up 0.16%. DAX is up 0.54%. CAC is up 0.93%. UK 10-year yield is down -0.0405 at 4.003. Germany 10-year yield is down -0.030 at 2.314. Earlier in Asia, Nikkei rose 1.21%. Hong Kong HSI rose 0.41%. Singapore Strait Times rose 1.20%. Japan 10-year JGB yield fell -0.030 to 0.730.

US retail sales falls -0.8% mom in Jan, ex-auto sales down -0.6% mom

US retail sales fell -0.8% mom to USD 700.3B in January, well below expectation of -0.2% mom. Ex-auto sale fell -0.6% mom to USD 567.9B, much worse than expectation of 0.1% mom rise. Ex-gasoline sales fell -0.8% mom to USD 647.9B. Ex-auto, gasoline sales fell -0.5% mom to USD 515.5B. In the three months to January, sales were up 3.1% from the same period a year ago.

Also released, initial jobless claims fell from 220k to 212k in the week ending February 9, better than expectation of 217k. Empire state manufacturing index improved from -43.7 to -2.4 in February, above expectation of -12.5. Philly Fed manufacturing index rose form -10.6 to 5.2 in February, above expectation of -8.9.

European Commission forecasts slower Eurozone growth, but quicker inflation slowdown

According to European Commission’s Winter 2024 Economic Forecast, Eurozone’s GDP growth for 2024 was revised notably downwards to 0.8% from Autumn’s estimate of 1.2%, reflecting a more subdued outlook than previously anticipated. For 2025, GDP growth forecast as slightly downgraded to 1.5% from 1.6%.

Inflation is expected to decelerate more rapidly in 2024, with HICP forecasted at 2.7%, down from prior 3.2%. Meanwhile, inflation forecast for 2025 remains unchanged at 2.2%.

Vice-President Valdis Dombrovskis highlighted that despite the challenges faced in 2023, “rebound should speed up gradually this year and into 2025”. Inflation will continue its “broad-based decline” and bolstered consumer demand through real wage growth and a robust labour market.

Commissioner for Economy Paolo Gentiloni acknowledged the “more modest” economic rebound this year. But growth is set to “firm” and inflation to decline to close to ECB’s 2% target in 2025.

ECB’s Lagarde highlights wage growth as increasingly important inflation

In a European Parliament committee hearing, ECB President Christine Lagarde highlighted that the “ongoing disinflation process” is expected to continue “gradually further down over 2024,” attributing this trend to the diminishing effects of past upward shocks and the impact of tighter financing conditions on inflation.

Lagarde noted a “gradual decline” in core inflation, which excludes energy and food prices, while also pointing out the “signs of persistence” in services inflation.

Significantly, Lagarde identified wage growth as a crucial factor, stating it is becoming an “increasingly important driver of inflation dynamics.” ECB’s wage tracker signals sustained wage pressures, although there’s “some levelling off” observed in the latest quarter of 2023. The direction of wage pressures in 2024 largely depends on “ongoing or upcoming negotiation rounds” affecting a broad segment of the workforce.

Furthermore, Lagarde observed that the influence of unit profits on domestic price pressures is on the decline, suggesting that wage increments are being partly accommodated through “profit margins.”

UK slides into technical recession with -0.3% qoq GDP contraction in Q4

UK GDP contracted -0.3% qoq in Q4, worse than expectation of -0.1% qoq. This downturn was a collective result of declines across all primary sectors: services saw a -0.2% dip qoq, production tumbled by -1.0% qoq, and construction experienced a significant -1.3% qoq fall. Following -0.1% qoq contraction in Q3, these figures confirm UK’s entry into a technical recession.

December’s GDP data offered a slight respite with a marginal -0.1% mom decrease, better than expectation of -0.2% mom. That followed 0.2% mom growth in November, and -0.5% mom contraction in October. Services fell -0.2% mom. Production grew 0.6% mom. Construction fell -0.5% mom.

Reflecting on the entire year of 2023, UK’s GDP saw a meager 0.1% growth, a stark contrast to 4.3% expansion in 2022. This marks the weakest annual performance since the 2009 financial crisis, with the exception of the pandemic-stricken year of 2020.

Japan enters technical recession amid falling consumption and investment

Japan’s economy has entered a technical recession as GDP unexpectedly contracted by -0.1% qoq in Q4, much worse than expectation of 0.3% qoq growth. That also marked a continuation from -0.8% contraction seen in Q3. On annualized basis, the downturn was -0.4%, a stark contrast to the anticipated 1.4% growth and following -3.3% contraction in the previous quarter.

The contraction is attributed primarily to decline in private consumption, which accounts for over half of the Japanese economy, falling by -0.2% qoq. Capital expenditure, another significant driver of private-sector growth, also decreased by -0.1% qoq. However, external demand, as indicated by the net exports, provided a slight buffer, contributing 0.2 percentage points to GDP, with exports growing by 2.6% qoq.

Economy Minister Yoshitaka Shindo emphasized the importance of solid wage growth to support consumer spending, which he noted is currently “lacking momentum” amidst rising prices. He also pointed out that BoJ considers a broad range of data, including consumption patterns and risks to the economy, when formulating monetary policy.

RBA’s Bullock highlights inflation persistence and demand-supply imbalance

In today’s Senate Estimates appearance, RBA Governor Michele Bullock underscored the “persistent” nature of inflationary pressures within the Australian economy.

She pointed out the crucial distinction between demand growth rates and overall demand levels, emphasizing “growth rates are slowing, but aggregate demand is still above aggregate supply, and that’s what’s generating inflationary pressures.”

Bullock remained optimistic about RBA’s ability to manage inflation effectively without jeopardizing employment growth. “We think we’re in a good position to get inflation down in a reasonable amount of time while still keeping employment growing,” she noted.

Australia’s employment grows 0.5k in Jan, unemployment rate rises to 4.1%

Australia’s job market showed further signs of cooling in January, as the latest employment data reveals a modest increase of just 0.5k jobs, significantly below expectation of 20.7k growth. Looking at the details, full-time employment saw an uptick of 11.1k, counterbalanced by reduction in part-time job by -10.6k.

Unemployment rate unexpectedly rose from 3.9% to 4.1%, above expectation of 4.0%. That also marked the first occasion in two years since January 2022 that the rate has breached the 4% threshold. Participation rate held steady at 66.8%, but a notable decrease in monthly hours worked by -2.5% mom paints a picture of a slackening labor market.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8842; (P) 0.8864; (R1) 0.8880; More….

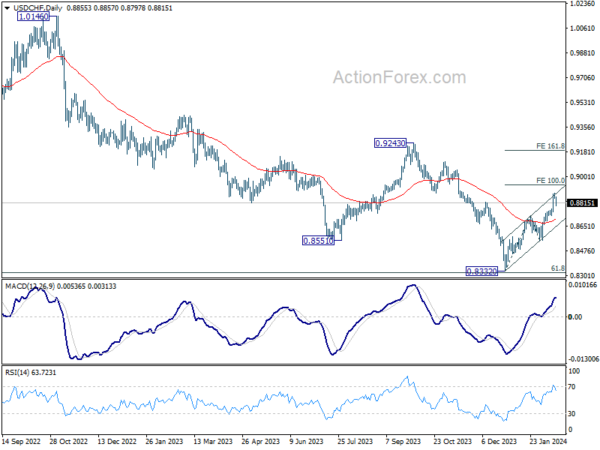

USD/CHF’s retreat from 0.8884 extends lower today and intraday bias remains neutral. Some more consolidative trading would be seen but downside should be contained by 0.8727 resistance turned support to bring another rally. On the upside, above 0.8884 will resume the rise from 0.8332 to 100% projection of 0.8332 to 0.8727 from 0.8550 at 0.8954. Firm break there will pave the way to 161.8% projection at 0.9189. However, sustained break of 0.8727 will dampen this bullish view, and turn bias back to the downside for 0.8550 support instead.

In the bigger picture, a medium term bottom should be formed at 0.8332, on bullish convergence condition in W MACD, just ahead of 0.8317 long term fibonacci support, on bullish convergence condition in W MACD. It’s still early to decide if the larger down trend from 1.0146 (2022 high) is reversing. But further rise should be seen to 0.9243 resistance even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q4 Q/Q P | -0.10% | 0.30% | -0.70% | -0.80% |

| 23:50 | JPY | GDP Deflator Y/Y Q4 P | 3.80% | 4.00% | 5.30% | |

| 00:00 | AUD | Consumer Inflation Expectations Feb | 4.50% | 4.50% | ||

| 00:30 | AUD | Employment Change Jan | 0.5K | 20.7K | -65.1K | -62.7K |

| 00:30 | AUD | Unemployment Rate Jan | 4.10% | 4.00% | 3.90% | |

| 04:30 | JPY | Industrial Production M/M Dec F | 1.40% | 1.80% | 1.80% | |

| 07:00 | GBP | GDP M/M Dec | -0.10% | -0.20% | 0.30% | 0.20% |

| 07:00 | GBP | GDP Q/Q Q4 P | -0.30% | -0.10% | -0.10% | |

| 07:00 | GBP | Industrial Production M/M Dec | 0.60% | -0.10% | 0.30% | |

| 07:00 | GBP | Industrial Production Y/Y Dec | 0.60% | -0.40% | -0.10% | 0.10% |

| 07:00 | GBP | Manufacturing Production M/M Dec | 0.80% | 0.00% | 0.40% | 0.80% |

| 07:00 | GBP | Manufacturing Production Y/Y Dec | 2.30% | 0.60% | 1.30% | 1.90% |

| 07:00 | GBP | Goods Trade Balance (GBP) Dec | -14.0B | -14.1B | -14.2B | -15.1B |

| 07:30 | CHF | PPI M/M Jan | -0.50% | -0.20% | -0.60% | |

| 07:30 | CHF | PPI Y/Y Jan | -2.30% | -1.10% | ||

| 08:00 | CHF | SECO Consumer Climate Q1 | -41 | -34 | -40 | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Dec | 13.0B | 15.7B | 14.8B | 15.1B |

| 12:22 | GBP | NIESR GDP Estimate Jan | -0.10% | 0.00% | -0.30% | |

| 13:15 | CAD | Housing Starts Jan | 224K | 225K | 249K | |

| 13:30 | CAD | Manufacturing Sales M/M Dec | -0.70% | -0.50% | 1.20% | 1.50% |

| 13:30 | USD | Initial Jobless Claims (Feb 9) | 212K | 217K | 218K | 220K |

| 13:30 | USD | Retail Sales M/M Jan | -0.80% | -0.20% | 0.60% | |

| 13:30 | USD | Retail Sales ex Autos M/M Jan | -0.60% | 0.10% | 0.40% | |

| 13:30 | USD | Import Price Index M/M Jan | 0.80% | -0.10% | 0.00% | |

| 13:30 | USD | Empire State Manufacturing Index Feb | -2.4 | -12.5 | -43.7 | |

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Feb | 5.2 | -8.9 | -10.6 | |

| 14:15 | USD | Industrial Production M/M Jan | 0.30% | 0.10% | ||

| 14:15 | USD | Capacity Utilization Jan | 78.80% | 78.60% | ||

| 15:00 | USD | Business Inventories Dec | 0.30% | -0.10% | ||

| 15:00 | USD | NAHB Housing Market Index Feb | 46 | 44 | ||

| 15:30 | USD | Natural Gas Storage | -67B | -75B |