Dollar spiked higher after US PPI reported stronger-than-expected monthly rise. However, this upward movement was quickly reversed within minutes, indicating that bearish sentiment continues to dominate the greenback. The key question now is whether Dollar will see downside breakouts before tomorrow’s crucial CPI release.

Sterling’s movements have also been indecisive. The Pound initially recovered following stronger-than-expected UK wage growth data but upside was capped by a rise in unemployment rate. It softened again after BoE Chief Economist Huw Pill affirmed that a summer rate cut is “not unreasonable.” Despite these fluctuations, Sterling remains within yesterday’s range, except against Yen.

In the broader forex market, Euro is currently the strongest performer for the day, followed by Canadian Dollar and Aussie. Yen is the weakest, followed by Sterling and Swiss Franc, with Dollar and Kiwi position in the middle.

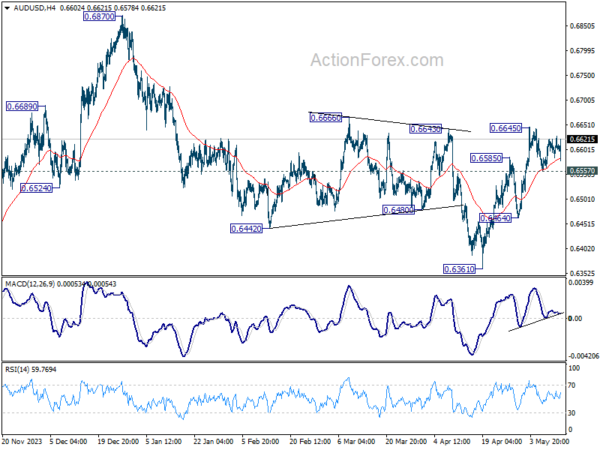

Technically, AUD/USD is staying bullish with 0.6557 support intact. Break of 0.6645 will resume rise from 0.6361. Further break of 0.6666 resistance should confirm the whole fall from 0.6870 has completed and target this resistance next. Australia’s wage price index data in the upcoming Asian session is a potential trigger for the move.

In Europe, at the time of writing, FTSE is up 0.33%. DAX is down -0.21%. CAC is up 0.10%. UK 10-year yield is down -0.055 at 4.166. Germany 10-year yield is up 0.028 at 2.540. Earlier in Asia, Nikkei rose 0.46%. Hong Kong HSI fell -0.22%. China Shanghai SSE fell -0.07%. Singapore Strait Times rose 0.29%. Japan 10-year JGB yield rose 0.0246 to 0.966.

US PPI rises 0.5% mom, 2.2% yoy in Apr, highest since Apr 2022

US PPI for final demand rose 0.5% mom in April, above expectation of 0.2% mom. Nearly three-quarters of the April advance in final demand prices is attributable to a 0.6% mom increase in the index for final demand services. Prices for final demand goods moved up 0.4% mom. PPI less foods, energy and trade services rose 0.4% mom.

For the 12 months period, PPI rose 2.2% yoy, highest since April 2023. Prices for final demand less foods, energy, and trade services increased 3.1% yoy, the largest advance since April 2023.

German ZEW rises to 47.1, signs of recovery growing

German ZEW Economic Sentiment jumped from 42.9 to 47.1 in May, above expectation of 44.9. Current Situation Index also rose from -79.2 to -72.3, above expectation of -75.0.

Eurozone ZEW Economic Sentiment rose from 43.9 to 47.0, above expectation of 46.1. Current Situation Index jumped by 10.2 pts to -38.6.

ZEW President Professor Achim Wambach said: ” Signs of an economic recovery are growing, bolstered by better assessments of the overall eurozone and of China as a key export market. The increased optimism is reflected in particular in the sharp rise in expectations for domestic consumption, followed by the construction and machinery sectors.”

BoE’s Pill: Summer rate cut not unreasonable

BoE’s Chief Economist Huw Pill suggested today that it is “not unreasonable” for central bank to consider rate cuts over the summer. However, he emphasized the critical need for to maintain a “restrictive stance” on monetary policy to address persistent domestic inflation pressures.

Pill’s comments come against the backdrop of newly released data, which he referenced in his remarks. “We actually got some additional data this morning that would be consistent with a small additional decline in the first quarter,” he said, pointing to the latest figures on private sector regular pay growth.

This data indicates a slight cooling in the labor market, although Pill noted that it “still remains pretty tight by historical standards.” He emphasized that “rates of pay growth remain quite well above what would be consistent for meeting the 2% inflation target sustainably.”

UK payrolled employment down -85k in Apr, but wages growth steady in Mar

UK payrolled employment fell -85k or -0.3% mom in April. This is a rise of 129,000 people over the 12-month period. Median monthly pay growth was 6.9% yoy, accelerated from March’s 6.4% yoy. Claimant count rose 8.9k, below expectation of 13.9k.

In the three months to March, unemployment rate rose from 4.2% to 4.3%, matched expectations. Average earnings including bonus rose 5.7% yoy. Average earnings excluding bonus rose 6.0% yoy. Both were unchanged from February’s figures.

IMF recommends gradual approach for future BoJ rate hikes

IMF projects Japan’s economic growth to continue, with a noticeable increase in consumption anticipated later this year. According to a report, Japan’s growth rate is expected to decelerate to 0.9% in 2024, largely due to the fading impact of one-off factors that boosted growth in 2023.

The report highlights that consumption will pick up in the latter half of 2024 and into 2025, driven by rising nominal wages following a strong Shunto settlement in 2024 and a decrease in headline inflation that will boost real wages.

IMF foresees core inflation gradually declining as the impact of higher import prices diminishes. However, core inflation is expected to remain above BoJ’s 2% target until the second half of 2025.

In light of these developments, IMF suggests that further increases in BoJ’s short-term policy rate should “proceed at a gradual pace” and be “datadependent”, considering the balanced risks to inflation and the mixed signals from recent economic data.

IMF emphasizes the importance of Japan’s adherence to a “flexible exchange rate regime”, which will play a crucial role in absorbing economic shocks and supporting the central bank’s focus on maintaining price stability.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0768; (P) 1.0788; (R1) 1.0809; More…

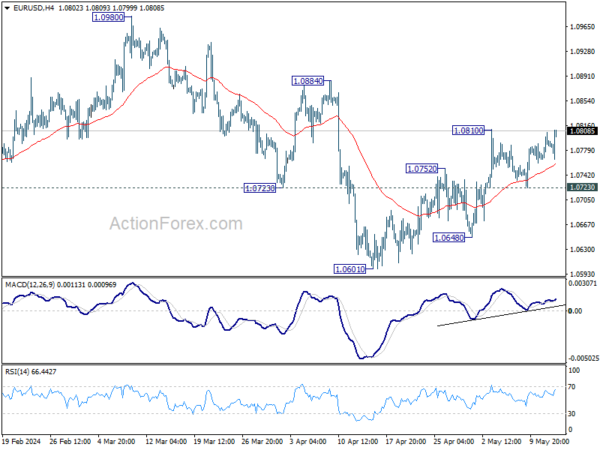

EUR/USD is still staying in range below 1.0810 and intraday bias remains neutral at this point. Further rally is in favor as long as 1.0723 minor support holds. On the upside, break of 1.0810 will resume the rebound from 1.0601 to 1.0884 resistance next. However, firm break of 1.0723 will argue that the rebound has completed, and turn bias to the downside for 1.0648 support instead.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern. Fall from 1.1138 is seen as the third leg and could have completed. Firm break of 1.1138 will argue that larger up trend from 0.9534 (2022 low) is ready to resume through 1.1274 high. On the downside, break of 1.0601 will extend the corrective pattern instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Apr | 0.90% | 0.90% | 0.80% | 0.90% |

| 06:00 | JPY | Machine Tool Orders Y/Y Apr | -11.60% | -3.80% | ||

| 06:00 | EUR | Germany CPI M/M Apr F | 0.50% | 0.50% | 0.50% | |

| 06:00 | EUR | Germany CPI Y/Y Apr F | 2.20% | 2.20% | 2.20% | |

| 06:00 | GBP | Claimant Count Change Apr | 8.9K | 13.9K | 10.9K | -2.4K |

| 06:00 | GBP | ILO Unemployment Rate (3M) Mar | 4.30% | 4.30% | 4.20% | |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Mar | 5.70% | 5.30% | 5.60% | 5.70% |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Mar | 6.00% | 6.00% | ||

| 06:30 | CHF | Producer and Import Prices M/M Apr | 0.60% | 0.20% | 0.10% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Apr | -1.80% | -2.10% | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment May | 47.1 | 44.9 | 42.9 | |

| 09:00 | EUR | Germany ZEW Current Situation May | -72.3 | -75 | -79.2 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment May | 47 | 46.1 | 43.9 | |

| 10:00 | USD | NFIB Business Optimism Index Apr | 89.7 | 88.1 | 88.5 | |

| 12:30 | USD | PPI M/M Apr | 0.50% | 0.20% | 0.20% | -0.10% |

| 12:30 | USD | PPI Y/Y Apr | 2.20% | 2.20% | 2.10% | 1.80% |

| 12:30 | USD | PPI Core M/M Apr | 0.50% | 0.20% | 0.20% | -0.10% |

| 12:30 | USD | PPI Core Y/Y Apr | 2.40% | 2.40% | 2.40% | |

| 12:30 | CAD | Wholesale Sales M/M Mar | -1.10% | -0.90% | 0.00% | 0.20% |