The currency markets are currently in a state of anticipation, with Dollar trading within familiar range as investors await FOMC rate decision. The critical question facing the markets is whether Fed will signal the pace of rate cuts in its updated dot plot. In September, the median projection indicated the federal funds rate would remain at 5.125% by the end of 2024, implying no rate cuts from the current level. While revisions to this projection are expected, the exact pace and extent of potential rate cuts remain uncertain.

Meanwhile, Sterling has weakened broadly following release of GDP data that showed deeper-than-anticipated contraction. This has raised concerns that the UK economy may already be in a recession. Additionally, the slowing wage growth combined with a less optimistic economic outlook could lead to a shift in stance among the more hawkish members of BoE’s MPC. While BoE Governor Andrew Bailey is expected to push back against speculations on rate cut following tomorrow’s decision, there are discussions suggesting BoE might cut rates sooner than previously anticipated due to subdued growth.

Regarding weekly performance, Swiss Franc leads as the strongest currency so far, followed by Euro and Canadian Dollar. Japanese Yen is at the bottom of the list, with New Zealand and Australian Dollars trailing close behind. Sterling and Dollar are exhibiting mixed performances.

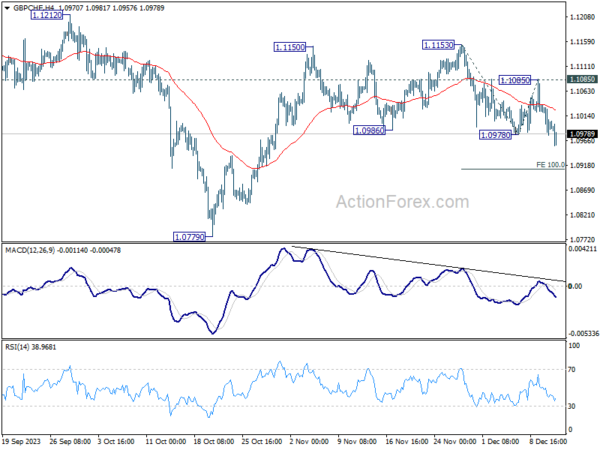

Technically, GBP/CHF’s break of 1.0978 invalidated our original bullish view and indicates that fall from 1.1153 is in progress. Near term outlook is mixed for now, with focus on 100% projection of 1.1153 to 1.0978 from 1.1085 at 1.0910. Sustained break there could prompt downside acceleration to 1.0779 to resume larger down trend. Nevertheless, strong rebound from this projection level could revive near term bullishness for another rise through 1.1153 at a later stage.

In Europe, at the time of writing, FTSE is up 0.32%. DAX is up 0.07%. CAC is up 0.18%. Germany 10-year yield is down -0.031 at 2.197. UK 10-year yield is down -0.122 at 3.852. Earlier in Asia, Nikkei rose 0.25%. Hong Kong HSI fell -0.89%. China Shanghai SSE fell -1.15%. Singapore Strait Times rose 0.06%. Japan 10-year JGB yield fell -0.0484 to 0.690.

US PPI at 0.0% mom, 0.9% yoy in Nov

US PPI for final demand was unchanged at 0.0% mom in November, below expectation of 0.1% mom. Both indexes for final demand goods and services were unchanged. PPI less foods, energy, and trade services edged up by 0.1% mom.

For the 12 months period, PPI slowed from 1.2% yoy to 0.9% yoy, below expectation of 1.0% yoy. PPI less foods, energy and trade services slowed from 2.8% yoy to 2.5% yoy.

UK GDP shrinks -0.3% mom in Oct, all sectors contract

UK’s GDP contracted by -0.3% mom in October, a figure that is notably worse than the expected -0.1% mom. The primary factor contributing to this downturn was the decline in services output, which fell by -0.2% mom. Additionally, production output experienced a sharper drop of -0.8% mom, and construction output also saw a contraction of -0.5% mom.

When examining the three-month period leading up to October, UK’s real GDP showed no growth compared with the three months leading to July. During this quarter, while services output saw a marginal growth of 0.1%, both production and construction outputs declined, falling by -0.7% and -0.3%, respectively.

NIESR: BoE may cut rates earlier due to subdued growth

NIESR forecasts that UK’s GDP will remain flat Q3. An early prediction for Q1 of 2024 indicates a modest GDP growth of 0.3%, primarily driven by the services sector. NIESR noted that these projections align with UK’s long-term trend of low but stable economic growth.

Today’s subdued GDP data, as suggested by NIESR, might be interpreted as a sign by BoE that “no further monetary tightening is needed”. This could pave the way for BoE to “start cutting interest rates earlier than previously expected”, depending on future inflation trends.

Eurozone industrial production falls -0.7% mom in Oct, EU down -0.5% mom

Eurozone industrial production fell -0.7% mom in October, worst than expectation of -0.3% mom. Production of capital goods fell by -1.4%, intermediate goods and non-durable consumer goods both by -0.6%, while production of durable consumer goods grew by 0.2% and energy by 1.1%.

EU industrial production declined -0.5% mom. Among Member States for which data are available, the largest monthly decreases were registered in Ireland (-7.0%), Malta (-2.5%) and the Netherlands (-2.1%). The highest increases were observed in Greece (+6.0%), Portugal (+3.8%) and Czechia (+2.9%).

SECO downgrades 2024 Swiss growth outlook

Swiss State Secretariat for Economic Affairs has revised down its 2024 economic growth forecast for Switzerland, now expecting a growth of 1.1% instead of previous 1.2%. This revision indicates an expectation of below-average growth for the Swiss economy for a second consecutive year. A key factor influencing this outlook is the expected slow growth in the eurozone in 2024, which is anticipated to impact Swiss exports.

Looking ahead to 2025, SECO forecasts an economic recovery with growth projected at 1.7%, driven by a gradual global economic rebound. On the inflation front, SECO anticipates deceleration from 2.1% in 2023 (revised down from 2.2%) to 1.9% in 2024, followed by a further reduction to 1.1% in 2025.

SECO’s report also underscores several considerable risks to the economic outlook. Ongoing conflict in the Middle East poses geopolitical risks that could lead to surge in oil prices and, consequently, higher inflation. Additionally, the report warns of possibility of tighter international monetary policy in response to sustained core inflation.

Other highlighted risks include global debt, potential market corrections in real estate and finance, and balance sheet vulnerabilities at financial institutions. Further, economic developments in Germany and China are noted as potential risks for the international economy that could adversely affect Swiss foreign trade.

Energy security remains a concern for Switzerland. Significant energy shortage in Europe, leading to widespread production stoppages and a severe economic downturn, could push Switzerland into a recession coupled with high inflation.

Japan’s Tankan manufacturing index rose to 12, highest in nearly 2 years

Japan’s Tankan survey for Q4 show signs of strength in both manufacturing and non-manufacturing sectors. Yet, the cautious outlook among manufacturers suggests uncertainty about future economic conditions.

Large Manufacturing Index rose from 9 to 12, surpassing the expected figure of 10. This increase marks the third consecutive quarter of improvement and the highest level since Q1 2022. The Non-Manufacturing Index also showed positive development, rising from 27 to 30, exceeding the forecast of 27. This improvement represents the seventh consecutive quarter of growth, reaching its highest point since 1991.

However, the outlook for the next three months tells a different story. Large Manufacturing Outlook Index fell from 10 to 8, falling short of the expected 9, indicating less optimism among manufacturers for the near future. In contrast, Non-Manufacturing Outlook Index did improve from 21 to 24, yet it missed the anticipated mark of 25.

In terms of capital expenditure, big firms in Japan are projecting an increase of 13.5% for the current fiscal year ending in March 2024. This projection is more optimistic than the median market forecast, which anticipated a 12.4% increase.

ADB raises 2023 growth forecast, driven by stronger performance in China and India

Asian Development Bank upgrades growth forecasts Developing Asia for 2023, raising projection from 4.7% to 4.9%. This upgrade is primarily attributed to stronger than expected growth in two of the region’s largest economies, China and India. On the other hand, growth forecast for 2024 remains unchanged at 4.8%.

Specifically, for China, ADB now projects growth to reach 5.2% in 2023, an increase from previous forecast of 4.9% made in September. Growth rate for China in 2024 is expected to slow to 4.5%, unchanged from prior predictions. In contrast, India’s growth forecast for 2023 is raised from 6.3% to 6.7%, and the country is anticipated to maintain this robust growth rate of 6.7% in 2024.

In terms of inflation, ADB made slight adjustments to its forecasts for Developing Asia. Inflation expectation for 2023 is reduced from 3.6% to 3.5%, while forecast for 2024 sees a minor increase from 3.5% to 3.6%.

ADB, in its release, highlighted several downside risks to these forecasts. Key among these are the potential for “higher-for-longer interest rates in advanced economies,” which could lead to financial instability. Additionally, potential supply disruptions from factors like El Niño and the ongoing Russian invasion of Ukraine pose risks of renewing energy and food security challenges, which could reignite inflationary pressures.

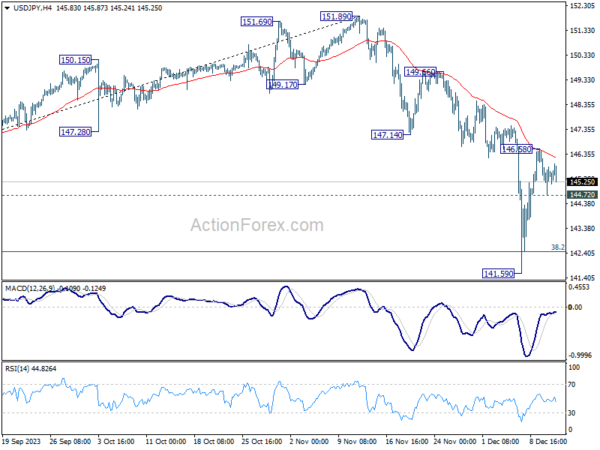

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 144.74; (P) 145.47; (R1) 146.19; More…

Intraday bias in USD/JPY remains neutral, and outlook stays bearish with 147.14 support turned resistance intact. On the downside, break of 144.72 minor support will suggest that rebound from 141.59 has completed at 146.58. Intraday bias will then be back on the downside for retesting 141.59 low. However, decisive break of 147.14 will dampen the bearish view, and bring stronger rally back towards 149.56/151.89 resistance zone.

In the bigger picture, current fall from 151.89 is seen as the third leg of the corrective pattern from 151.93 (2022 high). Deeper decline would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. This will now remain the favored as long as 147.14 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturing Index Q4 | 12 | 10 | 9 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q4 | 8 | 9 | 10 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q4 | 30 | 27 | 27 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q4 | 24 | 25 | 21 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q4 | 13.50% | 12.40% | 13.60% | |

| 07:00 | GBP | GDP M/M Oct | -0.30% | -0.10% | 0.20% | |

| 07:00 | GBP | Industrial Production M/M Oct | -0.80% | -0.10% | 0.00% | |

| 07:00 | GBP | Industrial Production Y/Y Oct | 0.40% | 1.10% | 1.50% | |

| 07:00 | GBP | Manufacturing Production M/M Oct | -1.10% | 0.00% | 0.10% | |

| 07:00 | GBP | Manufacturing Production Y/Y Oct | 0.80% | 1.90% | 3.00% | |

| 07:00 | GBP | Goods Trade Balance (GBP) Oct | -17.0B | -14.1B | -14.3B | |

| 08:00 | CHF | SECO Economic Forecasts | ||||

| 10:00 | EUR | Eurozone Industrial Production M/M Oct | -0.70% | -0.30% | -1.10% | -1.00% |

| 13:30 | USD | PPI M/M Nov | 0.00% | 0.10% | -0.50% | -0.40% |

| 13:30 | USD | PPI Y/Y Nov | 0.90% | 1.00% | 1.30% | 1.20% |

| 13:30 | USD | PPI Core M/M Nov | 0.00% | 0.20% | 0.00% | |

| 13:30 | USD | PPI Core Y/Y Nov | 2.00% | 2.20% | 2.40% | |

| 15:30 | USD | Crude Oil Inventories | -1.9M | -4.6M | ||

| 19:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | ||

| 19:30 | USD | FOMC Press Conference |