Dollar remained relatively steady following the balanced post-FOMC press conference, with notable exceptions against the stronger yen and Swiss franc. Fed Chair Jerome Powell explicitly mentioned the possibility of a rate cut in September but refrained from making any firm commitments or providing extended guidance. While markets are aggressively betting on three Fed cuts this year, some economists view this as overly optimistic. The greenback’s next moves will likely be influenced by today’s ISM manufacturing data and tomorrow’s non-farm payroll data.

For the week, Yen remains the strongest currency with no clear signs of a sustainable pullback. Swiss Franc is currently the second strongest, with its strength partially attributed to rising tensions in the Middle East, which have also driven up gold and oil prices. Canadian Dollar is the third strongest, benefiting from a lack of significant selling pressure.

Conversely, Euro and Sterling are at the bottom of the weekly performance chart alongside the Australian dollar. The selloff against Swiss franc is adding pressure on these two European majors. Sterling is now focused on BoE rate decision, where uncertainty about a potential rate cut looms large. The decision could trigger significant volatility in Pound and shift its position notably.

In Asia, Nikkei fell -2.49%, more than reversing yesterday’s gains. Hong Kong HSI is up 0.07%. China Shanghai SSE is down -0.17%. Singapore Strait Times is down -0.91%. Japan 10-year JGB yield is down -0.0248 at 1.036. Overnight, DOW rose 0.24%. S&P 500 rose 1.58%. NASDAQ rose 2.64%. 10-year yield fell -0.034 to 4.109.

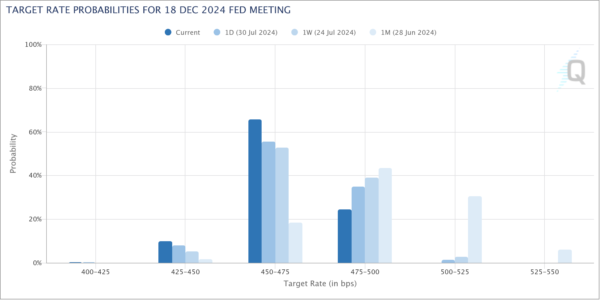

Fed’s Powell opens door to Sep rate cut, markets price In 75% chance of three cuts by year-endd

US stocks closed higher overnight as investors cheered Fed Chair Jerome Powell’s suggestion that a September rate cut is “on the table.” Nevertheless, he emphasized that any decision would hinge on the “totality” of incoming economic data.

In the post-FOMC meeting press conference, Powell highlighted that recent Q2 inflation data has “added to our confidence,” and continued positive data would further solidify this confidence that inflation is moving towards the 2% target.

He explained that the committee’s “broad sense” is that the economy is nearing a point where reducing the policy rate could be appropriate. The decision will depend on whether the overall data, evolving economic outlook, and balance of risks align with increased confidence in controlling inflation while maintaining a robust labor market.

“If that test is met, a reduction in our policy rate could be on the table for as soon as the next meeting in September,” Powell stated. Meanwhile, he clarified that a 50bps rate cut is “not something we’re thinking about right now.”

Market reactions were immediate. Fed funds futures are now pricing in over a 100% probability of a 25bps cut in September. More strikingly, the likelihood of three rate cuts by the end of this year has surged to over 75%, up from less than 60% a week ago.

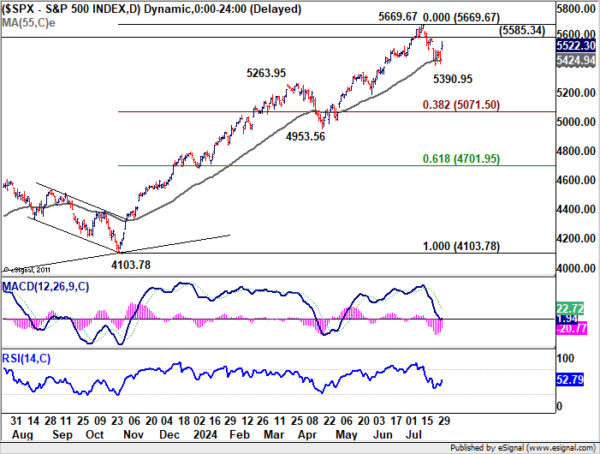

Technically, it appears that 55 D EMA is providing enough support for S&P 500 for now. Focus is back on 5585.34 resistance. Break there will argue that correction from 5669.67 has already completed at 5390.95. Larger up trend would then be ready to resume for new record highs.

Japan confirms JPY5.53T intervention, AUD/JPY slide persists

Japan confirmed its intervention in the currency market last month following Yen’s drop to a 38-year low against Dollar. This intervention marked the turning point for Yen’s massive month-long rally, which continues this week following BoJ’s second interest rate hike this year. Governor Kazuo Ueda has indicated that further tightening remains a possibility.

The Japanese Ministry of Finance disclosed on Wednesday that authorities spent JPY 5.53T, or USD 36.8B, on market intervention between June 27 and July 29. This amount aligns with market expectations and underscores the significant effort to stabilize the yen.

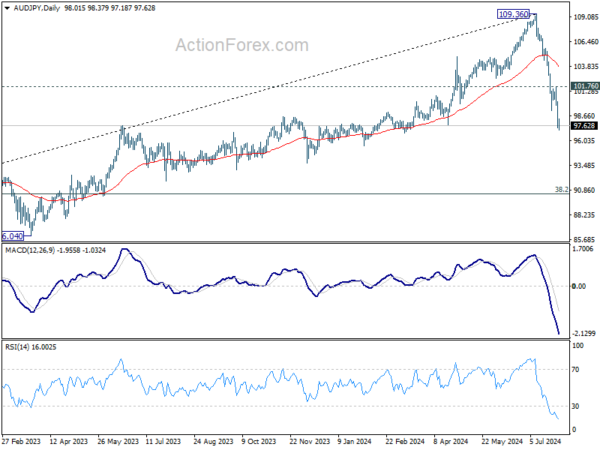

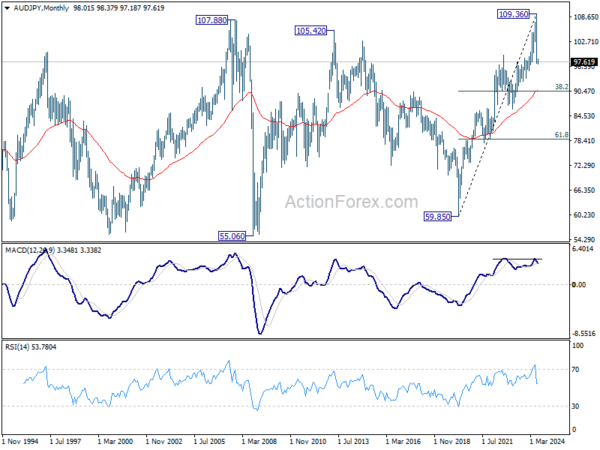

The AUD/JPY pair has been one of the biggest losers, dropping more than 3% this week alone. Technically, the near-term outlook remains bearish as long as the 101.76 resistance holds, even if there is a rebound. The fall from 109.36 is viewed as a correction to the uptrend that started from the 2020 low of 59.85. A deeper decline is anticipated towards the 38.2% retracement level of 59.85 to 109.36 at 90.44. Strong support is likely at this level, considering its proximity to the 55-month EMA (currently at 90.83) and the psychological 90 level, which could provide a floor to the downside on the first attempt.

Japan’s PMI manufacturing finalized at 49.1 in Jul, back in contraction

Japan’s PMI Manufacturing was finalized at 49.1 in July, down from June’s 50.0, indicating that the sector is back in contraction streak since early 2023.

Usamah Bhatti of S&P Global Market Intelligence described the sector’s performance as “downbeat” at the start of Q3. The decline was driven by a stronger reduction in new orders, leading to a renewed fall in production levels.

Inflationary pressures remained high, with input price inflation reaching a 15-month peak. Despite this, firms raised their selling prices more cautiously to stay competitive.

The near-term outlook appears “muted” due to the lack of new order inflows, allowing firms to clear outstanding business at the fastest rate since March. However, firms are optimistic that this period will pass within the coming year, expecting business expansion and new product launches to coincide with a broader economic recovery.

China’s Caixin PMI manufacturing drops to 49.8, below expectations

China’s Caixin PMI Manufacturing dropped from 51.8 to 49.8 in July, falling below the expected 51.6. S&P Global noted that output expanded at the slowest pace in nine months, average selling prices declined, and input cost inflation eased. However, business confidence showed improvement.

Wang Zhe, Senior Economist at Caixin Insight Group, commented, “Overall, the manufacturing sector largely stabilized in July. Supply expanded slightly, while domestic demand declined and external demand was steady. The reduction in business purchases was coupled with decreases in raw material stocks. The job market contraction was steady. Price levels faced pressure while market optimism improved slightly.”

BoE faces uncertainty over first rate cut decision amid divided MPC

Today’s focus is squarely on BoE’s rate decision, with significant uncertainty surrounding whether the first rate cut will be initiated to kick-start the policy easing cycle.

Communications from various MPC members have shown no clear consensus. Known dove Swati Dhingra is expected to continue pushing for a rate reduction, urging BoE to stop squeezing living standards. Conversely, hawkish members like Catherine Mann are likely to guard against resurgence of inflation pressures, viewing the dip to 2% as “touch and go.”

Chief Economist Huw Pill has stated that it’s still an “open question” on whether rate cuts should start now. Adding to the uncertainty, Deputy Governor Clare Lombardelli, who is voting for the first time, remains a big unknown factor in today’s decision.

Markets are currently pricing in around a 60% chance of a quarter-point cut today.

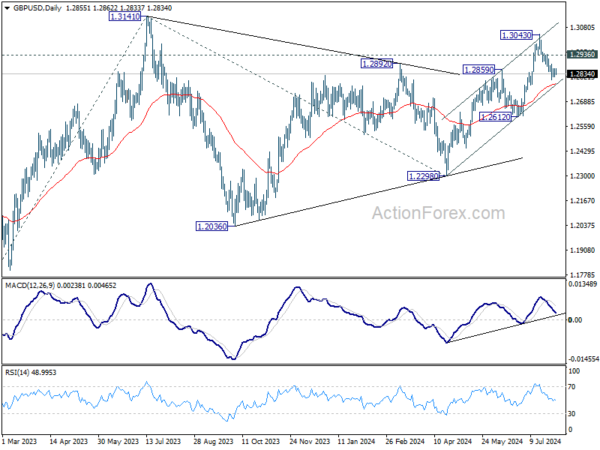

GBP/USD has been in steady but slow downward spiral since hitting 1.3043 in mid-July. For now, risk will stay on the downside as long as 1.2936 resistance holds. Sustained trading below 55 D EMA (now at 1.2783) as well as near term channel support (now at 1.2781) will argue that whole rally from 1.2298 might be over. Deeper fall would then be seen back to 1.2612 support. Nevertheless, break of 1.2936 will suggest that the pull back from 1.3043 has completed, and rise from 1.2998 is ready to resume. We’ll know very soon.

Elsewhere

Eurozone PMI manufacturing final and unemployment rate, as well as UK PMI manufacturing final will be released in European session. later in the day, US ISM manufacturing is the main event while jobless claims will also be featured.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3777; (P) 1.3818; (R1) 1.3849; More…

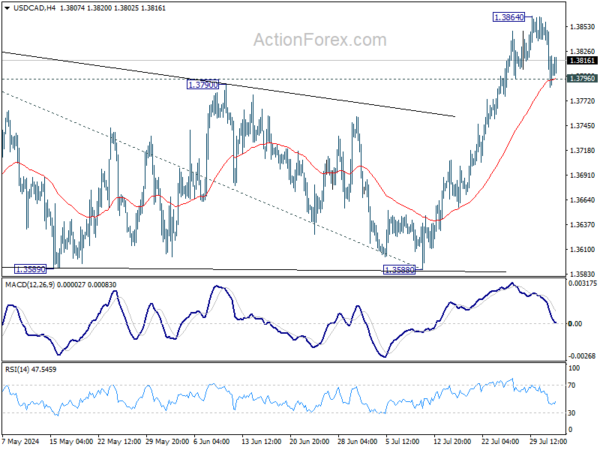

Intraday bias in USD/CAD remains neutral for the moment. Further rally is expected as long as 1.3796 support holds. Rise from 1.3176 should be resuming and next target is 61.8% projection of 1.3176 to 1.3845 from 1.3588 at 1.4025. On the downside, below 1.3796 minor support will delay the bullish case and bring deeper pullback first.

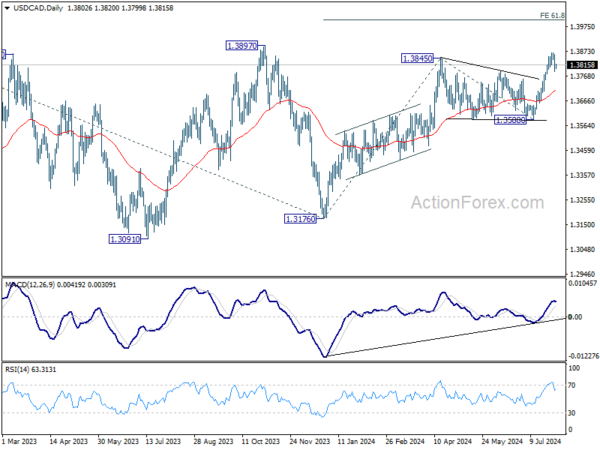

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern, that might have completed at 1.3176 (2023 low) already. Firm break of 1.3976 will confirm resumption of whole up trend from 1.2005 (2021 low). Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3176 at 1.4149. This will be the favored case as long as 1.3588 support holds, in case of pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | Manufacturing PMI Jul F | 49.1 | 49.2 | 49.2 | |

| 01:30 | AUD | Trade Balance (AUD) Jun | 5.59B | 4.95B | 5.77B | 5.05B |

| 01:30 | AUD | Import Price Index Q/Q Q2 | 1.00% | -0.70% | -1.80% | |

| 01:45 | CNY | Caixin Manufacturing PMI Jul | 49.8 | 51.6 | 51.8 | |

| 07:45 | EUR | Italy Manufacturing PMI Jul | 46.2 | 45.7 | ||

| 07:50 | EUR | France Manufacturing PMI Jul F | 44.1 | 44.1 | ||

| 07:55 | EUR | Germany Manufacturing PMI Jul F | 42.6 | 42.6 | ||

| 08:00 | EUR | Italy Unemployment Jun | 6.80% | 6.80% | ||

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 08:00 | EUR | Eurozone Manufacturing PMI Jul F | 45.6 | 45.6 | ||

| 08:30 | GBP | Manufacturing PMI Jul F | 51.8 | 51.8 | ||

| 09:00 | EUR | Eurozone Unemployment Rate Jun | 6.40% | 6.40% | ||

| 11:00 | GBP | BoE Interest Rate Decision | 5.00% | 5.25% | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–6–3 | 0–2–7 | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Jul | 19.80% | |||

| 12:30 | USD | Initial Jobless Claims (Jul 26) | 239K | 235K | ||

| 12:30 | USD | Nonfarm Productivity Q2 P | 1.50% | 0.20% | ||

| 12:30 | USD | Unit Labor Costs Q2 P | 1.60% | 4.00% | ||

| 13:30 | CAD | Manufacturing PMI Jul | 49.3 | |||

| 13:45 | USD | Manufacturing PMI Jul F | 49.5 | 49.5 | ||

| 14:00 | USD | ISM Manufacturing PMI Jul | 48.8 | 48.5 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Jul | 52.5 | 52.1 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Jul | 49.3 | |||

| 14:00 | USD | Construction Spending M/M Jun | 0.20% | -0.10% | ||

| 14:30 | USD | Natural Gas Storage | 22B |