Dollar is gradually recovering from the selloff triggered by US CPI data release earlier in the week. However, the recovery momentum remains indecisive. US stock markets, after a record run, are taking a breather, but bullish sentiment still appears dominant. The stock rally might resume if DOW convincingly breaks the 40k mark, which could again put the greenback under pressure. With an empty US economic calendar today, significant moves are probably only to be seen next week.

For the week, Swiss Franc, Yen, and Dollar are the worst performers, reflecting an overall risk-on sentiment. New Zealand Dollar remains the strongest, followed by British Pound and Australian Dollar. Euro and Canadian Dollar are positioned in the middle.

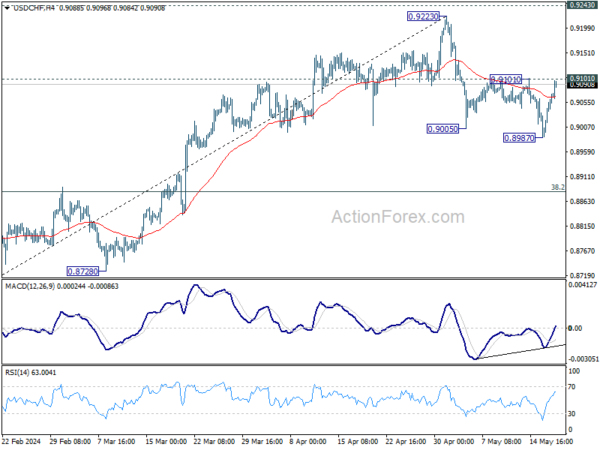

Technically, a key focus for the last session of the week is USD/CHF, which is now eyeing the 0.9101 resistance level. A firm break there would suggest that the corrective fall from 0.9223 has completed with three waves down to 0.8987. A stronger rally could then be expected, potentially retesting the 0.9223 high. If this scenario plays out, it might signal a broader comeback for Dollar.

In Europe, at the time of writing, FTSE is down -0.38%. DAX is down -0.29%. CAC is down -0.45%. UK 10-year yield is up 0.0276 at 4.115. Germany 10-year yield is up 0.041 at 2.505. Earlier in Asia, Nikkei fell -0.34%. Hong Kong HSI rose 0.91%. China Shanghai SSE rose 1.01%. Singapore Strait Times rose 0.26%. Nikkei rose 0.0261 to 0.952.

Eurozone CPI finalized at 2.4% in Apr, core CPI at 2.7%

Eurozone CPI was finalized at 2.4% yoy in April, unchanged from March’s reading. CPI core (ex-energy, food, alcohol & tobacco) was finalized at 2.7% yoy, down from prior month’s (2.9% yoy). The highest contribution to the annual Eurozone inflation rate came from services (+1.64 percentage points, pp), followed by food, alcohol & tobacco (+0.55 pp), non-energy industrial goods (+0.23 pp) and energy (-0.04 pp).

EU CPI was finalized at 2.6% yoy. The lowest annual rates were registered in Lithuania (0.4%), Denmark (0.5%) and Finland (0.6%). The highest annual rates were recorded in Romania (6.2%), Belgium (4.9%) and Croatia (4.7%). Compared with March 2024, annual inflation fell in fifteen Member States, remained stable in four and rose in eight.

ECB’s de Guindos: Inflation to fluctuate at current levels before falling to 2% in 2025

ECB Vice-President Luis de Guindos addressed inflation expectations at an event today, noting that “headline inflation is there at 2.4%, core inflation below 3%.” He projected that inflation will “fluctuate around these values” in the coming months.

Looking further ahead, de Guindos expressed confidence in achieving ECB’s long-term inflation goal, stating, “In the medium term, in the year 2025, we will be moving in a stable way towards our price stability objective which is 2%.

Mixed signals in China’s economic data: Industrial production surges, retail sales lag

China’s economic data for April revealed a mixed picture, with industrial production rising by 6.7% yoy, surpassing the expected 4.6%.

However, fixed asset investment for the year to date grew by 4.2% yoy, falling short of the anticipated 4.6%. Notably, real estate investment declined significantly, dropping by -9.8% in the first four months of the year.

Retail sales, a critical indicator of consumer spending, increased by only 2.3% yoy, below the forecast of 3.8%.

According to the National Bureau of Statistics , production and demand saw a stable increase, with employment and prices showing overall improvement. The NBS stated that the economy was generally stable, continuing to rebound and progress well.

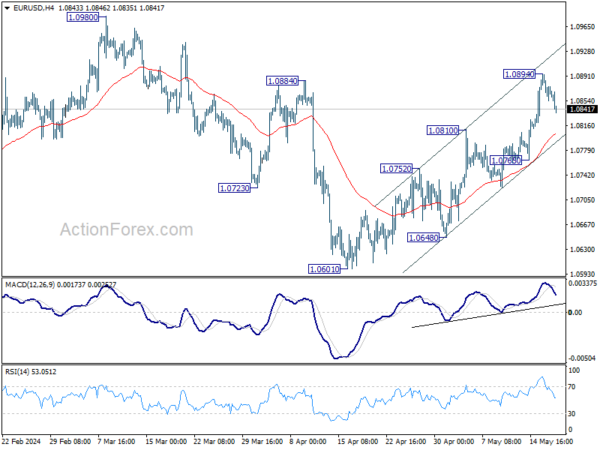

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0850; (P) 1.0872; (R1) 1.0890; More…

EUR/USD is staying in consolidation below 1.0894 and intraday bias stays neutral at this point. Further rally is expected as long as 1.0765 support holds. Break of 1.0894 will resume the rise from 1.0601 to 1.0980 resistance. Decisive break there will confirm that whole fall from 1.1138 has completed already.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern. Fall from 1.1138 is seen as the third leg and could have completed. Firm break of 1.1138 will argue that larger up trend from 0.9534 (2022 low) is ready to resume through 1.1274 high. On the downside, break of 1.0601 will extend the corrective pattern instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Input Q/Q Q1 | 0.70% | 0.60% | 0.90% | |

| 22:45 | NZD | PPI Output Q/Q Q1 | 0.90% | 0.50% | 0.70% | |

| 02:00 | CNY | Retail Sales Y/Y Apr | 2.30% | 3.80% | 3.10% | |

| 02:00 | CNY | Industrial Production Y/Y Apr | 6.70% | 4.60% | 4.50% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Apr | 4.20% | 4.60% | 4.50% | |

| 09:00 | EUR | Eurozone CPI Y/Y Apr F | 2.70% | 2.70% | 2.70% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Apr F | 2.40% | 2.40% | 2.40% |