Dollar is showing broad but mild strength today as global financial markets stabilize after recent turmoil. The stock market rebound, including a notable 10% surge in the Nikkei, appears to be driven by short covering rather than a sustained recovery. Despite the temporary calm, the risk of another round of sell-offs remains, but with some consolidation likely first in the near term. Canadian Dollar follows as the second strongest performer of the day, with Swiss Franc in third place.

On the other hand, Sterling has emerged as the worst performer, breaking to new lows against greenback despite robust UK PMI construction data. Yen is the second weakest, digesting its recent gains, while Euro is the third weakest. Australian and New Zealand Dollars are positioned in the middle of the performance spectrum.

In particular, Aussie saw no special support from the hawkish rate hold by RBA today. Governor Michele Bullock ruled out a rate cut in the near term, asserting that it “doesn’t align with the board’s current thinking.” This cautious stance is justified by RBA’s new economic projections, which anticipate headline inflation rising again after mid-2025. Additionally, underlying inflation is expected to return to the 2-3% target range by late 2025 and approach the midpoint in 2026, reflecting a slower return to target than forecasted in May.

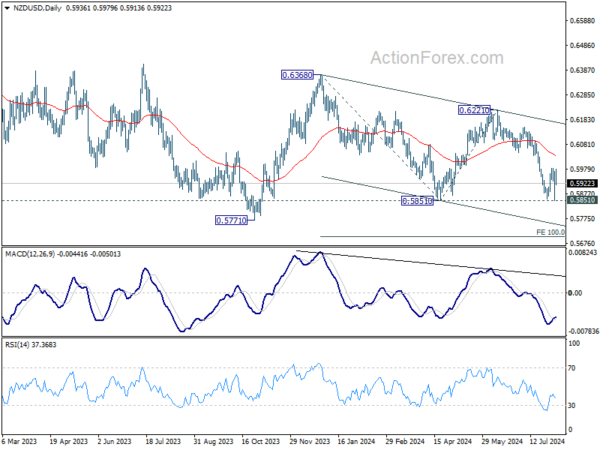

Looking ahead, NZD/USD will be in focus during the upcoming Asian session with the release of New Zealand’s employment data. Some economists are predicting that RBNZ might consider lowering interest rates next week, given recent economic indicators pointing to a significant downturn. Activity in the manufacturing and services sectors has slumped further into contraction, and inflation slowed more than expected in Q2. The Q2 job and wage data will be crucial for the policy decision.

Technically, NZD/USD turned into consolidation after failing to break through 0.5851 support. But subsequent rebound was capped well below 55 D EMA. Hence further decline remains in favor. Firm break of 0.5851 will resume the whole fall from 0.6368 to 0.5771 support first, and then 100% projection of 0.6368 to 0.5851 from 0.6221 at 0.5704.

In Europe, at the time of writing, FTSE is down -0.57%. DAX is down -0.51%. CAC is down -0.97%. UK 10-year yield is down -0.0003 at 3.867. Germany 10-year yield is down -0.0034 at 2.154. Earlier in Asia, Nikkei rose 10.23%. Hong Kong HSI fell -0.31%. China Shanghai SSE rose 0.23%. Singapore Strait Times fell -1.39%. Japan 10-year JGB yield rose 0.140 to 0.894.

Eurozone retail sales falls -0.3% mom in June, EU down -0.1% mom

Eurozone retail sales volume fell -0.3% mom in June, worse than expectation of -0.2% mom. Retail trade decreased for food, drinks, tobacco by -0.7%, and for non-food products (except automotive fuel) by – 0.1%. Retail trade increased increased for automotive fuel in specialised stores by 0.5%.

EU retail sales volume fell -0.1% mom. Among Member States for which data are available, the largest monthly decreases in the total retail trade volume were recorded in Croatia (-2.7%), Austria (-2.3%), Latvia and Lithuania (both -1.7%). The highest increases were observed in Romania (+1.8%), Bulgaria (+1.4%) and Denmark (+1.0%).

UK PMI construction jumps to 55.3, paused projects released

UK PMI Construction rose from 52.2 to 55.3 in June, highest reading since May 2022. S&P Global noted that activity rose amid much faster increase in new orders. Employment increased for the third month running. Emerging pressure on supply chains signaled.

Andrew Harker, Economics Director at S&P Global Market Intelligence, said: “The election-related slowdown in growth seen in June proved to be temporary, with the pace of expansion roaring ahead in July. Firms saw the strongest increases in new orders and activity since 2022 as paused projects were released amid reports of improved customer confidence.”

RBA maintains cash rate, anticipates inflation resurgence post-mid-2025

RBA kept its cash rate target unchanged at 4.35%, as widely expected. Maintaining its stance of “not ruling anything in or out,” the highlighted that underlying inflation “remains too high” and stated it will be “some time yet” before inflation sustainably returns to the target range. The central bank emphasized that monetary policy will need to be “sufficiently restrictive” until the Board is confident that inflation is moving sustainably towards the target range.

In its new economic projections, RBA forecasts headline inflation to briefly dip to 2.8% in June 2025, back in the target range, but expects it to surge above the target in subsequent quarters before falling back to 2.6% by the end of 2026. Meanwhile, growth projections have been generally upgraded.

Details of the new economic projections include:

CPI at:

- 3.0% by the end of 2024, downgraded from the prior 3.8%.

- 3.7% by the end of 2025, upgraded from the previous 2.8%.

- 2.6% by the end of 2026 (new projection).

Trimmed mean CPI at:

- 3.5% by the end of 2024, up from 3.4%.

- 2.9% by the end of 2025, up from 2.8%.

- 2.6% by the end of 2026 (new projection).

Year-average GDP growth in:

- 2024 downgraded from 1.3% to 1.2%.

- 2025 upgraded from 2.1% to 2.5%.

- 2026 projected to be 2.4% (new).

Unemployment rate at:

- 4.3% by the end of 2024, up from the prior 4.2%.

- 4.4% by the end of 2025, up from 4.3%.

- be 4.4% by the end of 2026 (new projection).

Japan’s nominal wages surge 4.5% yoy in Jun, outpacing inflation for first time in 27 months

Japan’s nominal wages, or average monthly cash earnings, rose by 4.5% yoy in June, significantly exceeding expectations of a 2.3% yoy increase. This marks the 30th consecutive month of wage growth. More importantly, with CPI rising 3.3% yoy in the same month, real wages increased by 1.1% yoy, marking the first gain in 27 months as wage growth finally outpaced inflation.

A Ministry of Health, Labor and Welfare official commented, “We will monitor incoming data closely to see if the trend has really changed as there is a possibility that those firms that paid bonuses in July might have just moved up the timing this year.”

Excluding bonuses and non-scheduled payments, average wages climbed 2.3% yoy, while overtime and other allowances rose by 1.3% yoy.

Also released, household spending in June fell by -1.4% yoy, worse than the expected -0.9% yoy decline, marking the second consecutive month of decline following a -1.8% drop yoy in May.

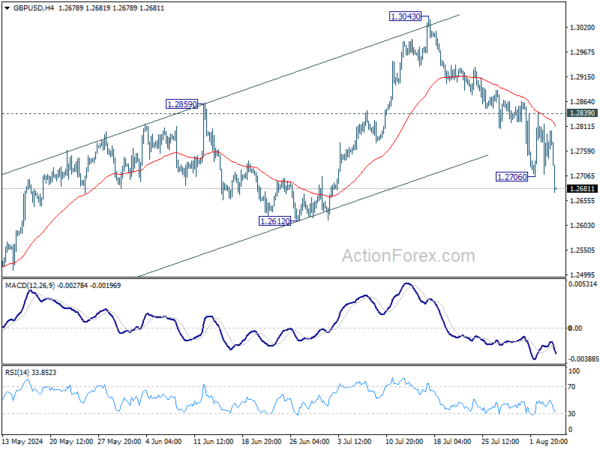

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2719; (P) 1.2769; (R1) 1.2829; More…

GBP/USD’s fall from 1.3043 resumed by breaking 1.2706 temporary low and intraday bias is back on the downside for 1.2612 support. Decisive break there should confirm that rise from 1.2298 has completed, and target this support next. For now, risk will remain on the downside as long as 1.2839 resistance holds, in case of recovery.

In the bigger picture, current development suggests that corrective pattern from 1.3141 is extending with fall from 1.3043 as another leg. Break of 1.2612 support would strengthen this case. But still, downside should be contained by 1.2036/2298 support zone even in case of deep decline. Rise from 1.0351 (2022 low) remains in favor to resume at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Jun | 4.50% | 2.30% | 1.90% | 2.00% |

| 23:30 | JPY | Household Spending Y/Y Jun | -1.40% | -0.90% | -1.80% | |

| 04:30 | AUD | RBA Rate Decision | 4.35% | 4.35% | 4.35% | |

| 05:45 | CHF | Unemployment Rate M/M Jul | 2.50% | 2.50% | 2.40% | |

| 06:00 | EUR | Germany Factory Orders M/M Jun | 3.90% | 0.80% | -1.60% | -1.70% |

| 06:30 | CHF | Real Retail Sales Y/Y Jun | -2.20% | 0.50% | 0.40% | -0.20% |

| 08:30 | GBP | Construction PMI Jul | 55.3 | 51 | 52.2 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Jun | -0.30% | -0.20% | 0.10% | |

| 12:30 | CAD | Trade Balance (CAD) Jun | 0.6B | -2.0B | -1.9B | -1.6B |

| 12:30 | USD | Trade Balance (USD) Jun | -73.1B | -72.5B | -75.1B | -75.0B |