Dollar is experiencing a broad retreat today, reflecting a phase of consolidation after its notable advancements in the recent days. Market participants are seemingly recalibrating their positions, with the closure of the month in sight and in anticipation of pivotal economic data slated for release next week.

While the rise in US 10-year yield continues to extend its robust performance, it finds itself overshadowed by surges in Germany and UK yields. Further consolidation in Dollar might be observed before the week concludes, although this trend remains highly sensitive to ongoing risk developments globally.

For now, Australian Dollar and Sterling emerge as frontrunners for today, with New Zealand Dollar tailing closely. In contrast, Canadian Dollar is bearing the brunt of the pullback, only outdone by US Dollar itself. Yen is also on the weaker side, while Euro and Swiss Franc are delivering mixed performance.

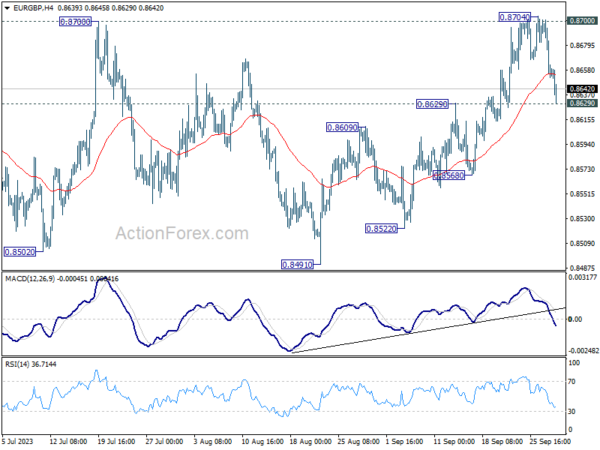

Technically, EUR/GBP is now eyeing 0.8629 resistance turned support. Firm break there should bring deeper decline back to 0.8568. More importantly, confirmed rejection by 0.8700 resistance will retain medium term bearishness in the cross. That would open the way for deeper fall through 0.8491 low to resume larger down trend from 0.9267 (2022 high).

In Europe, at the time of writing, FTSE is down -0.31%. DAX is up 0.10%. CAC is up 0.28%. Germany 10-year yield is up 0.0953 at 2.939. Earlier in Asia, Nikkei dropped -1.54%. Hong Kong HSI dropped -1.36%. China Shanghai SSE rose 0.10%. Singapore Strait Times rose 0.22%. Japan 10-year JGB yield rose 0.0212 to 0.761.

US initial jobless claims rose to 204k, vs exp. 200k

US initial jobless claims rose 2k to 204k in the week ending September 23, above expectation of 200k. Four-week moving average of continuing claims dropped -6k to 211k.

Continuing claims rose 12k to 1670k in the week ending September 16. Four-week moving average of continuing claims dropped -12k to 1674k.

Eurozone economic sentiment fell to 93.3, EU down to 92.8

Eurozone Economic Sentiment Indicator dropped slightly from 93.6 to 93.3 in September, down for the fifth month. Employment Expectation indicator rose from 102.2 to 102.7. Economic Uncertainty Indicator rose from 19.8 to 21.5.

Eurozone industry confidence rose from -9.9 to -9.0. Services confidence dropped from 4.3 to 4.0. Consumer confidence fell from -16.0 to -17.8. Retail trade confidence dropped from -5.1 to -5.7. Construction confidence fell from -5.4 to -6.2.

EU Economic Sentiment Indicator rose from 93.2 to 92.8. Amongst the largest EU economies, the ESI deteriorated in Spain (-3.2) and Italy (-2.2), while it improved in France (+2.7). Sentiment in Germany (+0.3), the Netherlands (+0.3) and Poland (-0.1) remained virtually stable.

German institutes forecast -0.6% GDP contraction this year, but downturn to subside by year-end

In the Joint Economic Forecast by five leading economic institutes, Germany is bracing for an economic contraction of -0.6% in 2023, a significant downward adjustment by 0.9% from the spring 2023 prediction. Nevertheless, the silver lining comes in the form of anticipated rebounds in the following years: Growth of 1.3% in 2024 and 1.5% in 2025. Notably, the 2024 figure represents a mere 0.2% adjustment from their spring forecast.

On the inflation front, CPI is expected to moderate from 2022’s staggering 6.9% to a still elevated 6.1% in 2023, before cooling off substantially to 2.6% in 2024 and 1.9% in 2025. Labor market is anticipated to feel a slight pinch with unemployment ticking up from 5.3% in 2022 to 5.6% in both 2023 and 2024, before retracting to 5.3% in 2025.

The report highlights, “Business sentiment has recently deteriorated again, not least because of heightened political uncertainty.” The third quarter of 2023 experienced a noticeable fall in production, attributed to the waning business sentiment.

Despite the bleak outlook, there are silver linings. The tailwind of wage increases following the price hike, declining energy prices, and exporters partially offsetting their higher costs offers a semblance of balance, and as a result, purchasing power is making a comeback.

“Therefore, the downturn is expected to subside by the end of the year, and the degree of capacity utilisation will rise again going forward,” adds the report.

This biannual Joint Economic Forecast is commissioned by German Federal Ministry for Economic Affairs and Climate Action. Contributors to this report comprise of eminent institutes including DIW Berlin, ifo Institute, IfW Kiel, IWH, and RWI.

Mixed signals in New Zealand business confidence, ANZ anticipates another RBNZ hike

September has seen a noteworthy rebound in New Zealand’s ANZ Business Confidence, rising from -3.7 to 1.5. However, a closer examination of the details offers a more nuanced picture.

Metrics such as own activity output experienced a slight decline, dropping from 11.2 to 10.9. More alarmingly, export intentions plummeted from a positive 7.5 to a -0.4. There were also declines in investment intentions (from -1.3 to -4.1) and employment intentions (from 4.6 to 1.2).

On the inflation front, cost expectations edged upwards from 75.3 to 78.6, while profit expectations showed an improvement, moving from -17.6 to -13.2. Pricing intentions rose from 44.0 to 47.1, but inflation expectations took a downward turn, shifting from 5.06 to 4.95.

ANZ provided their insights on this mixed bag of indicators, stating, “The New Zealand economy is certainly patchy, and the rebound in activity indicators – that’s been evident since the start of the year – may be running out of steam.”

They further highlighted the complexities in the inflation scenario: “Inflation pressures are gradually waning in the big picture, but not rapidly nor in a straight line, and the jury remains out on whether it’s occurring fast enough to bring core inflation pressures down in a timely fashion.”

Looking ahead, ANZ anticipates further action from RBNZ to ensure inflation is reined in effectively, with a 25 bps hike expected in November.

Australian retail sales see modest 0.2% mom rise amid cost-of-living pressures

The latest retail statistics out of Australia show a muted picture of consumer spending, with retail sales turnover in August rising only 0.2% mom (in seasonally adjusted terms) to AUD 35.4B, falling short of the anticipated 0.3% increase. Through the year, sales turnover was up 1.5% yoy.

According to Ben Dorber, the head of retail statistics at the Australian Bureau of Statistics (ABS), this modest rise indicates a notable restraint in consumer spending. Dorber noted, “The modest rise in August shows consumers continued to restrain their retail spending.”

The trend growth in retail sales paints an even starker image. “In trend terms, retail turnover rose 0.1 per cent, and was up only 1.3 per cent compared to August 2022 – the smallest trend growth over 12 months in the history of the series,” Dorber added.

Dorber highlighted, “Considering how high inflation and strong population growth have added to retail turnover in the past year, the historically low trend growth highlights just how much consumers have pulled back in response to cost-of-living pressures.”

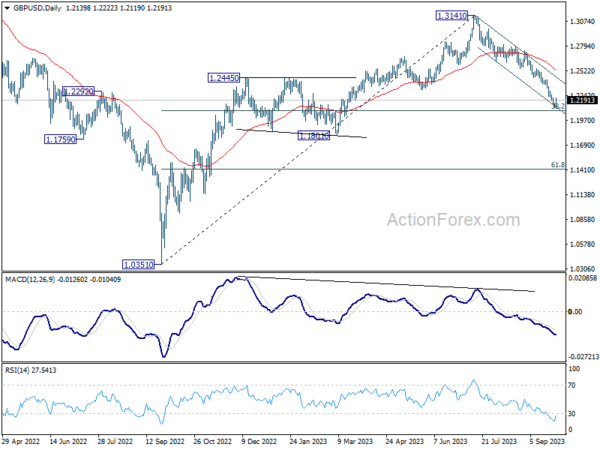

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2108; (P) 1.2138; (R1) 1.2164; More…

A temporary low should be in place at 1.2109 in GBP/USD and intraday bias is turned neutral first. Some consolidations could be seen, and stronger recovery cannot be ruled out. But near term risk will stay on the downside as long as 1.2618 support turned resistance holds,. On the downside, decisive break of 1.2075 fibonacci level would carry larger bearish implication and target 1.1801 support next.

In the bigger picture, fall from 1.3141 medium term top could still be a correction to up trend from 1.0351 (2022 low) only. But risk of complete trend reversal is rising. Sustained break of 38.2% retracement of 1.0351 to 1.3141 at 1.2075 will pave the way to 61.8% retracement at 1.1417. For now, risk will stay on the downside as long as 55 D EMA (now at 1.2526) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | NZD | ANZ Business Confidence Sep | 1.5 | -3.7 | ||

| 01:30 | AUD | Retail Sales M/M Aug | 0.20% | 0.30% | 0.50% | |

| 08:00 | EUR | ECB conomic Bulletin | ||||

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Sep | 93.3 | 92.5 | 93.3 | 93.6 |

| 09:00 | EUR | Eurozone Industrial Confidence Sep | -9 | -10.5 | -10.3 | -9.9 |

| 09:00 | EUR | Eurozone Services Sentiment Sep | 4 | 3.5 | 3.9 | 4.3 |

| 09:00 | EUR | Eurozone Consumer Confidence Sep F | -17.8 | -17.8 | -17.8 | |

| 12:00 | EUR | Germany CPI M/M Sep P | 0.30% | 0.30% | 0.30% | |

| 12:00 | EUR | Germany CPI Y/Y Sep P | 4.50% | 4.60% | 6.10% | |

| 12:30 | USD | Initial Jobless Claims (Sep 22) | 204K | 200K | 201K | 202K |

| 12:30 | USD | GDP Annualized Q2 F | 2.10% | 2.10% | 2.10% | |

| 12:30 | USD | GDP Price Index Q2 F | 1.70% | 2.00% | 2.00% | |

| 14:00 | USD | Pending Home Sales M/M Aug | 0.20% | 0.90% | ||

| 14:30 | USD | Natural Gas Storage | 90B | 64B |