Dollar remains broadly under pressure during Asian session as markets await the highly anticipated US CPI data. Expectations of Fed rate cuts have been building again since non-farm payroll data indicated a loosening job market. However, for the Fed to consider monetary easing, it is crucial that inflation shows signs of following suit with clear decline. Fed Chair Jerome Powell, appearing unperturbed by the stronger-than-expected PPI readings released yesterday, described the data as “mixed” rather than “hot.” Additionally, he reiterated that the next move in interest rates is unlikely to be a hike. Today’s CPI data will be pivotal in shaping both market expectations and Fed’s future policy direction.

Meanwhile, Australian Dollar and New Zealand Dollar are currently the strongest performers of the day. Aussie, in particular, is buoyed by reports that China is considering a plan for local governments to purchase millions of unsold homes to alleviate the ongoing property crisis. This development has provided significant support to the Aussie, overshadowing the news that US has unveiled a bundle of tariff increases on various Chinese imports, including electric vehicles, computer chips, and medical products. The market largely shrugged off these tariffs, focusing instead on the potential boost from China’s housing plan.

Elsewhere in the currency markets, Canadian Dollar is the third strongest for now. On the other hand, British Pound is the second weakest currency after Dollar, followed by Euro. Japanese Yen and Swiss Franc are positioned in the middle of the pack.

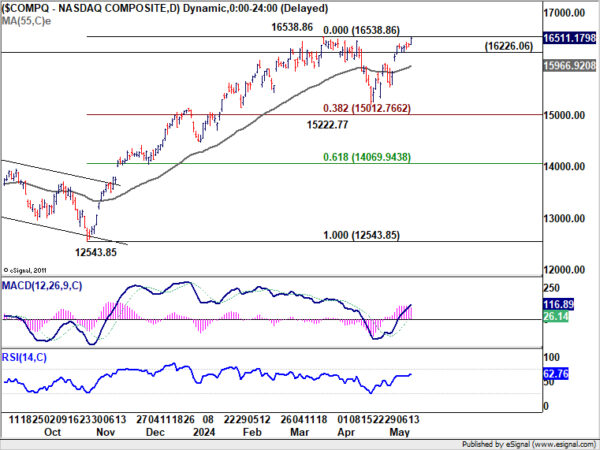

Technically, NASDAQ closed record 16511.17 overnight, despite missing intraday record of 16538.86. For now, another fall is still expected before corrective pattern from 16538.86 completes. Break of 16226.06 support will argue that this third leg has started back towards 38.2% retracement of 12543.85 to 16538.86 at 15012.76. However, decisive break of 16538.86 will invalidate this view and confirm larger up trend resumption. Today’s developments should provide more clarity.

In Asia, at the time of writing, Nikkei is up 0.11%. Hong Kong is on holiday. China Shanghai SSE is down -0.20%. Singapore Strait Times is down -0.62%. Japan 10-year JGB yield is down -0.006 at 0.960. Overnight, DOW rose 0.32%. S&P 500 rose 0.48%. NASDAQ rose 0.75%. 10-year yield fell -0.036 to 4.445.

Fed’s Mester not eager to consider rate hikes

Cleveland Fed President Loretta Mester, in an interview with WSJ, expressed a cautious stance on interest rate hikes, stating, “I am not eager to consider interest rate hikes.” Mester emphasized that Fed is in a “really good place” to study the economy before deciding on the next steps for interest rates.

Mester highlighted that it’s too early to determine whether the disinflation has stalled or if inflation is set to reverse. She noted that there are clear indications that the real side of the economy is “moderating”, which is contributing to a better balance within the economy.

Fed’s Schmid advocates patience in tackling inflation

Kansas City Fed President Jeffrey Schmid expressed confidence that inflation will gradually return to Fed’s 2% target “over time”. But he also emphasized the importance of patience, saying, “I am prepared to be patient as this process plays out.”

Schmid highlighted the necessity of curbing demand growth to allow supply to catch up, which is essential for closing the imbalance driving inflation.

Regarding Fed’s balance sheet, “I didn’t really think we should have slowed the runoff,” Schmid said. “I think there was room to continue to run off like we were doing.”

Australia’s wage price index rises 0.8% qoq, 4.1% yoy in Q1

Australia wage price index rose 0.8% qoq, below expectation of 0.9% qoq. The private sector rose 0.8% qoq and the public sector rose 0.5% qoq. Over the year, WPI slowed from 4.2% yoy to 4.1% yoy, below expectation of 4.2% yoy.

Michelle Marquardt, ABS head of prices statistics, said: “The WPI annual all sectors wage growth has remained at or above 4 per cent since September quarter 2023. The last time wages growth was at this level for three consecutive quarters was March quarter 2009.”

Looking ahead

Eurozone will release GDP revision, and industrial production. Later in the day, Canada will release housing starts and manufacturing sales. US will release CPI, retail sales, Empire State manufacturing, business inventories and NAHB housing index.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6595; (P) 0.6612; (R1) 0.6643; More…

AUD/USD’s breach of 0.6645 resistance suggests that rise from 0.6361 is resuming. Intraday bias is now on the upside for 61.8% projection of 0.6464 to 0.6645 from 0.6578 at 0.6690. Firm break there will target 100% projection at 0.6759. For now, further rally will remain in favor as long as 0.6578 support holds, in case of retreat.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which could still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Wage Price Index Q/Q Q1 | 0.80% | 1.00% | 0.90% | 1.00% |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 P | 0.30% | 0.30% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Mar | -0.30% | 0.80% | ||

| 09:00 | EUR | Eurozone Employment Change Q/Q Q1 P | 0.30% | 0.30% | ||

| 12:15 | CAD | Housing Starts Y/Y Apr | 232K | 242K | ||

| 12:30 | CAD | Manufacturing Sales M/M Mar | -1.40% | 0.70% | ||

| 12:30 | USD | Empire State Manufacturing Index May | -10.8 | -14.3 | ||

| 12:30 | USD | Retail Sales M/M Apr | 0.40% | 0.70% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Apr | 0.20% | 1.10% | ||

| 12:30 | USD | CPI M/M Apr | 0.30% | 0.40% | ||

| 12:30 | USD | CPI Y/Y Apr | 3.40% | 3.50% | ||

| 12:30 | USD | CPI Core M/M Apr | 0.30% | 0.40% | ||

| 12:30 | USD | CPI Core Y/Y Apr | 3.60% | 3.80% | ||

| 14:00 | USD | Business Inventories Mar | 0.00% | 0.40% | ||

| 14:00 | USD | NAHB Housing Market Index May | 51 | 51 | ||

| 14:30 | USD | Crude Oil Inventories | -1.4M |