Dollar had a dramatic turnaround in its fortune overnight, following the significant slide in US 10-year yield, which coincided with robust rally in US stock markets. Major indexes effectively wiped out the sharp declines seen on Wednesday. Anticipation of a Fed rate cut in March has notably dwindled, with fed fund futures now showing a mere 37.5% probability. Conversely, likelihood of a cut in May has escalated markedly, with market bets nearing 92%. Against this backdrop, today’s Non-Farm payroll data looms large, poised to influence Dollar’s next move, along with broader implications for risk sentiment and the outlook of treasury bonds.

Throughout this week, Dollar has turned into the weakest link among major currencies, with Euro trailing as the second weakest, then. Australian Dollar and British Pound. Though Aussie has managed to derive some benefit from risk-on market sentiment. its progress is constrained by the ongoing downturn in Chinese markets. Meanwhile, Sterling is in search of direction, with market participants keenly awaiting comments from BoE Chief Economist Huw Pill for insights into BoE’s monetary policy outlook, especially in the wake of yesterday’s confusing rate decision.

Japanese Yen continues to stand out as the strongest currency for the time being, although its rally appears to be past its limits. New Zealand Dollar secures the position as the second strongest, with Swiss Franc also showing strength. Canadian Dollar, however, maintains a neutral stance in the midst of its peers.

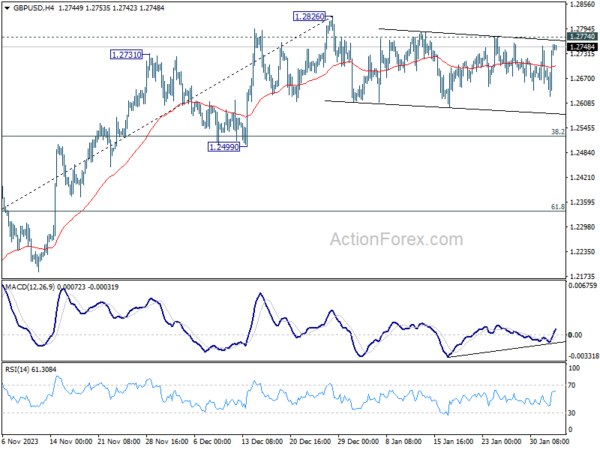

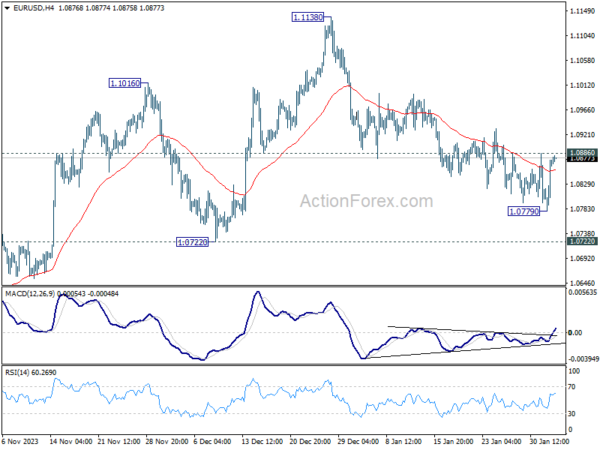

Technically, after failing to follow through with this week’s rally attempt, Dollar is starting to look vulnerable for a reversal. Levels to watch today include 1.0886 resistance in EUR/USD, 1.2774 resistance in GBP/USD, 0.6639 resistance in AUD/USD, 145.97 support in USD/JPY, as well as 1.3342 support in USD/CAD. Simultaneous break of these levels could mark the beginning of more pronounced weakness in Dollar, and set the stage for further decline in February.

In Asia, at the time of writing, Nikkei is up 0.60%. Hong Kong HSI is up 0.21%. China Shanghai SSE is down -1.12%. Singapore Strait Times is up 1.24%. Japan 10-year JGB yield is down -0.0237 at 0.671. Overnight, DOW rose 0.97%. S&P 500 rose 1.25%. NASDAQ rose 1.30%. 10-year yield fell -0.104 to 3.863.

BoC’s Macklem: Inflation decline expected to be gradual and uneven

BoC Governor Tiff Macklem emphasized the anticipated “gradual and uneven” decline in inflation towards 2% target. Speaking to the House of Commons Finance Committee, he noted that the journey to achieving inflation target “will be slow,” highlighting the persistence of risks along the way.

The central bank’s focus has evolved from assessing the sufficiency of current restrictive monetary policy stance to “how long to maintain the current restrictive stance,” he added.

Macklem also pointed out that while the Bank is keen on starting to reduce interest rates to support economic growth, it remains vigilant. The decision to lower rates will be contingent on a clear trajectory towards the inflation target, ensuring premature policy easing does not derail the progress made.

He stated, “you do want to start lowering interest rates before you’re all the way back, but you don’t want to lower them until you’re convinced…that you’re really on a path to get there.”

Additionally, the Governor reiterated the Bank’s readiness to adjust rates upwards should “new developments” warrant further action to curb inflation.

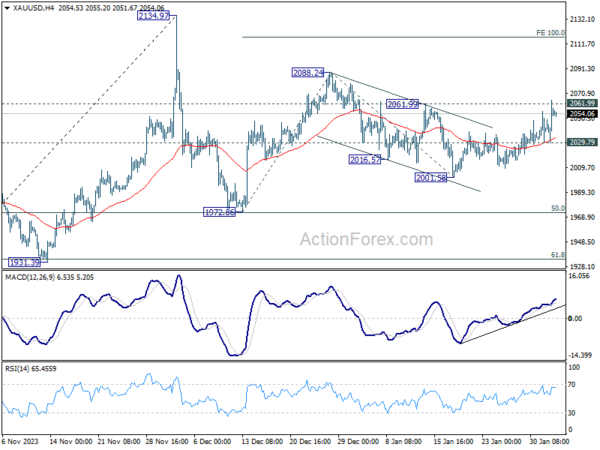

Gold pressing 2061 resistance after strong bounce

Gold jumped notably overnight following extended decline in benchmark treasury yields, as well as broad selloff in Dollar. Technically speaking, immediate attention is now on 2061.99 resistance. Decisive break there should confirm that corrective pullback from 2088.24 has completed with three waves down to 2001.58. More importantly, rally from 1972.86 would then be ready to resume through 2088.24. This will now be the favored case as long as 2029.79 minor support holds.

However, in the bigger picture, Gold might not be ready to break through 2134.97 record high yet. Current bounce from 1972.86 is seen as the second leg of a medium term corrective pattern from 2134.97. Upside will likely be limited by 100% projection of 1972.86 to 2088.24 from 2001.58 at 2116.96 to start the third leg.

NFP to conclude eventful week, 10-year yield in focus

Today’s US Non-Farm Payroll report is poised to be the focal point, concluding a week brimming with significant market events. Expectations are set for moderation in headline job growth to 178k in January, from December’s robust 216k. Additionally, unemployment rate is anticipated to inch higher to 3.8% from 3.7%, while the pace of average hourly earnings growth is projected to decelerate to 0.3% mom.

Preliminary indicators such as ADP private employment figure, which registered growth of only 107k, and a slight dip in ISM manufacturing employment component to 47.1, suggest potential softness in the headline job growth. However, wage growth aspect remains a wildcard, capable of influencing market dynamics significantly.

A key post-NFP development to watch is in 10-year yield, which has witnessed a marked decline throughout the week. The strong downside momentum now amplifies the likelihood that the overarching downward trend from 4.997 peak is resuming.

A weekly close below 3.785 support would corroborate the bearish case, and steer 10-year yield to 61.8% projection of 4.997 to 3.785 from 4.198 at 3.448 this quarter, before it could find a bottom. That would also keep Dollar pressured, in particular against Yen.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0810; (P) 1.0843; (R1) 1.0905; More…

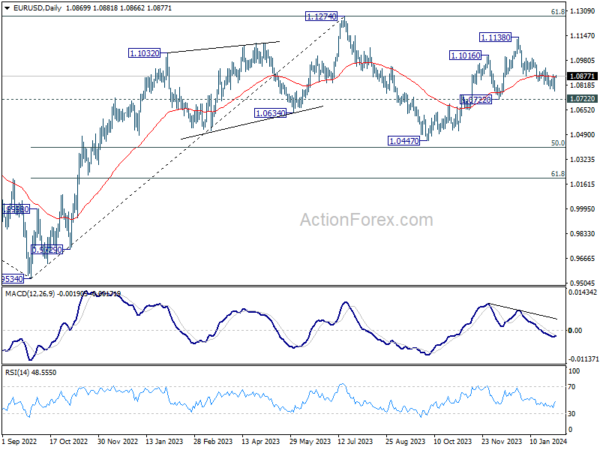

Intraday bias in EUR/USD is turned neutral again as it recovered after dipping to 1.0779. While another fall cannot be ruled out, considering persistent bullish convergence condition in 4H MACD, downside should be contained by 1.0722 key structural support. On the upside, firm break of 1.0886 will confirm short term bottoming, and bring stronger rebound back towards 1.1138 resistance. Nevertheless, decisive break of 1.0722 will argue that whole rise from 1.0447 has completed, and target this low.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Dec | 3.70% | -10.60% | ||

| 23:50 | JPY | Monetary Base Y/Y Jan | 4.80% | 7.50% | 7.80% | |

| 00:30 | AUD | PPI Q/Q Q4 | 0.90% | 1.90% | 1.80% | |

| 00:30 | AUD | PPI Y/Y Q4 | 4.10% | 3.80% | ||

| 07:45 | EUR | France Industrial Output M/M Dec | 0.20% | 0.50% | ||

| 13:30 | USD | Nonfarm Payrolls Jan | 178K | 216K | ||

| 13:30 | USD | Unemployment Rate Jan | 3.80% | 3.70% | ||

| 13:30 | USD | Average Hourly Earnings M/M Jan | 0.30% | 0.40% | ||

| 15:00 | USD | Factory Orders M/M Dec | 0.50% | 2.60% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Jan F | 78.8 | 78.8 |