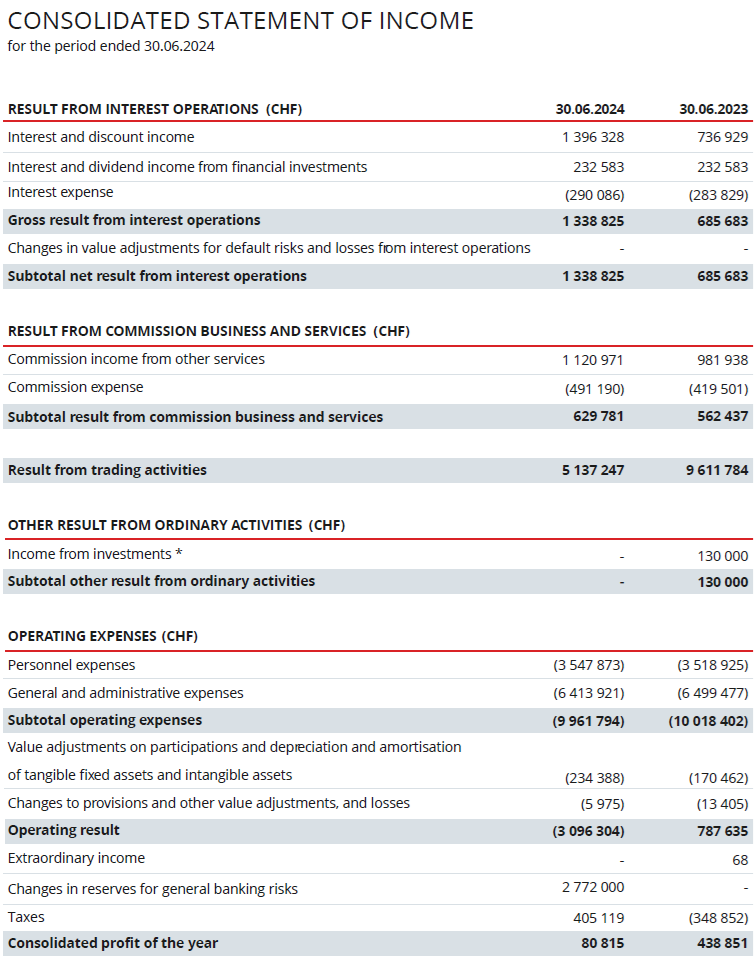

Things have gone from bad to worse at Geneva based Retail FX and CFDs broker Dukascopy Bank SA, with the company continuing to see its Revenues decline in the first half of 2024, and Dukascopy posting its first Operating Loss since 2018.

Revenues at Dukascopy fell by 38% in H1 2024, to CHF 7.1 million (USD $8.4 million) from CHF 11.4 million in the second half of 2023. This also marks the first time that Dukascopy’s semi-annual consolidated Revenues dropped below the CHF 10 million level since the mid 2010’s.

The company’s core Revenue from trading activities (i.e. brokerage) fell by 47% from CHF 9.6 million last year in H1-2023 to just CHF 5.1 million in H1-2024. Dukascopy benefited somewhat in 2024 from higher interest rates, with Net Interest Income up to CHF 1.3 million, from CHF 686K last year.

Dukascopy saw its decline in Revenue turn into a CHF 3.1 million (USD $3.7 million) Operating Loss in H1-2024 – its first semi-annual loss since 2018 – although changes in reserves for general banking risks, plus a booked tax benefit, led to an overall modest net profit of CHF 80,815 for the six months ended June 30, 2024.

By comparison, Dukascopy’s (much larger) Switzerland based rival Swissquote just posted record results on both the top and bottom line during H1-2024, as crypto trading has become a much bigger piece of the pie in 2024 at Swissquote.

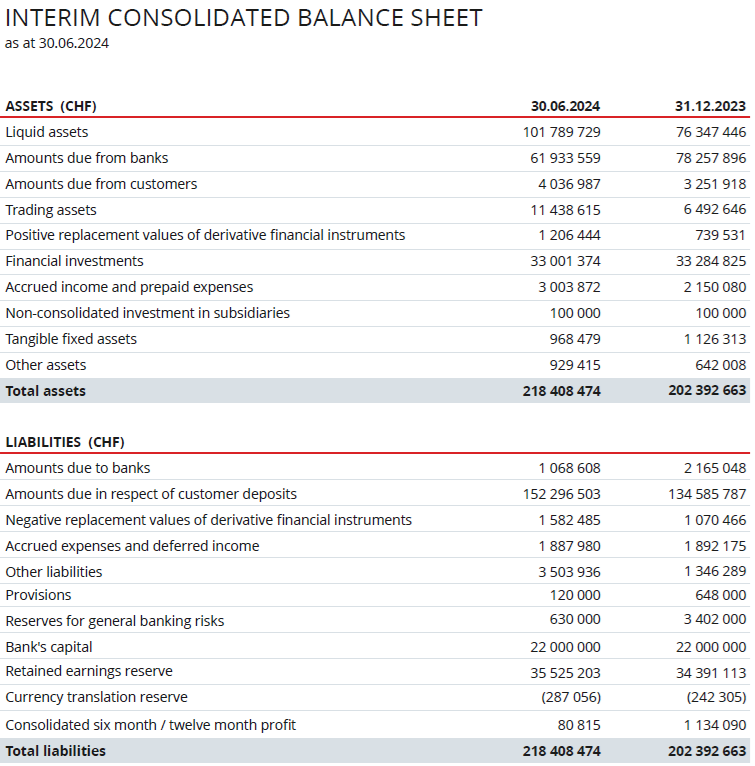

Customer deposits at Dukascopy actually rose in the first half of 2024, coming in at CHF 152.2 million as at June 30, 2024, versus CHF 134.6 million as at year end 2023.

Companies within Dukascopy Group are regulated in Switzerland, Latvia and Japan. The Latvian entity, Dukascopy Europe has a license to operate in the European Union. Founded in 2004, Dukascopy is controlled by its founders Andre and Veronika Duka, who serve as co-CEOs of the company.

Dukascopy’s H1-2024 consolidated income statement and balance sheet follow.