Markets have spent recent months girding for a monetary policy pivot to lower interest rates by central banks representing roughly a third of the global economy.

However, despite inflation in the U.S., eurozone and the U.K. starting the year well down from cycle highs and nearing 2% targets, the European Central Bank on Thursday, at 8:15 a,m. Eastern, will be the first of the high profile monetary guardians to tell investors they must wait a bit longer for interest rates to fall.

It should not come as a shock.

Derivatives markets are pricing in next to no chance that the ECB will trim its deposit rate from a record high of 4% this week. Similarly, traders see a 99.5% probability that the U.S. Federal Reserve will not cut borrowing costs at its next meeting on January 31. Nor should the Bank of England budge the day after that. (Note: the Bank of Japan is expected to next raise rates).

The next few meetings are a different matter. To varying degrees they are considered potentially ‘live’, with rate cuts by the Fed, in particular, considered possible in March, and the market punting on the ECB trimming in June.

Consequently, ECB President Christine Lagarde will be first to set the tone for the weeks approaching these potential pivots.

Unfortunately, many analysts think it unlikely Lagarde will shift her position on the inflation environment she perceives, or give clues during her press conference, as to when a rate cut may occur.

“We expect Lagarde to indicate that it is premature to talk about rate cuts. However, she is also likely to stress that ECB decisions are meeting by meeting and are data dependent,” said Mohit Kumar, Chief European Economist at Jefferies.

Arnaud Marès, chief European economist at Citi, agrees: “[W]e do not expect any meaningful or particularly new communication to come out of this week’s meeting of the Governing Council of the European Central Bank,” he said.

Indeed, Marès reckons that with eurozone inflation not expected to quickly fall from its current 2.9% — Barclays sees January’s reading dipping slightly to 2.7% — an easing of policy may not come until the summer.

Source: Citi

“So long as the ECB projects 2025 inflation above 2%, we expect resistance to rate cuts to remain strong. Once those projections fall below 2%, we expect pressure to ease policy to become irresistible. We expect this will be the case in June, but not earlier,” said Marès in a note to clients.

In its latest forecasts, published last month, the ECB said it saw the bloc’s economy growing 0.8% in 2024 — an acceleration from the expected 0.6% expansion for 2023 — “as real disposable income rises – supported by declining inflation, robust wage growth and resilient employment – and export growth catches up with improvements in foreign demand.”

But this year’s projected growth rate is lower than the 1% forecast in September, and it may be possible the ECB may nudge growth forecasts lower still given recently soft data, such as weak purchasing managers’ surveys.

Source: ECB Macroeconomic Projections December 2023

Despite this, comments from ECB officials of late suggest they have been keen, just like their peers at the Fed, to push back against traders’ more optimistic timing for rate cuts.

“We accordingly expect all policy parameters to remain unchanged at the upcoming meeting, and for the formal guidance to reiterate that rates will be set ‘at sufficiently restrictive levels for as long as necessary’,” said the economics team at Goldman Sachs led by Sven Jari Stehn.

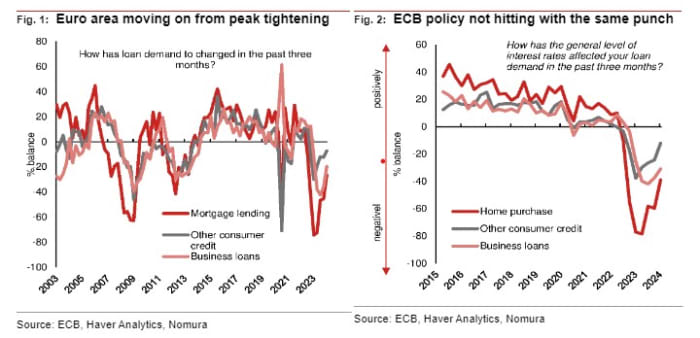

The ECB’s decision to stand pat on Thursday, and not imply a timetable for looser policy, may be supported by indications that the impact on bank lending of previous rate-rises is already much reduced, according to Nomura.

Analyzing the ECB’s Fourth Quarter 2023 Bank Lending Survey, released Tuesday, the Nomura team led by George Moran, observed that almost all the transmission from tighter monetary policy to financial conditions has now happened.

“For some hawks this may be a concern, potentially pushing out when they think rate cuts should happen,” said Nomura in a note to clients.

“However, we think that the majority of [ECB] Governing Council members are satisfied with the degree of tightening, which has already happened, are pleased that the transmission is slowing down. Hence, we expect cuts from June 2024.”

Source: Nomura. Charts from the ECB’s Fourth Quarter 2023 Bank Lending Survey

Goldman’s Stehn, however thinks lower rates may come sooner, as the U.S. bank sees core inflation falling lower that the ECB expects, wage growth easing, and the disruption to shipping by war in the Middle East having less of an impact on inflation than people think.

“We therefore maintain our modal case for a 25bp cut in April,” said Goldman. “Waiting until April provides the Governing Council with one more inflation report and some additional color on the Q1 wage negotiations, which we expect to provide enough confidence that inflation is returning to 2% in a sustainable manner.”

The German 2-year bond yield

BX:TMBMKDE-02Y,

the eurozone short-term benchmark, was little changed at 2.719% early Thursday. It has fallen from around 3.3% in October, amid easing inflation and hopes for the ECB pivot.