The inflows in the equity category surged by approximately 23%, according to the AMFI data released on Friday. The inflows in February stood at Rs 26,866 crore against Rs 21,780.56 crore in January. Among the equity categories, all categories except for focused funds received inflows in February.

The sectoral/thematic funds have continued to gain traction in February witnessing an increase in AUM by 134%. The category witnessed the highest inflows of Rs 11,262.72 crore in February, compared to Rs 4,804.69 crore in January. Large and midcap funds managed to gain investors interest with second highest inflow of Rs 3,156.64 crore.

Also Read | She the shakti! Top 5 women fund managers handling Rs 3.74 lakh crore

The inflows in the smallcap category declined by 10% and stood at Rs 2,922.45 crore in February from Rs 3,256.98 crore in January. Flexi cap funds witnessed inflows of Rs 2,613.23 crore. Multi-cap fund category received an inflow of Rs 2,414.04 crore.

Large cap funds witnessed inflows in February of around Rs 921.14 crore against an inflow of Rs 1,287.05 crore in January. The focused fund category witnessed an outflow of Rs 532.89 crore in February against an outflow of Rs 201.83 crore in January.

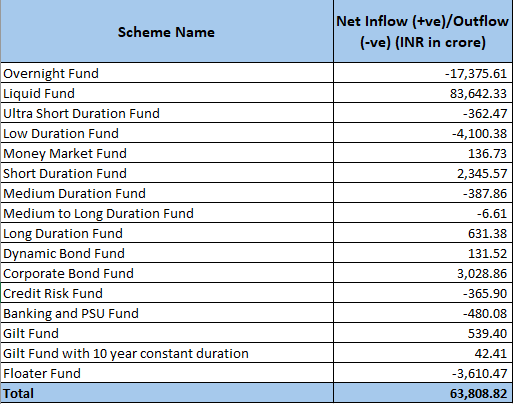

The debt mutual funds witnessed an inflow in February. The category saw a total inflow of Rs 63,808.82 crore during the same month, compared to an outflow of Rs 76,468.96 crore in January. The net inflows declined 17% on a month-on-month basis. Most categories witnessed outflows in February.

Liquid funds recorded the highest inflow in February of around Rs 83,642.33 crore against an inflow of Rs 49,467.67 crore in January. Corporate bond funds witnessed second highest inflows of around Rs 3,028.86 crore. Gilt Fund with 10 year constant duration received the lowest inflows of Rs 42.41 crore.

Overnight funds saw the highest outflow of Rs 17,375.61 crore against an inflow of Rs 8,995.07 crore in January. Low duration funds witnessed outflow of Rs 4,100.38 crore in February.

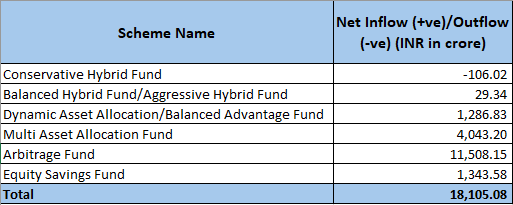

The inflows in hybrid fund categories rose by 12% in February and stood at Rs 18,105.08 crore. The category received a total inflow of Rs 20,636.99 crore in January. All hybrid categories except for conservative hybrid funds witnessed inflows in February. Arbitrage funds stood first in the inflow chart and received the highest inflows of Rs 11,508.15 crore in February.

Multi asset allocation funds witnessed the second highest inflow of Rs 4,043.20 crore in February, followed by equity savings fund which received an inflow of Rs 1,343.58 crore in February.

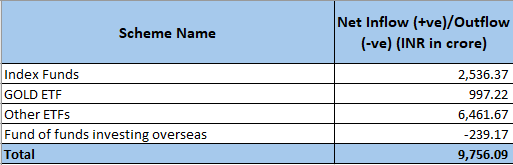

The net inflows in the ‘others’ category which includes Index Funds and ETFs increased by around 145% in February. The category received total inflows of Rs 9,756.09 crore in February against an inflow of Rs 3,982.85 crore in January. All categories received inflows except for fund of funds investing overseas. Other ETFs were investors’ favourites. The category received the highest inflows of Rs 6,461.67 crore in February against an inflow of Rs 571.19 crore in January.

Also Read | Top 11 equity mutual funds with over 20% CAGR in last 7 years. Do you own any?

Index funds received a total inflow of Rs 2,536.37 crore, followed by gold ETFs that received inflow of Rs 997.22 crore in February. Fund of funds investing overseas witnessed an outflow of Rs 239.17 crore in February.

The total assets under management (AUM) of mutual funds increased by approximately 3.42% and stood at Rs 54.54 lakh crore in February, as against Rs 52.74 lakh crore in January.

Around 20 open-ended NFOs were floated in February, which together mobilised Rs 11,469 crore. Two close-ended NFOs were floated in February which mobilised Rs 251 crore.

Smallcap Funds

The smallcap category has continued to witness a decline in net inflows for a second consecutive month. The net inflows in February declined by around 10% on a month-on-month basis and stood at Rs 2,922.45 crore. The net inflows in January declined by around 16% from December.

The smallcap funds lost around 0.57% in February. The smallcap schemes are benchmarked against Nifty Smallcap 100 – TRI, Nifty Smallcap 250 – TRI, and S&P BSE 250 Small Cap – TRI. Nifty Smallcap 100 – TRI, Nifty Smallcap 250 – TRI, and S&P BSE 250 Small Cap – TRI lost around 0.83%, 0.69%, and 0.43% respectively in February.

In February, the market regulator Sebi has told mutual funds to frame a policy to protect the interest of investors of small and midcap mutual fund schemes.

Sebi asked mutual funds to frame a policy which contains appropriate and proactive measures to protect investors, including but not limited to moderating inflows, portfolio rebalancing, etc. and to take steps to ensure that investors are protected from the first mover advantage of redeeming investors.