The European Securities and Markets Authority (ESMA), the EU’s financial markets regulator and supervisor, has published a discussion paper on the digitalisation of retail investment services and related investor protection considerations.

The regulator notes that it is important to ensure that (digital) marketing practices and advertisements remain compliant with relevant regulations by ensuring that these messages are fair, clear and not misleading. One of the aspects of clear and fair presentation is comprehensible and clear wording and presentation of the investment firms’ offer, including with regard to financial instruments.

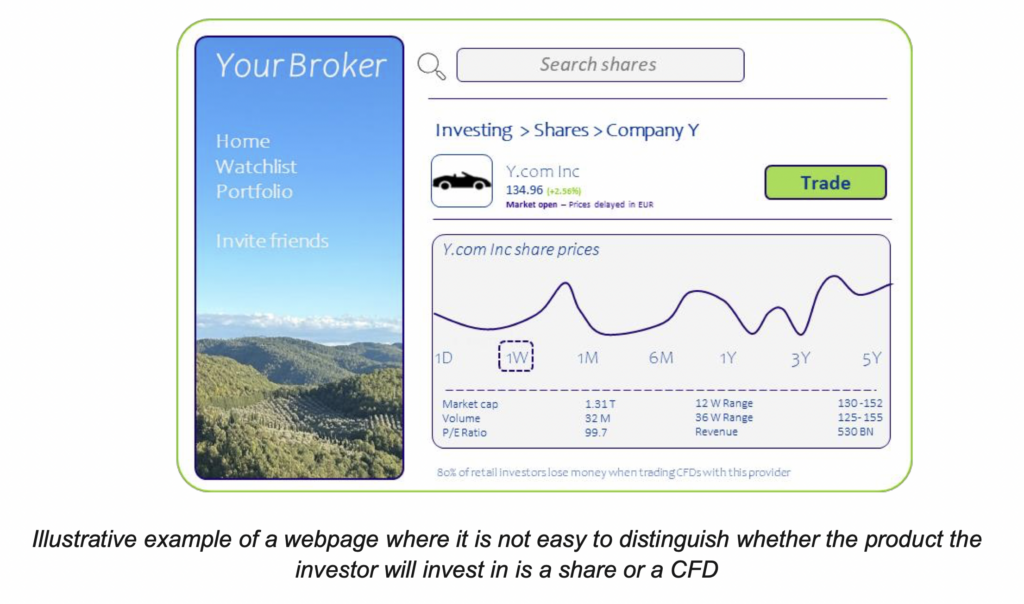

As an example, firms offering contracts for difference (CFDs), Structured retail products (SRPs) or Exchange traded products (ETPs) may market these products alongside “typical” shares or bonds on the same webpage, listing them in the same tab or webpage, including presenting them as equal or similar alternatives.

Shares and CFDs on those shares may be labelled with the same or a similar code in the transaction system. In such situations, it is very likely that the customer will make a mistake and buy the wrong financial instrument. Furthermore, marketing communication may be structured in such a way that does not facilitate distinguishing whether the instrument marketed is a CFD, retail structured product or its underlying, because the advertisement or communication includes only (or mostly) information on shares or commodities that are the distributed product’s underlying. In fact, the firm may market products not actually offered by them.

It is necessary to balance the information and indicate all the necessary information in a clear manner. When for example a firm in its advertising uses ambiguous language such as “the possibility of choosing investment strategies on shares” or “access to investments on ETFs” whilst not making clear that they are advertising CFDs, then this provision of information is not clear and misleading. In this case, the client is not able to directly see or understand the type of product that is offered. Let alone understand the risks related to such investments.

A more extreme scenario is when the content of the message suggests that less complex instruments such as shares are offered when in fact, options or CFDs are sold.

Another example is when an investment firm is paying an affiliate/finfluencer for advertising. Then the firm’s investment services should ensure that the affiliate presents the firms services in a fair and balanced manner. A presentation where the affiliate praises advantages of the firm’s services only without giving a fair and prominent indication of any relevant risks is in breach with the requirement that information is accurate and always gives a fair and prominent indication of any relevant risks when referencing any potential benefits of an investment service or financial instrument.

The affiliate should, in any case, mention in their publication that it is as an advertisement.

ESMA is seeking stakeholders input by 14 March 2024 on recommendations regarding online disclosures, digital tools, and marketing practices.