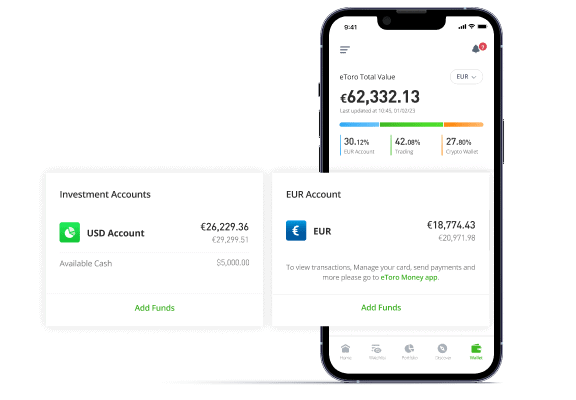

Social trading focused online broker eToro has announced that it has enhanced its local offering for users in the UK and Europe, by allowing them to trade in GBP or EUR, alongside USD.

eToro users can now fund trades directly from their balances within their GBP or EUR account, rather than having to convert to USD by default, saving money in conversion fees when investing in UK or EU-listed stocks. The new feature also allows users to adopt a more sophisticated strategy when it comes to currency, allowing them to better manage currency exposure.

eToro’s GBP and EUR accounts, which recently surpassed one million users, are available to eligible users in the UK and Europe, allowing them to deposit, hold, withdraw and fund trades in GBP or EUR, alongside USD.

The option to invest in EUR or GBP, as well as USD, is only available to eToro users based in Europe and the UK. GBP and EUR accounts are provided by eToro Money UK Ltd for UK clients, and by eToro Money Malta Ltd for EU clients, who are authorised for the issuance of e-Money in the UK (FCA FRN 900926) and Malta (the MFSA) respectively.

eToro said it has created a global product offering that is accessible to users from 75 countries and in 20 languages. Users around the world can trade and invest in companies listed on 20 of the world’s leading stock exchanges, and stay informed thanks to our extensive network of local analysts from across the globe. Introducing the ability to fund trades in EUR and GBP is part of a wider move to complement this global offering with a more localised investment experience for users in eToro’s key markets.

Doron Rosenblum, Executive Vice President, Business Solutions at eToro explained,

Doron Rosenblum, Executive Vice President, Business Solutions at eToro explained,

“As we continue strengthening our presence in Europe and the UK, we want to offer our users the best of both worlds. Access to our global product offering alongside a localised investment and money management experience. Introducing the possibility to invest directly in GBP and EUR marks a significant addition in our product offering. This isn’t just about adding another feature, it’s about fundamentally enhancing the way our users tailor their investment strategy by improving their domestic and international trading experience.”

Earlier this month, eToro joined forces with Deutsche Boerse to add a further 290 German-listed stocks to the platform. This follows a collaboration with London Stock Exchange, announced in July, whereby eToro will add an additional 1,000 UK stocks to the platform. eToro also recently partnered with Dubai Financial Market to offer users access to ten of the leading companies listed on their exchange. The company also boosted its Danish stock offering and now offers more than 70% of all Denmark-listed companies to its users.