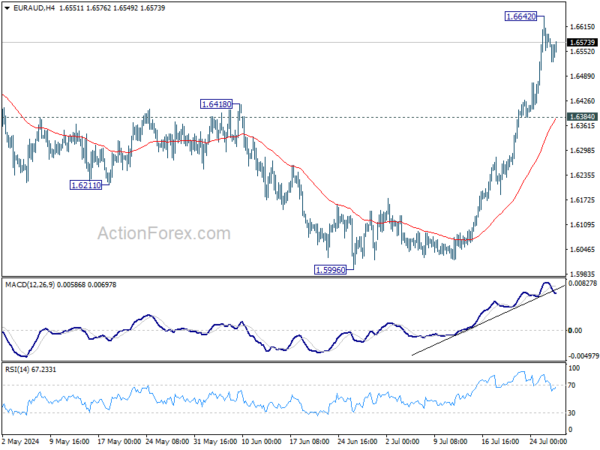

EUR/AUD’s rise from 1.5996 accelerated to as high as 1.6642 last week but retreated since then. Initial bias remains neutral this week for consolidations. Further rally is expected as long as 1.6384 support holds. Corrective fall from 1.7062 should have completed with three waves down to 1.5998. Above 1.6642 will target 1.6742 resistance. Decisive break there will argue that larger up trend is going to resume through 1.7062 high.

In the bigger picture, fall from 1.7062 medium term top is seen as a correction to the up trend from 1.4281 (2022 low) and could have completed after hitting 38.2% retracement of 1.4281 to 1.7062 at 1.6000. On resumption next target will be 61.8% projection of 1.4281 to 1.7062 from 1.5996 at 1.7715. This will now remain the favored case as long as 55 D EMA (now at 1.6264) holds.

In the longer term picture, price actions from 1.9799 (2020 high) are seen as a long term decline at the same scale as the rise from 1.1602 (2012 low). Rebound from 1.4281 is seen as the second leg. As long as 55 M EMA (now at 1.5987) holds, this second leg could still extend higher. However, sustained trading below 55 M EMA will open up the bearish case for extending the decline through 1.4281 low.