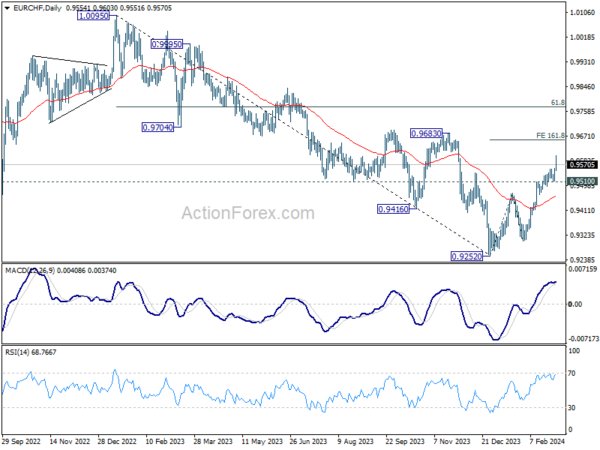

EUR/CHF’s rally from 0.9252 continued last week and hit as high as 0.9603. Initial bias stays on the upside this week for 161.8% projection of 0.9252 to 0.9471 from 0.9304 at 0.9658 next. For now, further rally is expected as long as 0.9510 support holds, in case of retreat.

In the bigger picture, as long as 0.9683 resistance holds, rebound from 0.9252 are seen as a corrective move only. Larger down trend is expected to resume through 0.9252 after the correction completes. However, firm break of 0.9683 and sustained trading above 55 W EMA (now at 0.9622) will argue that 0.9252 is already a medium term bottom. Stronger rise would then be seen 61.9% retracement of 1.0095 to 0.9252 at 0.9773 and above.

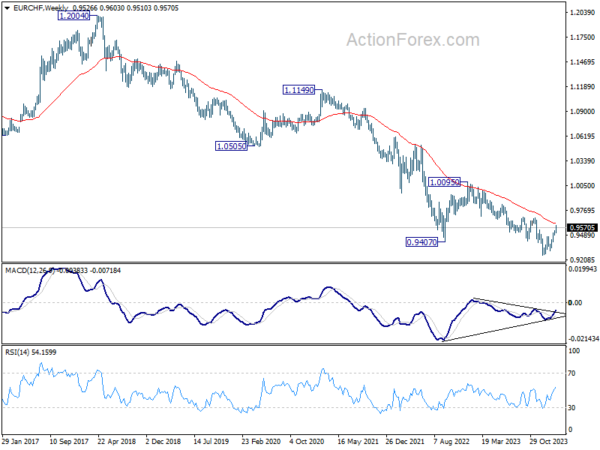

In the long term picture, fall from 1.2004 (2018 high) is part of the multi-decade down trend. Firm break of 1.0095 resistance is needed to be the first sign of long term bottoming. Otherwise, outlook will remain bearish.