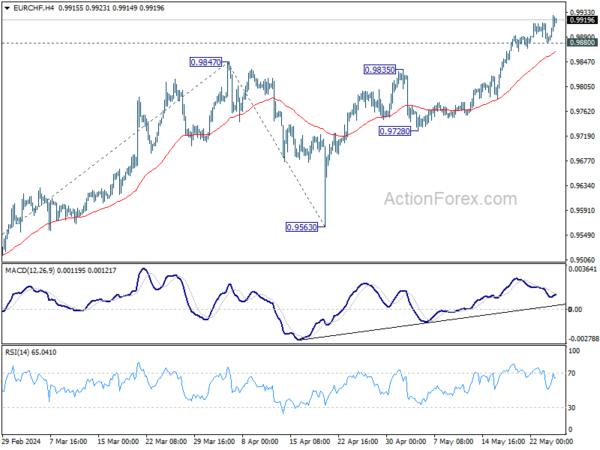

EUR/CHF’s rally continued last week despite some brief interim retreat. Initial bias is now on the upside this week. Current rise from 0.9252 should target 100% projection of 0.9304 to 0.9847 from 0.9563 at 1.0106, which is slightly above 1.0095 key structural resistance. On the downside,e below 0.9880 minor support will turn intraday bias neutral and bring consolidations first.

In the bigger picture, as long as 0.9728 support holds, rise from 0.9252 medium term bottom is still in favor to continue. Next target is 38.2% retracement of 1.2004 (2018 high) to 0.9252 (2023 low) at 1.0303, even just as a correction to the down trend from 1.2004.

In the long term picture, fall from 1.2004 (2018 high) is part of the multi-decade down trend. Firm break of 1.0095 resistance is needed to be the first sign of long term bottoming. Otherwise, outlook will remain bearish.