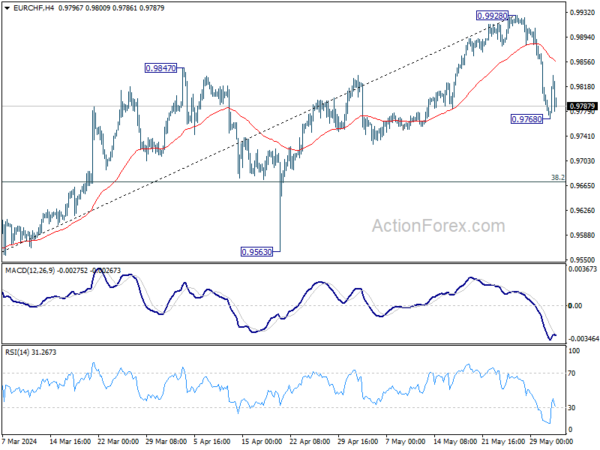

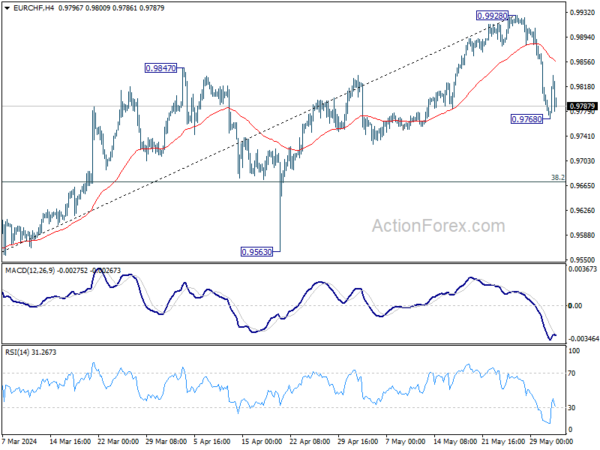

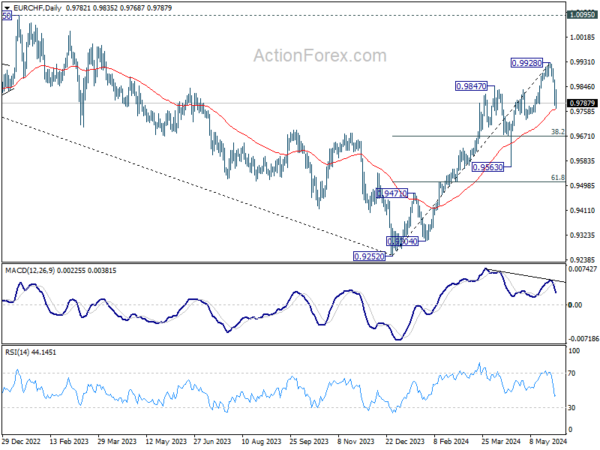

Considering bearish divergence condition in D MACD, EUR/CHF might have formed a medium term at 0.9928 with last week’s steep decline. Risk will now stay mildly on the downside as long as 0.9928 resistance holds, in case of recovery. Break of 0.9768 and sustained trading below 55 D EMA (now at 0.9765), will bring deeper fall to 38.2% retracement of 0.9252 to 0.9928 at 0.9670. Strong support is expected there to complete the pull back and bring rebound.

In the bigger picture, as long as 0.9563 support holds, rise from 0.9252 medium term bottom is still in favor to continue. Next target is 38.2% retracement of 1.2004 (2018 high) to 0.9252 (2023 low) at 1.0303, even just as a correction to the down trend from 1.2004.

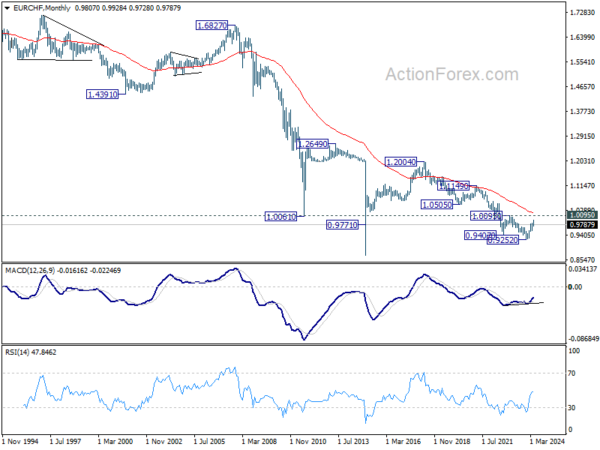

In the long term picture, fall from 1.2004 (2018 high) is part of the multi-decade down trend. Firm break of 1.0095 resistance is needed to be the first sign of long term bottoming. Otherwise, outlook will remain bearish.