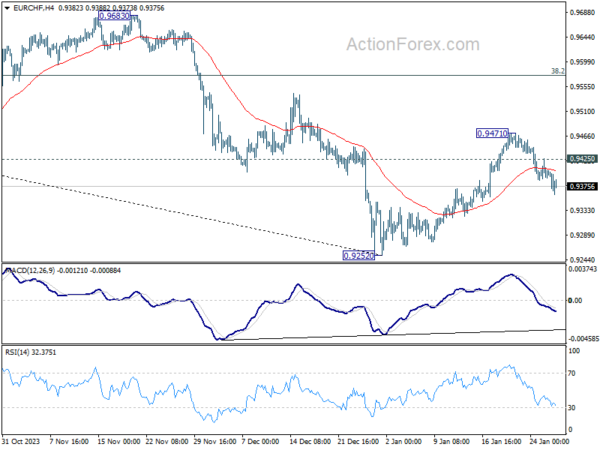

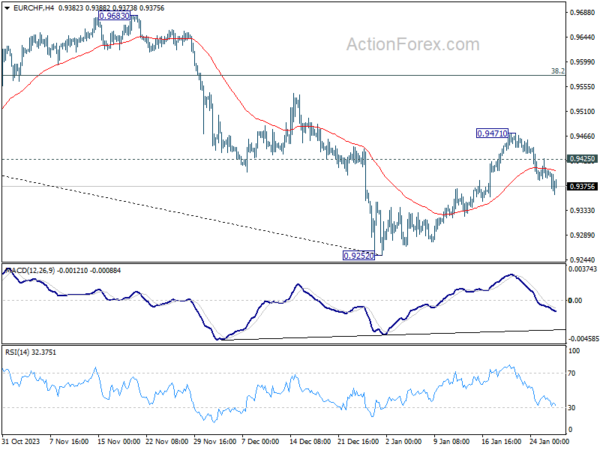

EUR/CHF failed to sustain above 55 D EMA (now at 0.9443) last week, and reversed from there. Initial bias stays mildly on the downside this week for deeper pull back. But downside should be contained above 0.9252 low to bring rebound. On the upside, above 0.9425 minor resistance will turn bias back to the upside. Further break of 0.9471 will resume the rebound to 38.2% retracement of 1.0095 to 0.9252 at 0.9574.

In the bigger picture, medium term outlook remains bearish as long as 0.9683 resistance holds. Current fall from 1.2004 (2018 high) is part of the multi-decade down trend. Another decline is in favor after rebound from 0.9252 completes. However, firm break of 0.9683, and sustained trading above 55 W EMA (now at 0.9659) will argue that EUR/CHF is already in a medium term rally, even as a corrective move.

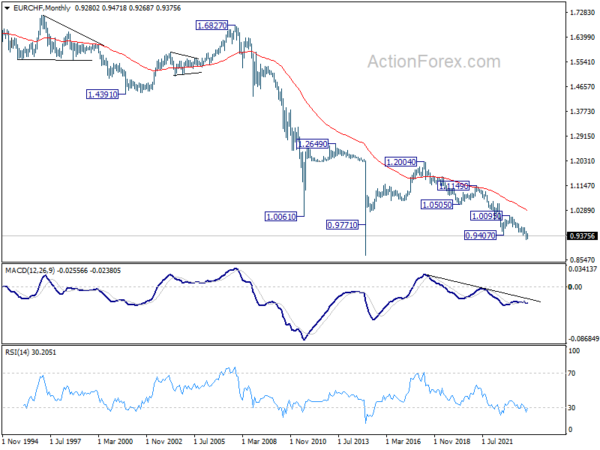

In the long term picture, outlook remains bearish as it’s staying well below 55 M EMA (now at 1.0265). Larger down trend from 1.2004 (2018 high) is in progress.