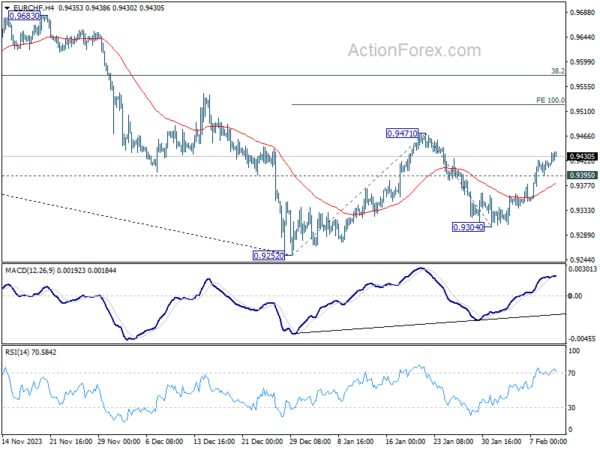

EUR/CHF’s rebound last week suggests that pull back from 0.9471 has completed at 0.9304 already. Initial bias remains on the upside this week for 0.9471. Firm break there will resume whole rebound from 0.9252 to 100% projection of 0.9252 to 0.9471 from 0.9304 at 0.9523. On the downside, below 0.9395 minor support will turn intraday bias neutral first.

In the bigger picture, price actions from 0.9252 are tentatively seen as a correction to the five-wave down trend from 1.0095 (2023 high). Further rise would be seen to 38.2% retracement of 1.0095 to 0.9252 at 0.9574. But overall medium term outlook will remain bearish as long as 0.9683 resistance holds.

In the long term picture, fall from 1.2004 (2018 high) is part of the multi-decade down trend. Firm break of 1.0095 resistance is needed to be the first sign of long term bottoming. Otherwise, outlook will remain bearish.