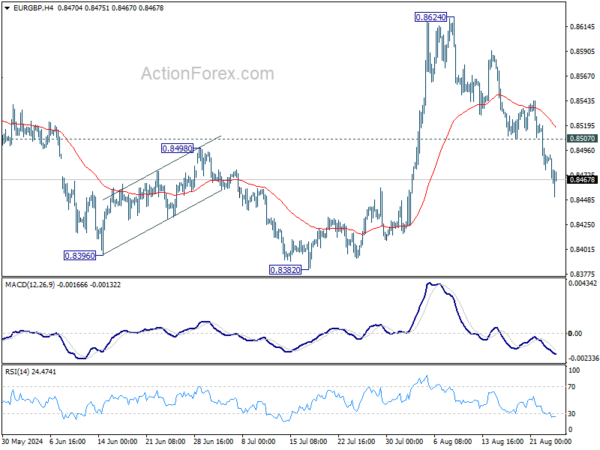

EUR/GBP’s steep decline last week suggest that rebound from 0.8382 has completed 0.8624 already, after rejection by 0.8643 resistance. Initial bias stays on the downside this week for retesting 0.8382 low. Decisive break there will resume larger down trend. On the upside, above 0.8507 support turned resistance will turn intraday bias neutral first.

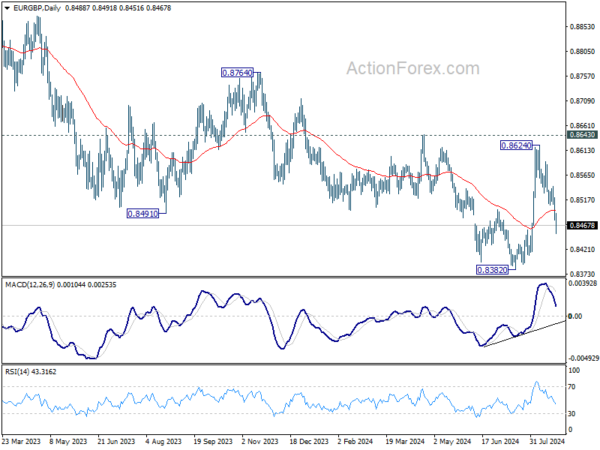

In the bigger picture, while the rebound from 0.8382 is strong, there is no confirmation of trend reversal yet. As long as 0.8643 resistance holds, down trend from 0.9267 could still resume through 0.8382 at a later stage towards 0.8201 (2022 low). However, firm break of 0.8643 will indicate that such down trend has completed, and turn outlook bullish for 0.8764 resistance next.

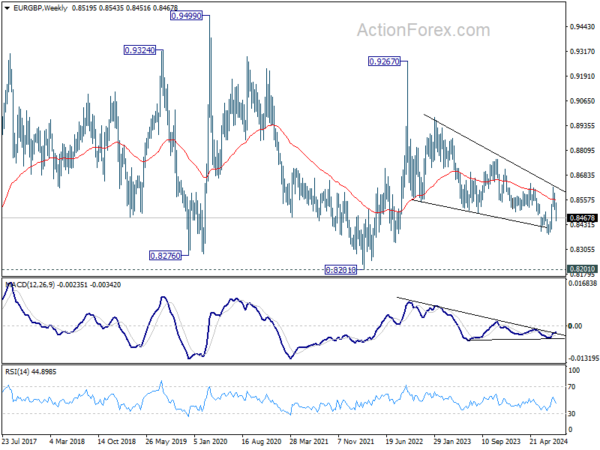

In the long term picture, price action from 0.9499 (2020 high) is seen as part of the long term range pattern from 0.9799 (2008 high). Range trading should continue between 0.8201 and 0.9499, until there is clear signal of imminent breakout.