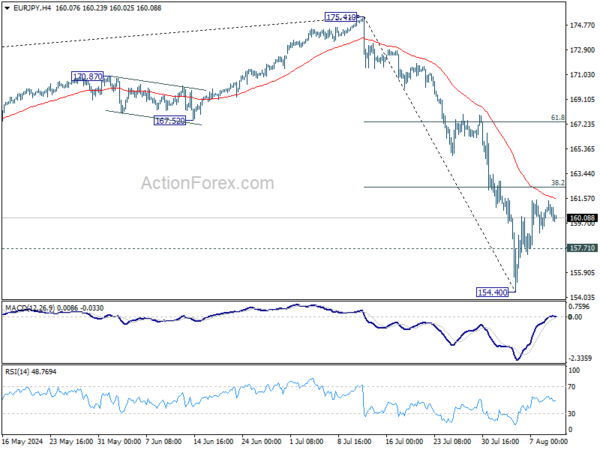

EUR/JPY rebounded strongly after initial dive to 154.40 last week. While further rise cannot be ruled out, outlook will remain bearish as long as 38.2% retracement of 175.41 to 154.40 at 162.42 holds. On the downside, below 157.71 minor support will bring retest of 154.40 first. Break there will resume the fall from 175.41 to 153.15 support next. However, sustained break of 162.42 will bring strong rise to 61.8% retracement at 167.38, even as a corrective move.

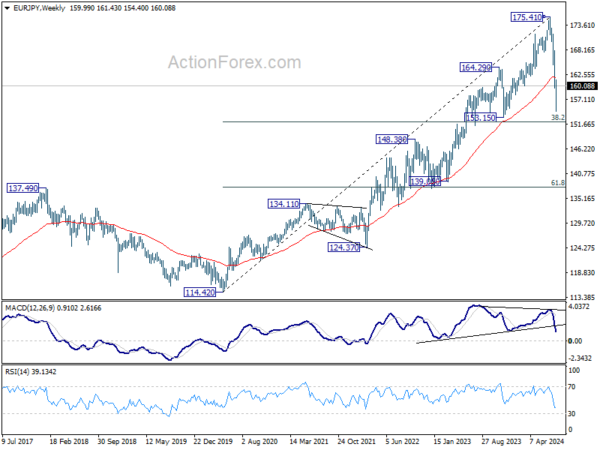

In the bigger picture, fall from 175.41 medium term top should be correcting the whole rise from 114.42 (2020 low). Deeper decline could be seen as long as 55 W EMA (now at 161.92) holds. But strong support should emerge between 153.15 and 38.2% retracement of 114.42 to 175.41 at 152.11 to bring rebound, at least on first attempt. Meanwhile, sustained trading above 55 W EMA will argue that the range of the medium term corrective pattern has already been set.

In the long term picture, considering bearish divergence condition in W MACD, 175.41 is at least a medium term top. It’s still early to conclude that up trend from 94.11 (2012 low) has completed. But a medium term corrective phase is in progress with risk of deeper fall back to 55 M EMA (now at 145.46).